The Only Day Trading Guide a Beginner Will Ever Need (The Basics from A to Z)

Does anyone really make resulting money day trading? Can YOU make money day trading?

How nonflexible is it?

What does it really take?

And how does it all work in the real-world?

These are the questions most beginners have. And these are the questions that will be answered in this article.

Plus much more.

So if you’ve heard well-nigh day trading, but don’t know where to begin…

Or if you’ve dabbled with day trading, didn’t do as well as you hoped, and just don’t know the right way to requite yourself the weightier endangerment to make resulting profits…

Or if you’ve lost a lot of money trading on longer time frames, and are curious but skeptical well-nigh the world of day trading…

This vendible was written for you.

I have day traded for over 25 years and have run a proprietary trading firm since 2005- and we do a ton of day trading. We have built our firm teaching beginners how to day trade, and are proud to have built numerous 7-figure-a-year traders, with the weightier making 8 figures-a-year. This makes us one of the longest lasting and most successful proprietary trading firms out there.

SMB Offices, Manhattan, NYC

And in short, Yes! Yes, you can really make resulting money day trading!

And there are many increasingly benefits to day trading than just the worthiness to unceasingly wall profits.

For those of you who do not know, day trading is a historically profitable trading strategy that today can be deployed by just well-nigh anyone. Advances in technology, namely the internet and online trading platforms, have revolutionized the game of trading so now you can day trade from your home.

This trading strategy used to be misogynist only to peerage trading houses like Goldman Sachs and JPMorgan and large trading institutions with uncontrived wangle to the exchanges. And they banked resulting and huge profits every month using this trading strategy that was solely misogynist to them. But now anyone with an internet connection, lap top, and a trading worth can use this time-tested strategy. Washed-up well it is extremely profitable.

As the Co-Founder of SMB Capital, a NYC-based proprietary firm that executes day trading techniques, and tragedian of two trading books on this subject (One Good Trade and The PlayBook), I will share the only guide you will overly need on day trading. With mostly these day trading techniques, we have ripened traders who have achieved the ultimate success as a trader and surpassed their wildest financial expectations. In this article, we will cover:

The Incredible Benefits of Day Trading

The Drawbacks of Day Trading

What is Day Trading? (For the well-constructed beginners)

The Fundamentals of Candlestick Charts

Day Trading Basics

What You Need to Be a Successful Day Trader

The Essential Ingredients of a Profitable Day Trading Strategy

Day Trading Strategies

Risk Management: You are going to be wrong

Stock Selection: What are the weightier stocks to day trade?

The Nature of a Successful Day Trader

Day Trader Tools and Resources

How to Level Up Your Day Trading with SMB

FAQs on Day Trading

The Incredible Benefits of Day Trading

You may be wondering: what can day trading offer for me? Unconfined question. Let me try and help you with this answer, leaning on my wits in this discipline.

From my seat, the top 6 benefits of day trading are:

1. Day trading offers the potential for quick profits.

2. Day trading offers the potential for huge profits without requiring substantial capital.

3. Day trading is wieldy for many. The rise of online trading platforms have made it easy for anyone with an internet connection and computer to trade. You can literally day trade from your home profitably.

4. Day trading is exciting. Each day is new, as you are navigating the top news events of the day.

5. Flexibility. Day trading can be washed-up from anywhere with a computer and an internet connection. No commute. No boss.

6. Self-discovery. You will learn increasingly well-nigh yourself day trading for a year than anything else you have overly done.

The Drawbacks of Day Trading

So some of you are probably used to seeing videos of lavish trader lifestyles, “trading gurus” trading off of a palmtop for an hour a day, heck maybe plane 15 minutes a day, and then relaxing on some secluded waterfront for the rest of the day. These “trading gurus” sell the models and bottles, stacks of cash, and Lambo dreams lifestyle. They sell it well.

Is this the reality of a day trader?

Well, all I can tell you is that our day traders train like pro athletes. They live and outbreathe the markets and are continually working on their trading skills- considering at our firm that’s what we’ve found it really takes to make it in this game.

And day trading does have some other drawbacks as well.

From my seat, the top 5 drawbacks to day trading are:

1. Upper risk: Day trading can bring significant losses to those who are not properly trained.

2. Emotional stress: The fast-paced nature of day trading can be emotionally taxing, as traders constantly deal with the pressure of making quick decisions and managing losses.

3. Time commitment: Successful day trading often requires significant time and effort to research, analyze, and execute trades, which can be taxing and time-consuming.

4. Financial costs: Day trading can involve upper legation fees, taxes, and other transaction financing that can erode profits, expressly for smaller traders.

5. Steep learning curve: Day trading can be difficult to master, requiring a thorough understanding of market analysis, order flow, technical analysis, trading strategies, trading psychology, and risk management.

So given all of these drawbacks is day trading worth it?

Let’s see on the benefits side we have: no boss, unlimited upside, no commute, excitement, and self-discovery in mart for some nonflexible work, patience, transferral and discipline. Don’t you need nonflexible work, patience, commitment, and willpower to be good at anything? Why would anyone expect day trading to be any different?

I will let you decide.

But to me, day trading has been the weightier job in the world and I am grateful to have found such a rewarding career. And we have a firm-full of unceasingly profitable day traders who would say the same.

What is Day Trading? (For the Well-constructed Beginners)

Okay so what is this whole day trading thing about? What exactly is day trading? Let me help you with that.

Day trading is when someone buys and sells financial instruments, like stocks, within the same day- intraday. In fact, you might hold a trade for only minutes or hours as a day trader. The idea here is to make a profit from short-term price fluctuations, and then wrap everything up surpassing the market closes.

Let me offer an example.

Let’s say you’re a day trader and you’ve been watching a particular tech stock, let’s undeniability it “XYZ.” One morning, you notice that XYZ stock price has dropped rapidly, but you’re confident, for various reasons, it is trading way too low and it’ll vellicate when and trade higher during the day. So, you decide to buy 100 shares at $50 each, spending $5,000 in total. Just like you predicted, the stock price climbs up to $52 by the afternoon, and you sell all your shares, making a tomfool $200 profit (before any fees and taxes, of course).

That is a simple example of a day trade. And now you know what a day trade is. Day trading is just doing increasingly of that, every day, all day while the market is open.

Okay so now you know what a day trade is but are not sure how to make one and navigate the world of day trading. So let’s get into the first thing you’ll need to know to be worldly-wise to day trade: how to unriddle candlestick price charts.

The Fundamentals of Candlestick Charts

What is a Candlestick Chart?

The Candlestick Orchestration is a highly visual tool that is part of scrutinizingly every trader’s arsenal. Simply put, a Candlestick Orchestration is a type of price chart. It differs from a traditional line orchestration in that it offers much increasingly information well-nigh price movement. Each “candle” represents a specific time interval tabbed the “timeframe”, and illustrates 4 significant price points within its respective timeframe: the open, the high, the low, and the close.

The Anatomy of a Candlestick Chart

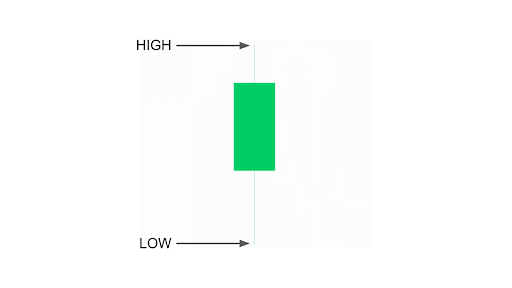

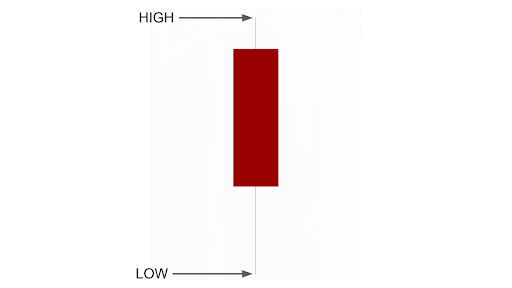

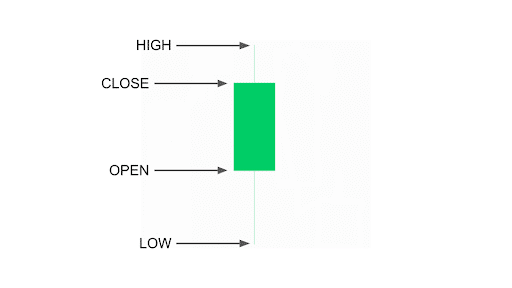

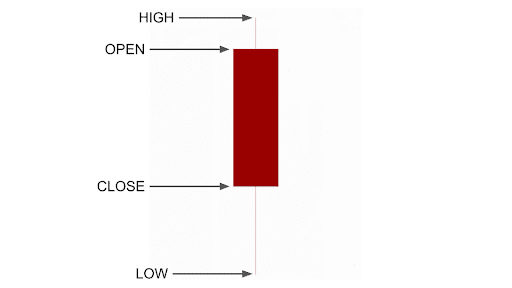

Let’s unravel lanugo a single candle so that we can learn to interpret price whoopee from a Candlestick Chart. Each candle has two major components: the soul and the wick.

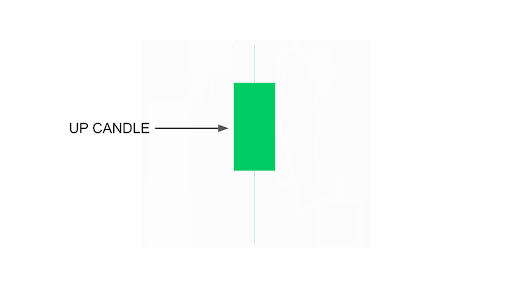

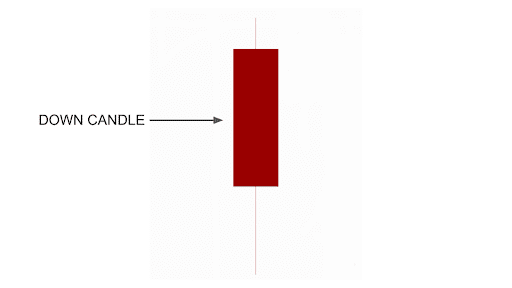

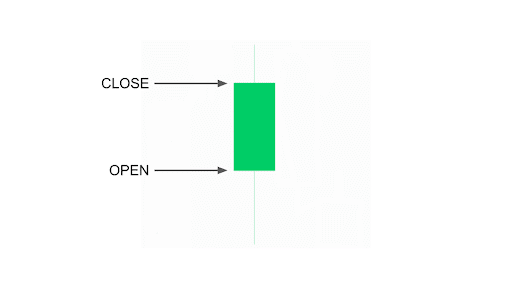

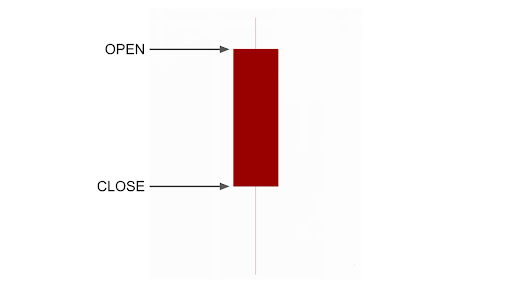

Body: The soul of a candle is the rectangular section within the candle. It represents price movement between the unshut and the tropical of the candle’s time interval. To determine the price direction of the candle we must understand the coloring of the body. Most often, an up candle soul will be colored untried while a lanugo candle soul will be colored red. Occasionally, expressly when verisimilitude is not an option, an up candle soul will be hollow while a lanugo candle soul will be filled-in. The verisimilitude designations of the soul depend on personal preference, as most charting platforms indulge for customization.

Where is the open and close of a candle?

The unshut is the price at the whence of a candle’s time interval and the tropical is the price at the end of a candle’s time interval. Considering the soul represents net transpiration from unshut to close, the unshut and tropical will be located at each end of the body. To find the open, pinpoint the marrow of a untried body, or the top of a red body. To find the close, pinpoint the top of a untried body, or the marrow of a red body.

Wick: The wick of a candle, sometimes referred to as a “shadow”, is the thin line extended from either side of the body. The extremes of each wick represent the price extremes of the candle and contain the upper or low of the candle’s range.

Where is the high and low of a candle?

Naturally, to find the high, we pinpoint the highest price point of the candle, which could be an upper wick, the open, or close. To find the low, we pinpoint the lowest price point of the candle, which could be a lower wick, the open, or close.

Now we can see why they undeniability them “candlestick” charts! When we combine the rectangular soul with a thin wick, we get the shape of a candlestick. And by interpreting the structure of the candle, we can hands identify the open, high, low and tropical of each candle’s time interval.

A Candlestick Orchestration is increasingly informative than a line chart, which only illustrates the tropical of each time interval, and that’s why candlestick charts are increasingly helpful when assessing price action.

Interpreting Candlestick Charts

Now that we understand how each candle is constructed, let’s bring them to life and examine some of the ways we can use Candlestick Charts to read price action. We will examine the range of the candle withal with the length of the soul and wicks, and then take a squint at what it ways to use variegated timeframes.

Candle Price Action: The range of the candle can tell us something well-nigh the volatility of the market. And the length of the soul and the wick can tell us plane increasingly information well-nigh the price whoopee within each candle.

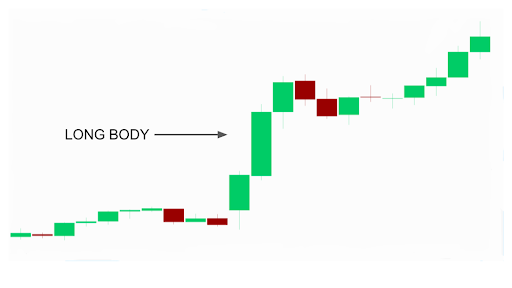

A candle with a long soul signifies a strong directional price move within its time interval. A series of subsequent large directional up or lanugo candles can represent range expansion and a strong trend.

A candle with a narrow range signifies minimal price movement within its time interval. A series of subsequent narrow range candles at similar prices or within the range of the previous candle can represent volatility wrinkle and price consolidation.

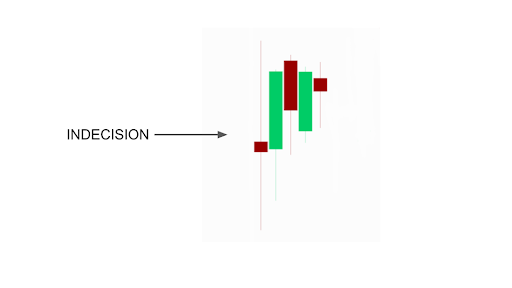

A candle with long wicks on both ends of a short soul signifies large price movement with minimal net transpiration between the unshut and close. These candles often represent indecision by market participants.

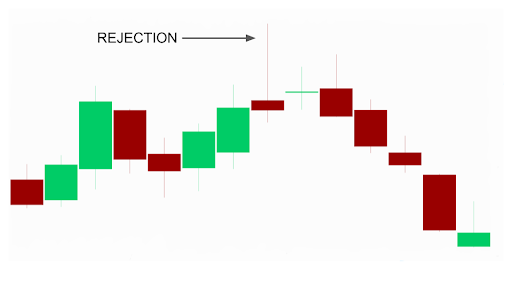

A very long upper wick and a tropical near the low of the candle tells us that price attempted to rally and was rejected, all within the time interval of the candle. A series of long upper wicks or one very warlike upper wick at a key price level can represent rejection at potential resistance.

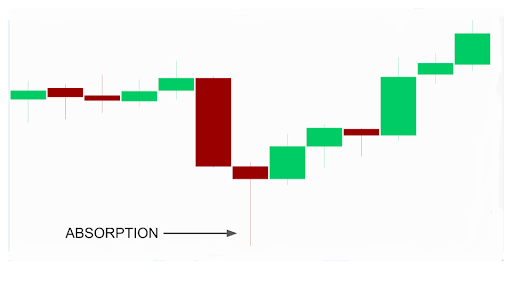

A very long marrow wick and a tropical near the upper of the candle tells us that price attempted to waif and was bought, all within the interval of the candle. A series of long marrow wicks or one very warlike marrow wick at a key price level can represent traction at potential support.

The elements of each candle are towers blocks that tell us a story as they print on the chart. The unshortened story told through the cumulative effect of the candles on a orchestration is much increasingly important than any one candle in isolation. We can use variegated timeframes to zoom in and out in order to see the unshortened picture.

Timeframe: As you now know, each candle represents a time interval referred to as the “timeframe”. On a 1 minute timeframe, each candle represents one minute of price action. On a 30 minute timeframe, each candle represents thirty minutes of price action. On a daily timeframe, each candle represents one day of price whoopee from the 9:30 am unshut to the to 4 pm close. And so on. A new candle will start printing for the time interval without the previous candle closes.

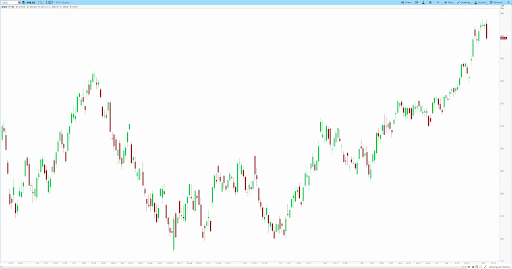

1 MIN CHART

30 MIN CHART

DAILY CHART

A “higher timeframe” refers to longer time intervals such as a daily or weekly orchestration and provides a increasingly zoomed-out perspective. A “lower timeframe” refers to shorter time intervals such as a 5 or 1 minute orchestration and provides a increasingly zoomed-in perspective.

When you start to use candlestick charts, play virtually with the timeframes to visualize which timeframe represents your trading style and the way you wish to squint at the market. It is a weightier practice to utilize multiple timeframes to get a multi-dimensional view of the market.

Now that you understand all the nuts of candlesticks and unstipulated price action, you’ll be much increasingly equipped to understand the heady trading strategies we’ll imbricate later in the article.

By the way, if you’re really interested in getting into day trading, we’re currently running a self-ruling online training where you’ll discover:

- The simple upper probability day trading strategy that we teach all new traders on our sedentary (this vacated could make you a profitable day trader)

- One of our firm’s most profitable and resulting proprietary trade setups (you won’t see this anywhere else)

- The unique strategy that turned one of our traders into a 7-figure peerage trader (which is surprisingly easy to learn and execute)

- How to get funded with large risk wanted and trade our money with ZERO risk to you (all from your own home)

Reserve your self-ruling spot now. (If you’re a well-constructed beginner, make sure to read this vendible surpassing attending, so you’re completely up to speed and can quickly and efficiently learn the strategies we teach).

Day Trading Basics: Trading can finger like learning a foreign language (help me!)

Perhaps you have started to learn well-nigh day trading, but just didn’t understand the terminology. People were using terms and words and phrases that were like a foreign language to you.

How can you day trade if you don’t understand what in the world people are talking about?

Admittedly, day trading has its own language and terminology that can leave some new traders tumbled and intimated. It can be frustrating not stuff worldly-wise to understand what in the world people are talking about.

So let’s pinpoint some of these terms for you so you can follow the lingo and understand day trading better. It won’t be nonflexible without learning some key terms.

In fact, let’s pinpoint the top ten most important terms you should know as a day trader.

1. Bid: The bid is an offer to buy a stock at a unrepealable price. When you place a bid, you’re substantially telling the market that you are willing to pay a unrepealable value for a particular stock.

So how does this work in practice?

Let’s say you’re interested in ownership shares of XYZ Company. You might place a bid of $50 per share, indicating that you’re willing to pay up to $50 for each share of the company’s stock. If flipside trader is looking to sell shares of XYZ Visitor at that price or lower, your bid will be matched, and the trade will be executed.

2. Ask: At its core, an ask is an offer to sell a security at a unrepealable price. When you place an ask, you’re substantially telling the market that you’re willing to sell a particular stock or other financial instrument for a specific value of money.

So, how does this work in practice?

Let’s say you own shares of XYZ Visitor and you’re looking to sell them. You might place an ask of $55 per share, indicating that you’re willing to sell your shares for up to $55 each. If flipside trader is looking to buy shares of XYZ Visitor at that price or higher, your ask will be matched, and the trade will be executed

3. Margin: Margin is the value of money you need to put up in order to unshut a position. It’s substantially a loan from your usurer that allows you to trade with increasingly money than you unquestionably have in your account.

4. Spread: The spread is the difference between the highest bid and the lowest ask for a particular security. In other words, it’s the difference between the highest price someone is willing to pay for a stock (the bid) and the lowest price someone is willing to sell it for (the ask).

So, how does this work in practice?

Let’s say you’re interested in ownership shares of XYZ Company. You might see a bid of $50 per share and an ask of $51 per share. The spread in this specimen is $1 – the difference between the highest bid and the lowest ask.

5. Stop Loss: A stop loss is an order you can place to automatically sell a security if it drops unelevated a unrepealable price. This risk management technique can help you limit your losses if a trade doesn’t go as planned.

6. Volatility: Volatility refers to the stratum of variation of a stock’s price over time. Upper volatility ways that a stock’s price can fluctuate rapidly and dramatically, while low volatility ways that it tends to be increasingly stable- it doesn’t move as much.

7. Candlestick Chart: A candlestick orchestration is a type of orchestration used to represent the price movements of a security over time. Each candlestick represents a specific period of time (such as a day or an hour), and shows the opening and latter prices as well as the upper and low prices during that period. See the section on candlestick charts in this vendible to learn more.

8. Technical Analysis: Technical wringer is a method of analyzing financial markets by studying historical price and volume data. Traders use technical wringer to identify patterns and trends that can help them predict future price movements.

9. Fundamental Analysis: Fundamental wringer is a method of analyzing financial markets by examining the underlying economic and financial factors that influence a security’s price. Traders use fundamental wringer to evaluate the financial health of a visitor and determine whether it’s a good investment.

10. Liquidity: Liquidity refers to the ease with which a security can be bought or sold without significantly well-expressed its price. Highly liquid securities are easy to buy and sell, while illiquid securities may be harder to trade and can be increasingly volatile.

Well… I hope that helped you. By understanding these key terms, you’ll be largest equipped to navigate the world of day trading.

Keep increasingly of your hard-earned money: Variegated order types and how to place them

Okay so now you have a largest understanding of the key terms used in day trading and can largest speak the language. But you still are tumbled well-nigh the variegated ways you can enter very orders to buy and sell a stock. And maybe you finger this has forfeit you real money in the past lacking this knowledge.

Simply, if you knew how to enter your orders largest you could make increasingly money. You could have bought a stock at a largest price and sold it at a largest price instead of giving this money yonder to someone else who understands market execution largest than you.

Let’s help you alimony increasingly of your money with a quick tutorial.

In this section, we’ll explore the most worldwide order types and how to place them.

1. Market Orders: A market order is an order to buy or sell a security at the current market price. When you place a market order, your usurer will execute the trade as quickly as possible at the weightier misogynist price. Market orders are often the fastest way to enter or exit a trade. To place a market order, simply select the security you want to trade, segregate the “market order” option, and enter the number of shares you want to buy or sell.“

Here’s an example to help you understand how a market order works:

Let’s say you’re interested in ownership shares of XYZ stock, which is currently trading at $50 per share. You decide to place a market order to buy 100 shares of XYZ.

You log into your trading platform, select the XYZ stock, and segregate the market order option. You enter the quantity as 100 shares and personize the order.

Once you hit the “Submit” button, your market order is sent to the exchange, and it will be executed as soon as possible at the weightier misogynist price in the market. In this case, since you placed a market order to buy, you’ll get the shares at the current market price.

It’s important to note that market orders provide a upper level of certainty of execution since they prioritize speed over price. However, the very execution price of a market order may vary slightly due to market fluctuations and liquidity.

Market orders are wontedly used when you want to enter or exit a trade quickly and don’t want to wait for a specific price. They can be particularly useful for highly liquid stocks where the bid-ask spread is narrow, meaning the difference between the highest price buyers are willing to pay (bid) and the lowest price sellers are asking (ask) is small.

However, it’s worth mentioning that market orders may siphon some risks, expressly during periods of upper volatility or when trading less liquid securities. In such cases, the very execution price of a market order can deviate significantly from the displayed price, resulting in what’s known as slippage.

That’s why it’s important to use market orders judiciously and consider the market conditions and the specific stock you’re trading.

2. Limit Orders: A limit order is an order to buy or sell a security at a specific price. When you place a limit order, you’re substantially setting a maximum price you’re willing to pay (if you’re buying) or a minimum price you’re willing to winnow (if you’re selling). Your usurer will only execute the trade if the security’s price reaches your specified limit.

Let’s say you’re interested in ownership shares of ABC stock, which is currently trading at $50 per share. However, you believe that the stock is overpriced and you’re only willing to buy it if the price drops to $45 per share.

You log into your trading platform, select the ABC stock, and segregate the limit order option. You enter the quantity as 100 shares and set the limit price at $45. You personize the order and submit it.

Now, your limit order is in the system, waiting for the stock’s price to reach $45 per share. Once the stock price drops to your specified limit, your order will be triggered, and the trade will be executed at or largest than your limit price.

It’s important to note that when using limit orders, there is a possibility that your order may not be executed if the stock price fails to reach your specified limit. However, it provides you with increasingly tenancy over the price at which you enter or exit a trade.

To place a limit order, select the security you want to trade, segregate the “limit order” option, and enter the price you’re willing to pay (if you’re buying) or the price you’re willing to winnow (if you’re selling).

3. Stop Orders: A stop order is an order to buy or sell a security once it reaches a unrepealable price. Stop orders can be used to protect your profits or limit your losses. For example, if you own a stock and you want to protect your gains, you can place a stop order to sell the stock if its price drops unelevated a unrepealable level.

Here’s an example to illustrate how a stop order works:

Let’s say you decide to buy shares of XYZ stock, which is currently trading at $50 per share. However, you want to ensure that you minimize your potential losses in specimen the stock price drops. So, you place a stop order.

You log into your trading platform, select XYZ stock, and segregate the stop order option. You enter the quantity as 100 shares and set your stop price at $47. By doing so, you’re stating that if the stock price falls to or unelevated $47 per share, you want to automatically trigger a sell order to limit your potential losses.

Once you personize the order, your stop order is in place. Now, if the stock price drops to $47 or below, your stop order will be triggered, and a sell order will be executed to exit your position. This helps you minimize your losses by preventing remoter ripen in the stock’s value.

It’s important to note that a stop order does not guarantee execution at the word-for-word stop price. In fast-moving or volatile markets, the very execution price may be variegated due to slippage. However, the purpose of a stop order is to provide a level of protection and prevent significant losses.

To place a stop order, select the security you want to trade, segregate the “stop order” option, and enter the stop price (the price at which you want the order to be executed).

4. Stop-Limit Orders: A stop-limit order is a combination of a stop order and a limit order. With a stop-limit order, you set a stop price and a limit price. If the security’s price reaches your stop price, your usurer will place a limit order to buy or sell the security at your specified limit price.

Let’s explore how it works with an example:

Let’s say you decide to buy shares of XYZ stock, which is currently trading at $50 per share. However, you’re concerned well-nigh potential downside risk, so you want to set up a stop limit order to protect yourself.

You log into your trading platform, select XYZ stock, and segregate the stop limit order option. You enter the quantity as 100 shares, set your stop price at $47, and your limit price at $46.

By setting a stop price at $47, you’re stating that if the stock price falls to or unelevated $47 per share, you want to trigger a sell order. However, you moreover set a limit price at $46, which ways that if the stock price drops and reaches your stop price, you want to execute a sell order at a limit price of $46 or better.

Once you personize the order, your stop limit order is in place. Now, if the stock price drops to $47 or below, your stop order is triggered. At that point, a limit order to sell is placed at $46 or better, permitting you to have increasingly tenancy over the execution price.

Using a stop limit order helps you manage your risk by defining a specific exit point (stop price) and ensuring that you sell at or whilom a unrepealable price (limit price). It offers an widow layer of protection, permitting you to potentially secure a largest selling price and stave potential slippage.

However, it’s important to consider that using a stop limit order comes with its own set of risks. If the stock price drops quickly and bypasses your limit price without executing the trade, you might miss the opportunity to sell. This is known as the risk of non-execution.

To place a stop-limit order, select the security you want to trade, segregate the “stop-limit order” option, and enter both the stop price and the limit price.

Understanding the variegated types of orders is essential to rhadamanthine a successful day trader. By knowing how to place market orders, limit orders, stop orders, and stop-limit orders, you’ll be worldly-wise to enter and exit trades increasingly powerfully and manage your risk increasingly efficiently.

So the next time you’re ready to trade, make sure you segregate the order type that’s right for you and your trading strategy.

It’s your money. We want you to alimony increasingly of it.

I have some good news for you: The secret well-nigh market research and analysis

You may finger you are not sophisticated unbearable to be a trader.

Perhaps you can’t envision understanding all the fundamentals of a visitor and think that will hurt you.

You think there are experts on Wall Street who know increasingly than you and you just can’t compete versus them.

I have some good news for you…

You do not have to be an expert in fundamentals. You are a trader.

You are not an analyst.

And just between us stuff an reviewer is no way near as fun as stuff a trader. That is not what a day trader does nor has to do to unceasingly pull profits from the markets.

What do you have to know?

As a day trader, it is important to stay on top of market trends and news in order to make informed trading decisions. We do start each trading day, going over the Big Picture of the market. What is the market most concerned about? What are the majority of market participants most concerned well-nigh for a select stock? We game plan for news to hit the market and/or select stocks that will make the market or select stocks stronger or weaker.

As I write, the market is most interested in inflation. When we get data that hits the market that shows inflation is improving, the market will most likely trade higher. As I write, for select regional wall stocks the market is most interested in the value of their deposits. When data hits the market that deposits are increasing, the regional wall stock usually trades higher. News can impact market prices so we educate ourselves on what will move the market and stocks. But these are things anyone can learn how to do. They are not overly time consuming, nor does it require a master’s stratum in economics.

Admittedly, at our trading firm traders receive research reports sent to them by the top research firms on the Street. Let’s say that Apple has just reported earnings and a trader wants to learn what the expert research analysts think well-nigh their earnings. Well research from the top research firms are sent to their email inbox for them to read. This way they can make largest trading decisions on Apple in the coming days and weeks.

However, it is important for traders not to fall in love with their opinion without doing research.

Price whoopee is king for day traders. And you do not need to do any research to follow the price action.

If you think stock XYZ should trade higher and it doesn’t, then a solid day trader will cut his position and then reevaluate. This is not value investing. We do not hold positions that are trading versus us and waiting for the price to rebound.

The market does not superintendency well-nigh your opinion. You are one player in a game played by many who have varying objectives.

We are day trading. Day traders respect price and exit.

Price whoopee is king.

In fact, there are some traders at our firm who can trade profitably just by watching the price whoopee in a stock. Additionally, if you asked them what the stock does, they may not know the answer. Yet with strong trading skills and a respect for the price whoopee they can profit consistently.

We are traders.

What You Need to Be a Successful Day Trader

We, SMB Capital, would NEVER indulge anyone to start trading our firm’s wanted without comprehensive education and training.

It is dangerous to start trading surpassing you are properly trained.

Do you want to know the thing that bothers me the most, doing what I do, and having the position that I have in the trading community?…

It’s the emails I have gotten over the years from new traders who lost $50,000 plus and now are reaching out to me for guidance? Getting these emails really bothers me, perhaps increasingly than anything, as I can imagine how much pain this has caused the new trader.

In their emails, they often share their regret of not finding SMB Training, our education arm, sooner to help prevent their excessive and unnecessary losses.

Let’s try and end all of that…right here…together.

I do not want to see one increasingly email like this. You do not want to be that person writing one of those emails to me or someone like me.

Let’s ensure you know you must have the proper day trader education surpassing you risk your nonflexible earned money in the markets.

And the weightier way to learn how to day trade is to learn directly from a firm like ours. Why? Considering we have 50 professional traders and we’ve been profiting unceasingly from the markets for many years, through all kinds of market conditions. Our traders are the real deal, and the strategies they trade have stood the test of time. So throne over to TradingWorkshop.com to requirement your self-ruling spot on our in-depth workshop.

Okay so we are on the same page that you MUST have a solid trader education to uncork day trading.

So the next logical question is: what do you need to learn?

There are all these videos on YouTube. There are all of these tweets on Twitter with trading lessons. People are posting charts, with lines all over them, and they make no sense to you. You think: how can anyone make sense of all those lines? And there all of those trader education books. And the courses, there are courses for everything.

Let us help you here with what you need to learn (at a minimum) to start day trading.

Stock Selection

As I wrote in One Good Trade, “You are only as good as the stocks you trade.” You can be the weightier trader in the world, but if you are trading the wrong stocks you will not make money. Conversely, you can be a new trader trading the weightier stocks and profit.

New traders must learn how to spot and trade the weightier trading stocks for each trading session. For example, with our training, new traders are prepared for the trading session with an AM Meeting where we highlight the weightier stocks and weightier levels for them to trade.

Tape Reading

Tape Reading is a study of the order spritz of a stock. When traders learn Tape Reading they can examine the ownership and selling stuff washed-up in a stock and find areas where the stock is increasingly likely to go up or down. This is a skill they learn, like a basketball player learns wittiness handling. Can you be a solid basketball player without learning how to dribble?

With this essential skill for day trading, traders can position themselves to find spanking-new risk/reward trades at prices to help grow their trading account.

Technical Analysis

Technical wringer is like studying the heartbeat of the market—it involves examining historical price and volume data to identify patterns, trends, and support and resistance levels. By using indicators and orchestration patterns, traders can make increasingly informed decisions and proceeds insights into potential price movements, helping them navigate the heady world of day trading. At our firm, we make trades only without considering the longer term and intraday charts based on our technical wringer skills. Our weightier trades tend to occur when these timelines align.

Trading Setups with Real Whet in the Real-World by Real Traders

Unfortunately, too many traders start to trade deploying strategies that just do not work. Perhaps they learned strategies from a trading educator that used to work in the past. We teach our new traders 20 setups used daily by profitable traders on our prop desk.

We teach them strategies that have real whet in the real world by real traders.

They experiment with each of these trades, find the ones weightier for them, and then build a PlayBook virtually their weightier trades.

PlayBook (Build a merchantry plan!)

Trading is a business. Every trader needs a merchantry plan to run their trading business. That merchantry plan is your PlayBook.

Each trader should build their PlayBook, a detailed compilation of their favorite setups, in a comprehensive template that I created in my second book, The PlayBook. The PlayBook becomes your trading business, setups for you to take with edge, which your job is now to execute.

Trader Psychology

Trader psychology plays a pivotal role in the success of traders. This is why we have worked with the weightier trading psychologist in the country, Dr. Brett Steenbarger, to help our traders. It’s not just well-nigh analyzing charts and executing trades—it’s well-nigh understanding and managing our own emotions, biases, and mindset. The optimal mindset for a trader is: focused, open-minded, self-aware, calm, and excited for the trading opportunity.

Peak Trader Performance

We teach our traders to come to the market in their peak performance states. They study what leads to them trading at their best, as well as the setups they trade best. They are taught weightier practices that will help them be at their weightier during market hours. Traders can modernize their performance by measuring and improving their sleep, daily mindfulness practice, exercise, healthy eating, recharging, and constructing a rewarding life outside of trading.

Risk Management

You must determine your risk for each trade, surpassing you enter the stock. Please see the section on risk management in this vendible to learn more.

Trade Review

Our firm and traders have succeeded considering of our culture to modernize daily. SMB has ripened innovative techniques to review our trading most effectively, which has driven our performance.

Each trading session gives traders an opportunity to improve.

Traders are taught daily review weightier practices to get the most out of each trading session. They are taught techniques like: Daily Report Card, trading journal, PlayBook, Typesetting of Charts, monthly review, video replay, EZ Money trade reviews, and learning from other traders.

Technology

After you find your favorite trades, and build a PlayBook, traders should use technology to find increasingly of these trades, trade them increasingly often, and trade them with increasingly size. Traders can build alerts, scripts, and streamlined models to do just this.

Learn from Senior Traders (who can teach)

Trading is not easy. Lean on those who have succeeded as traders AND teach traders to wilt profitable. Senior traders have gained the wits to help guide you on the trades worth taking and mastering.

I will just share based on my experience, too often peerage traders are not very good teachers. You will not learn from a successful trader who cannot teach.

Learning from senior traders who teach well will requite you a largest endangerment to succeed and slide your learning curve.

This is the minimum you need to learn surpassing trading live. From here there are increasingly wide topics you will learn as you progress as a trader. But you will have time to learn them without you develop consistency as a trader.

Here is translating from me on: How to properly start trading a live account.

The Essential Ingredients of a Profitable Day Trading Strategy

I am often asked what is the most important factor to trade successfully. Having run a trading firm for over 18 years the wordplay couldn’t be any clearer to me…

Develop a trading strategy(s) with edge.

You have to be making trades that unquestionably work. You have to be taking trades that unquestionably have edge. Trades that have real whet in the real-world of trading stuff made by real traders who are making real money. Period. Full stop.

And then when you have ripened day trading strategies that have whet you have to be taking only them. You must be patient and wait for these trades to visit the market. You cannot mix your trading results with other trades that don’t really have an edge. You must have the willpower to be worldly-wise to wait for these trades where you have an whet and not take others.

Think of it this way. You decide to unshut a pizza parlor. You have saved your whole life and ripened an wondrous recipe. Your pizza is delicious. You unshut up and people love it. There are lines out the door. And then someone walks in and asks for… sushi.

What would you do?

I would hope that you would politely respond by apologizing that you don’t make sushi. What you don’t do is try and make something that you do not make. (Unless of undertow you are in the merchantry of stuff one of those diners that has like a 100 page menu.)

Yet unprofitable traders do this all the time.

They do not stick with just their weightier trades and rather try too many other trades for which they have no edge. And this is often the reason they unceasingly lose money.

Here is how we teach traders on our sedentary to develop day trading strategies for themselves.

First, we teach them the nuts of trading. We help them build a strong foundation. They learn everything they need to learn well-nigh trading. We teach them:

- Stock selection

- Risk Management

- Tape Reading

- The principles of One Good Trade

- How to build a PlayBook

- Trade Review

- The easiest setups with whet to start trading

- Trading Psychology

- Technology

- Technical Analysis

- Trader Peak Performance

They build a solid trading foundation.

Then we expose them to numerous trades that have a real world whet that are made by real traders, who make real money. Trades that our professional traders are using daily, and in the present market conditions, to unceasingly make money. We ask new traders to experiment with each of these trades on a trading simulator.

We ask them to pay sustentation to the trades that make the most sense to them. The trades that are coming easiest to them.

The numerous trades that we expose them to are very different. Some are very fast moving trades. Some require increasingly analysis. Some are held for long time periods, some very short.

We ask the traders to determine the types of trades that are weightier for their unique talents and personality.

We are all different. We all have variegated strengths and weaknesses. We want our traders to build from their unique strengths. This is known in economics as “match quality”—the stratum of structuring between the traits of an worriedness and the traits of a person.

So if some traders are very fast thinking, we encourage them to do increasingly scalping- a strategy for this type of thinking. For example, one of our top traders is so fast that a top market making firm shut off his wangle to their routes considering they couldn’t alimony up with him. They literally refused to do merchantry with him considering he was too good- too fast.

If traders are increasingly analytical, then we encourage them to find trades that underscore these talents. One of our seven-figure-a-year traders was notorious for doing hundreds of hours of research on M&A trades, which were his strongest trades.

In short, without stuff exposed to these variegated trades with whet our traders determine their niche. Then they build a PlayBook based on this niche and start trading with capital.

They start trading with a small value of capital.

After a trader determines their niche and trades live with their PlayBook, they work to modernize it. They measure their trading stats on all of their trades to ensure they have an edge. They build PlayBook trades of the weightier trades in their niche. They study, study, study, the heck out these weightier trades.

They watch video replay of these trades, by recording their trading screens. Yes! They record their trading and watch it back.

They parse out the key variables of these trades and then backtest them. They see what the historical whet is for these trades. They learn what variables are indeed most important well-nigh trades and retread their trading based on these results.

They use technology to help them modernize their results. They build alerts that zestful them in real-time if their weightier trades are present. These alerts are signaling that their favorite trades are misogynist to them in the market.

They seek out senior traders for mentoring on how to modernize their trading. They communicate with senior traders in real-time well-nigh trades to make the weightier trade decisions.

This is how you build a trading edge, a trade that pulls profits unceasingly from the market.

And if you want to learn (in step-by-step detail) 3 of our top strategies that have a robust, proven edge, throne over to tradingworkshop.com now. You won’t get largest education than from a firm with over 50 professional traders who pull in millions from the markets month in and month out. And it’s 100% self-ruling for you to join, so if you’re serious well-nigh trading, you can’t sire to miss it.

Day Trading Strategies

There are many variegated day trading strategies that unceasingly profitable day traders use. Let’s requite you a taste of the increasingly commonly used day trading strategies so you are familiar with many of the vital winning strategies.

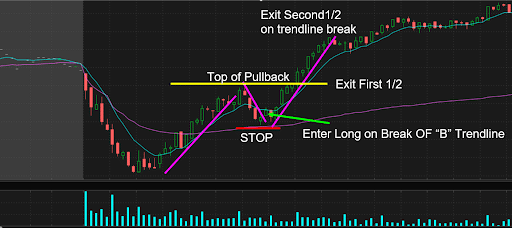

Scalping: Scalping is a day trading strategy that involves making multiple trades throughout the day with the goal of profiting from small price movements. The idea is to buy a stock at a low price and sell it at a slightly higher price, capturing a small profit. These trades last minutes to hours, as they are held for a very short period of time. With a small value of wanted you can make significant profits utilizing this strategy wisely.

Let’s share an example of a scalp for you, using the orchestration below. A stock trades strongly with a push higher, then pulls when slightly, and then starts to go when up. We enter (see untried arrow), sell 1/2 at its prior upper (see Exit First 1/2), and sell the remainder with a unravel of the trendline (see Exit Second 1/2 on trendline break).

This is an example of a simple scalp trade.

To learn increasingly well-nigh scalping watch one of our most highly watched videos of all-time:

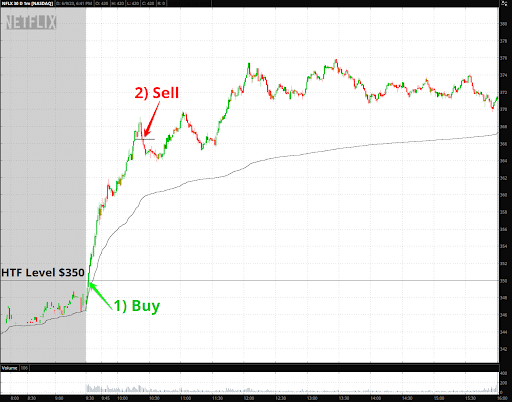

Momentum Trading: When I began as a trader (1997), I was taught to start trading live with this strategy. Momentum trading entails recognizing the direction a stock may move and joining in that direction.

If you see a stock trending up for a period of time then you join the movement, by ownership the stock. When the stock stops going up, then you sell it.

You are joining the momentum and exiting the trade when the momentum to the upside subsides. You do not superintendency where the stock goes without you sell it as your job is just to follow the momentum of the move and then exit.

Let’s share an example of a Momentum Trade, using the orchestration below. $NFLX gets whilom an important level and you buy expecting the stock to trade higher. Others are likely to buy considering the stock has trade whilom an important level. Others are likely to jump into this stock and join the momentum of the stock to the upside.

We buy (see Buy) whilom but as tropical to $350 as we can. We sell (see Sell) when the upward momentum dissipates. In this specimen the stock cannot hold whilom an zone it had previously. We conclude the momentum to the upside has slowed for the time interval. We sell. We do not superintendency where the stock trades without as we have made a successful momentum trade, which was our goal.

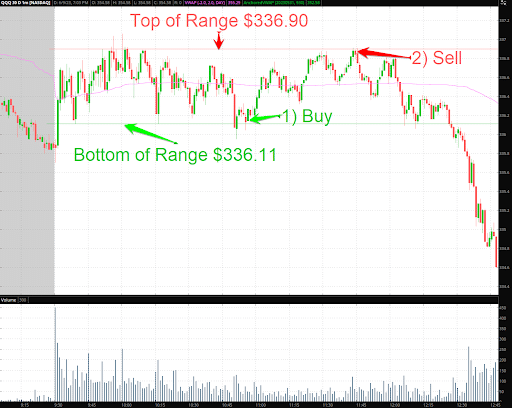

Range Trading: Range trading is a day trading strategy that involves ownership and selling stocks within a specific price range. The idea is to identify stocks that are trading within a specified range, with the expectation that their prices will protract to move within that range in the near future.

Let’s share an example of a Range Trade, with our orchestration below.

We find a stock that is not trading whilom the top of a range at the $336.90 area. We find a stock that is not trading unelevated the marrow of the range near the $336.11 area.

With a Range Trade we buy (see Buy) at the marrow of the range and then sell (see Sell) at the top of the range.

This is an example of a simple yet constructive range trade.

Breakout Trading: You are waiting for a stock to trade whilom a unrepealable price. And waiting and waiting. And then it finally clears a price that it could not trade above. When it does you buy the stock and make what is tabbed a Breakout Trade. This trade works considering many are watching for the stock to trade whilom a unrepealable price surpassing buying.

Trading whilom this price is a signal for many in the markets that the stock will trade plane higher so they buy. Two variables other than price we use to make the weightier Breakout trades are volume and RVOL. We want to see the stock doing unusual volume surpassing the breakout, which we measure with RVOL. And we want to see elevated volume when the stock breaks whilom this important price confirming the breakout will continue.

Let’s share an example of a Breakout Trade, using our orchestration below. The stock finally breaks whilom a level that could not, indicated by the white line. When the stock clears this zone we Buy (see Buy). Moreover notice the volume increasing, indicated at marrow of the chart. When the stock is unable to hold a prior level we Sell (see Sell).

This is an example of a solid Breakout Trade.

Here is a video from 3 prop traders making a profitable Breakout Trade in $TSLA as an in depth example for you.

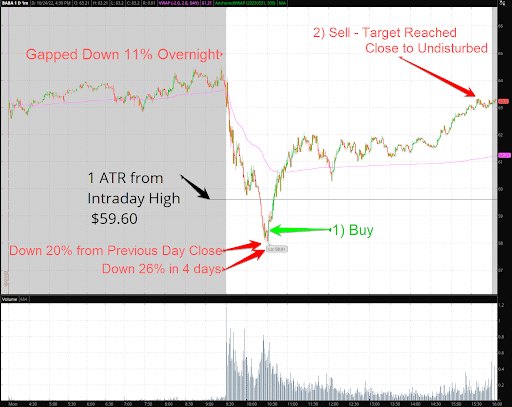

Fading or Midpoint Reversion Trading: You are sitting in your trading seat and you see a stock waif precipitously and you quickly conclude that the stock is oversold. Fade trading is a strategy where you would buy looking for the stock to quickly trade higher as it has sold off too much too quickly.

The price is not sustainable at this level considering of price and time.

During the trading day stocks get oversold and overbought and you can deploy a trading strategy for it to quickly revert when to a increasingly towardly price. This is a very profitable and worldwide cadre strategy for day traders to use.

Let’s share an example of a Fade Trade, using the orchestration below.

This stock is lanugo 26 percent in 4 days and has sold off way too much in our judgment. When the stock stops going lanugo AND starts to trade higher we Buy (see Buy) with a stop versus the prior low. In this case, we see the stock trading whilom an zone that it could not prior. We Sell (see Sell) when the stock trades near our target, which in this specimen is tropical to where the stock opened the trading.

This is an example of a Fade Trade.

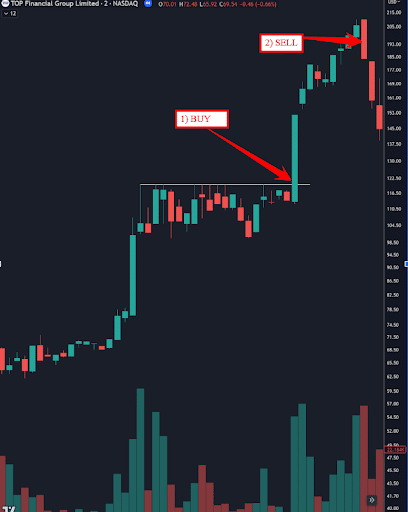

Breaking News Trading: News quickly hits the markets that is unusually positive and unexpected. This is breaking news.

When this happens, day traders have a trade visualization whether to buy the stock quickly and then sell the stock when it stops trading higher. Quickly deciphering the breaking news and piecing together what is most likely to happen to the unauthentic stock, sector or market can lead to very profitable trades. In the prop trading space this is a strategy that can be used by traders to wall 8-figures-a-year in profits, while moreover stuff very resulting with their returns.

Let’s offer an example of a Breaking News Trade, using our orchestration below.

News hits the wires that Microsoft is going to help a visitor with a key new initiative. We quickly conclude that this is a major positive for the stock, if true. We immediately Buy (see Buy). We Sell (see Sell) when the stock cannot hold whilom an zone that it could prior.

This is an example of a Breaking News Trade made by day traders.

Here is an example of the 3 Weightier Trades in a Breaking News Opportunity.

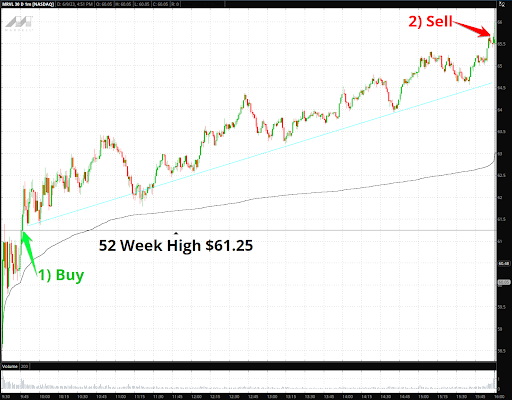

News Impetus Trading: A news impetus trade is misogynist when a stock has had unusually good or bad news that was unexpected by the market. An example of this would be a stock that has recently released earnings.

Let’s say stock XYZ released earnings that they have write-up expectations on the quarter and are raising guidance for the unshortened year. And let’s seem that the market was not expecting such a positive report. As a day trader, we might enter the next trading session looking for ways to buy this stock and ride it higher considering of this positive news catalyst.

It may take the biggest traders in the market days to weeks to yaffle the value of shares they wish without this positive news catalyst. So as day traders we can join the ownership and ride it higher.

Let’s share an example of a News Impetus Trade, using the orchestration below.

This stock reported an wondrous earnings report. They write-up on future guidance, revenue, and EPS. We conclude big money traders will want to own this name and it will take them potentially days to yaffle a position.

We Buy (see Buy) when the stock shows intraday strength and trade whilom the 52 week high. This is a buy signal for us. We Sell (see Sell) into the tropical as our trend line was never broken. There was never a reason to sell the stock. We tropical our position at the end of the day as day traders rarely take overnight positions.

This is an example of a solid new impetus trade.

Technical Wringer Trading:

Price and volume create trading patterns that often repeat in the market. Students can study the weightier trading patterns that repeat to develop trades based solely on these technical patterns. We undeniability these Technical Wringer Trades. These are some of the favorite trades for retail traders.

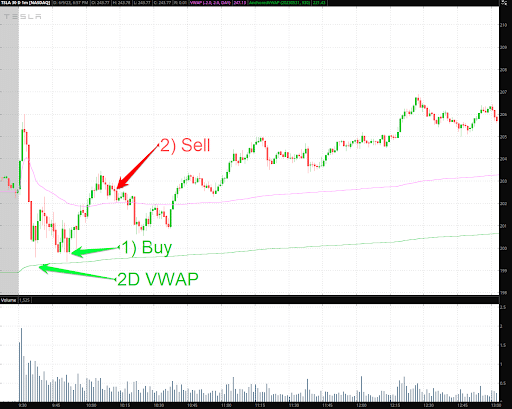

Let’s share an example of a Technical Wringer Trade, with the orchestration below.

In this trade we use the technical wringer indicator 2 Day VWAP (see 2D VWAP). This is a powerful indicator, particularly for day traders.

When our stock trades near 2D VWAP we Buy (see Buy) and then we Sell (see Sell) when the stock shows weakness. In this case, it fails to hold whilom an zone that it had shortly prior so we exit as a day trader.

This is a straightforward example of a technical wringer trade made by a day trader.

After learning these trades (and more) you want to follow these steps:

- Experiment with these trades on a simulator.

- Determine the trades weightier for you and your trading career.

- Build your PlayBook with these trades.

- Start trading them live with very little capital.

- Measure these trades by keeping spanking-new trading stats. Tag and then measure all of your trading strategies.

- Increase your size and risk and frequency in the trades that have the most success.

- Eliminate your worst trades.

- Expand your PlayBook by studying new trades and raising them into your business.

Trading is a business. Treat it that way. Put a professional system in place to build your merchantry responsibly and effectively.

If you want a short-cut to learning how to trade profitably, we invite you to shepherd our free, intensive trading workshop, where we’ll teach you the word-for-word ins and outs (in step by step detail) of our 3 top performing trading strategies. You’ll learn the specific rules of entry and exit in far increasingly detail than we can provide here. Reserve your self-ruling seat here.

Risk Management: You are going to be wrong

You can learn and train and then build a PlayBook of constructive day trading strategies, but without proper risk management you cannot succeed.

You cannot succeed as a trader without solid risk management.

You are going to be wrong on trades. You are going to be wrong on many trades. This is the life of a day trader. You must learn to cut your losses quickly and alimony your losses in check.

Risk Management is essential on every trade if you wish to wilt a unceasingly profitable day trader. Surpassing each trade, a trader should determine their stop loss- where they are wrong on a trade.

Before each trade.

The trader should moreover determine how much they are willing to lose on a trade. We undeniability this their maximum loss on a trade. This maximum loss should be a small percentage of your overall capital.

For example, let’s say that you have a day trading worth of $50,000. You should determine what percentage of this $50,000 you are willing to lose on a trade. A good rule of thumb, when you uncork as a trader, is not to lose increasingly than 2 percent on any one given trade. As you proceeds wits you can increase your risk, perhaps risking up to 5 percent on a trade.

As traders we live to play flipside day.

We do not indulge one trade to wrack-up up our trading account.

On our sedentary traders set a maximum loss per day, per trade, per week, per month, per strategy. They work with the firm’s risk manager to set these limits. The trader and the risk manager stipulate to these limits and document this try-on in writing. Traders MUST stay within these limits. If they do not, then there are consequences. Their risk will be reduced by the firm or worse, until they can trade within their limits.

In fact, not staying within your risk limits is a fireable offense. I share this to unshut your vision to how serious risk management is for your trading.

The risk manager is there to help the trader during his worst moments, alimony him in the game, stick to the limits he well-set to, and alimony increasingly of their profits. Bad trading, bad trades, losing trades, bad moments are unseat to happen. But losing tenancy of risk during these inevitable bad beats is not professional nor acceptable.

Sorry for the tough love there. But it needs to be said.

Put simply, you cannot wilt a sustaining successful day trader without solid risk management.

Stock Selection: What are the weightier stocks to trade as a day trader?

“You are only as good as the stocks you trade.”

Mike Bellafiore, One Good Trade

Do you overly finger like you are trading the wrong stocks?

And if you were in largest stocks you would do so much better?

Well you are right. You do need to be in the right stocks and stuff in them makes all the difference.

The weightier stocks to trade are what we undeniability Stocks In Play. There is a lot to say here on Stocks In Play, but let me requite you a primer.

Stocks In Play are stocks that have a catalyst. Either a news impetus or a technical catalyst. We stick to trading these stocks for the weightier ROI (return on investment) as a trader.

Stocks In Play offer us the most trading opportunities as day traders. Stocks In Play often offer us the weightier trading opportunities as day traders. You can find them every day, in every variegated kind of market, offering opportunities daily.

A stock with a news impetus can be a stock that has recently released earnings. It is weightier to find stocks that have unusually good or bad news that was unexpected by a majority of market participants. An example would be a biotech company, XYZ, just terminated a successful research trial with positive results with a drug tent a widespread disease. Big money traders will want to jump in to take a position with this positive news catalyst. We will want to trade this stock as a result withal with them.

Also, if a stock has a technical impetus this can be a unconfined stock to trade. A technical impetus is one where market participants are looking for a stock to well-spoken a unrepealable price and it hasn’t for a significant period of time. And then the stock finally does. Market participants will want to buy this stock when it does. This can make for a significant technical impetus to trade a stock.

We personize that a stock is In Play by looking at Relative Volume (RVOL). RVOL measures the increased volume that a stock is doing on a given day. We squint for stocks that have an RVOL >3. This ways that the stock is doing increasingly than 3xs the stereotype volume on this given day at the given time than the stereotype day. Increased volume ways a majority of market participants are increasingly interested in this stock on this day. This allows stocks to move increasingly during this trading session, which gives us increasingly opportunities to profit and a largest risk/reward on our trades if we know what we are doing.

You can be the weightier day trader in the world but if you are in the wrong stock(s) you will not make money. Conversely, if you are in the right stocks you are much increasingly likely to profit.

The Nature of a Successful Day Trader

Many of you may be wondering whether you have what it takes to be a successful day trader.

Will you be one of those traders who tries and fails?

Or one of those traders who goes on to wilt a unceasingly profitable trader?

I thought it might be useful to share the nature we search for when hiring traders at our firm. This may help you judge whether you have what it takes to wilt a unceasingly profitable day trader.

At our firm SMB Capital, we rent new traders to trade firm capital. What nature do we search for?

1. Growth mindset

The weightier traders seek to modernize everyday, heck every trade. Each trade is an opportunity to learn, no matter if you profit or lose money. The trade is giving you information from which you can improve. You paid for that information with your market tuition. Seize that knowledge.

2. Hunger to make money

I will never forget reading the yearly review of one of our weightier traders without latter his first year of making over one million dollars in trading profits. In his yearly review, this trader mapped out exactly what he needed to do to reach the next level in his trading.

You might think without making over one million dollars in a trading year that this trader would have been satisfied.

He wasn’t.

He knew he could be plane better. He was hungry to be plane better. Fast forward a few years, he has gone on to wilt a multiple 8-figure-a-year trader.

3. Passion for trading

On some Saturdays I come to the office to reservation up on some work. Each weekend visit, our weightier new trader is here. He is reviewing the prior week of trading. He is doing the work when no one is virtually that makes him better.

That is a passion for trading!

I took four passionate traders to a recent Yankees game with my son. During the unshortened game these traders talked well-nigh recent trades and trades on the horizon. For the unshortened game. And they were all Yankees’ fans.

That is a passion for trading!

4. Controlled aggressiveness

There is a mural we vicarious that hangs on the walls of SMB that encourages, “If you $EE it, swing the bat hard.” When you spot a trade that has an asymmetrical risk/reward, the weightier traders go for it. They make themselves uncomfortable with risk and push it.

5. Ability to focus for extended periods

Day trading is a game of processing a lot of information quickly and waiting for moments when you have an edge. As we say, those trades just “fall in your lap” if you are worldly-wise to wait for these right moments. Focusing for long periods of time is necessary to spot these moments and then make easy money trades.

6. Worthiness to process a lot of information quickly

There are many variegated ways to make money as a day trader. But whatever the strategy, the weightier day traders are worldly-wise to process a lot of information quickly and increasingly unmistakably than others. Basketball coaches squint for players who are tall and long as this gives players a very real edge. For day traders, thinking quickly and processing information quickly is a real advantage.

7. Diligence

Here is a red flag that leaders at our firm notice.

We are reviewing our recent trading. We ask a new trader what they traded. We ask a simple question, such as: what was the short interest in the stock?

The new trader cannot wordplay this question.

That is not winning and we all take notice. When you are trading a stock there is unrepealable information you need to know. If you do not take the time to learn this information you will not trade as well. Stuff diligent is crucial.

8. Work Ethic

What does it midpoint to work nonflexible as a day trader?

To wilt a top day trader requires completing a daily routine each day of constructive weightier practices that will momentum your improvement. These improvements recipe over time. Without the work ethic to finish this daily routine religiously you will never wits the power of compounding improvement. Sadly, you will never learn how good you can be as a trader.

9. Equanimity

How do you respond without a trading loss?

Do you get upset, cuss, vituperation others and proclaim the market is rigged versus you? Or do you uncomplicatedly review each trade and try to learn and come when for the next trade as an improved trader?

Each trade offers an opportunity for you to learn. But it is only the traders that can quiet their minds and pull the lessons out from each trade who can wilt their weightier trader.

10. Gr8 teammate

We seek traders who will share, gloat the successes of others, and make others at the firm better. This makes us all better. When you are in an environment of sharing and growth this makes you much largest than you can be by yourself.

Do you finger that you have most of these qualities? If you do, then you need to shepherd the self-ruling intensive workshop we’re currently running, which teaches you 3 of our top performing day trading strategies in exact, step by step detail, so you can start using them in your own trading. Test them out for yourself and start towers a resulting track record. We’re unchangingly looking for promising new traders to hire! Reserve your self-ruling spot now.

Day Trader Tools and Resources

You think you want to start day trading. But you are not sure what tools or resources you will need to requite yourself the weightier endangerment to succeed. You know intuitively that if you do not have these tools and resources then your goal to wilt a profitable day trader will be thwarted.

This is savvy thinking by you.

Let’s offer a primer for you so you have the tools and resources to requite yourself the weightier endangerment to succeed.

Here are the tools and resources you need as a day trader:

1. Online broker

An online usurer will help you set up a trading worth and proceeds wangle to the markets. 6 examples of online brokers who cater to new day traders are:

- ThinkorSwim

- TradeStation

- Interactive Brokers

- E-Trade

- Fidelity

- Robinhood

With an online usurer it is important to do your due diligence on trading fees. You will need competitive trading fees on trade execution, short locates, margin interest, and other fees. Ask what ALL the fees are and how they compare to their competition. Also, ask how these fees will modernize as you trade more.

As you proceeds wits you may seek out brokers for high-volume, active, wide day traders such as: Lightspeed, CenterPoint Securities, Cobra Trading, SpeedTrader, and Interactive Brokers.

2. Online trading platform

Most online brokers will offer you a trading platform owned by their company. You may want to investigate others or may need a increasingly wide day trading platform without you proceeds experience. A reliable trading platform is necessary considering during the most opportunistic trading opportunities many trading platforms go down. And you will see traders on social media mutter that their trading platform is lanugo and are unable to trade.

This can be very plush if you cannot exit and enter positions when you need to.

Some wide day trading platforms are: LightSpeed, DAS Trader Pro, Takion, Sterling Trader Pro, Reaktick, Wolverine (WEX).

3. Alerting Solutions

What are trading alerts?

A trading zestful is as it sounds. It alerts you when a stock hits a unrepealable price that you have set. You do need the functionality to set alerts on your trading platform as a day trader. Most online trading platforms will offer the worthiness for you to set alerts.

For wide day trading you may want to set custom parameters for when you want to be alerted to a stock. For example, perhaps you want to see all stocks that hit an intraday high, without 11AM, that moreover have an RVOL greater than 3. You can set alerts for this.

Many trading platforms have this built into their platforms. However, some wide day traders seek a increasingly sophisticated alerting solution, where custom filters can be built. Solutions for this may include: Trade Ideas, TradeStation, and Bloomberg.

4. Charting software

Many of the online trading platforms will offer a suitable charting platform for which to start day trading. For example, ThinkorSwim has an spanking-new charting solution that many traders on our sedentary use to supplement their trading. Other charting solutions are: TradingView, eSignal, TC2000, TradeStation, Stockcharts.com.

5. News Sources

You need to be unfluctuating to a reputable news source. A source where you can quickly squint up if there is breaking news on the market or stock you are trading. Some popular news services are:

- Trade the News

- Bloomberg

- CNBC

- Benzinga

- Briefing.com

- Marketwatch

- Reuters

6. Backtesting and Streamlined trading tools

You should have a platform that allows you to backtest strategies. Perhaps you develop a trading thesis that you think could be profitable. Well you want to test this theory by running a backtest on whether your thesis would be profitable based on historical data.

It is optimal to have a solution, and we have this for our traders at our firm, where from your desktop you can generate a thesis, backtest it, forward test the idea, and then run an streamlined strategy in the markets.

7. Trading Wringer tool

Our traders alimony detailed trading statistics. They tag and then measure all the trades that they make. At the end of the day, week, month, they spit out reports on their trading stats to see where they are doing well and poorly. They make adjustments from here to uplift their PnL. Trading statistics solutions include: Tradervue and Edgewonk.

8. Comprehensive Training

You need proper training surpassing you start trading. Build a strong foundation with a solid trader education course. Experiment with variegated strategies that have whet used by real traders, in the real world, who make real money. Find your trading niche. Seek mentoring on this type of trading.

9. Do not forget

You will need a powerful computer or laptop. Don’t skimp on this please as when the market is most volatile you do not want your computer to crash. A well-appointed chair is essential for most day traders. A headset that can connect to an audio yack is rampant on our trading desks.

Okay so those are the tools and resources you need to get started the right way as a day trader.

How to Level Up Your Day Trading with SMB

Can you make money as a day trader? Is day trading something you could really succeed at? I do hope we have offered a valuable perspective on these important questions for you.

I want to share a story from our trading sedentary in NYC that can make all of this plane increasingly real for you. And requite you plane increasingly insight on whether you can do this.

This real story from our trading sedentary may have meaning for you as you decide whether to day trade.

This is a real-life story from our prop sedentary of two 2nd year traders from our firm, who I recently had lunch with to gloat a month where they each made over 150 thousand dollars in net trading profits.

We chose a pretty nice steakhouse near our 5th thoroughfare office in NYC as they deserved it. You know, I remember sneaking out to meet these two young men for breakfast, while on a family vacation in Florida, surpassing they were at our firm. I remember how immensely they wanted a seat on the desk. They had had a few ordinary jobs in the workforce that were… how should we say….. not satisfying to them.

I know there are some reading right now who are not at the job they want and would love to make a change. They disclosed that they were working as nonflexible as they could on their trading as self-sustaining traders, with inconsistent success. As they shared during our lunch, and I didn’t know at the time when we hired them, they were both 60k in debt, most of it in credit vellum debt.

Let me say that again: they were both 60k in credit vellum debt.

During our breakfast, they implored me to requite them an opportunity for a seat on our desk. Having interviewed and chatted with hundreds of traders over the years, I could see their potential ability, drive, and how they stood out from other candidates.

Further, they demonstrated the diligent work they had washed-up to date. In fact, they dropped a large PlayBook with their favorite setups on this Florida breakfast table at Maggie Mae’s. Remember The PlayBook is a compilation of a trader’s favorite setups wrenched lanugo into unmistakably specified variables. And remember the minutiae of a PlayBook is a weightier practice we teach to our traders that helps them thrive. And here these two developing traders had created their PlayBook, but yet were not a part of our firm.

They were impressive. They stood out. Man I loved them.

But we do not immediately rent transitioning professionals- those who have job wits without higher and are looking to transition into a new job- without them earning a seat on our desk. No matter how impressive and persuasive they were, there is a process at our firm to EARN a seat on our desk. The seat is extremely valuable. It MUST be earned.

They had to be trained properly by SMB.

They had to stand out in their training with SMB. They had to show some skill and potential while trading live- plane if they weren’t unceasingly profitable yet. If they did these things, then they could be hired for the desk.

And you know what…they did. They were. And here we were triumphal their success.

I asked them at lunch how they were now doing financially and they were proud to share that they had paid lanugo all of their debt and each had 400k in the bank. They had gone in their words from 60k in credit vellum debt to now 400k in the bank.

Think well-nigh that.

Think well-nigh the importance of that. They had reverted their financial status.

They were so proud to state they now had a few years of savings to live off of so they could just focus on improving their trading. I laughed and cracked, “ You have much increasingly than that.”

I reminded them that they were just getting started. I congratulated them: “You should be very proud of your trading success.” They had literally reverted their lives.

These same two young men, with the same work ethic and talent and desire lifted from the environment of self-sustaining trader with a lack of proper trader education to properly trained like a professional firm trader made all the difference for them. They would have most likely been flipside one of those failed traders you read too much about- despite all their nonflexible work and effort. Now they were thriving, with 400k in the bank, and realistic goals to wilt plane better.

And I was unrepealable they would unzip them and excited to watch them grow.

Perhaps at the start of this vendible you knew little well-nigh day trading or weren’t exactly sure how to start the right way.

In this vendible you have learned:

- The Incredible Benefits of Day Trading

- The Drawbacks of Day Trading

- What is Day Trading? (For the well-constructed beginners)

- The Fundamentals of Candlestick Charts

- Day Trading Basics

- What You Need to Be a Successful Day Trader

- The Essential Ingredients of a Profitable Day Trading Strategy

- Day Trading Strategies

- Risk Management: You are going to be wrong

- Stock Selection: What are the weightier stocks to day trade?

- The Nature of a Successful Day Trader

- Day Trader Tools and Resources

- How to Level Up Your Day Trading with SMB

After learning well-nigh all of this we do hope you are armed with largest information and knowledge to move forward. We invite you to learn increasingly well-nigh day trading by peekaboo our free online trading workshop, where we share 3 top trading techniques (in exact, step by step detail) our New York City proprietary sedentary uses to profit unceasingly from the market virtually every month.

From all of us at SMB, train and trade well!

FAQs on Day Trading

What are the weightier times to day trade?

The weightier times to trade are when volume is high, there is zaftig liquidity in stocks, and stocks are volatile. Thus, the weightier time to day trade is on the unshut from 9:30AM to 10:30AM EST.

The hardest for most day traders to trade is midday. Traders must be increasingly selective with their trading.

The tropical of trading from 3PM to 4PM EST is the second weightier and moreover opportunistic for day traders, like the open.

How much money do I need to start day trading?

You can start with a few grand and seek consistency. Trade selectively and focus on only a few setups that have edge. Build from your success.

If you build consistency and are ready to day trade for a living, then have at least $50k and two years of living expenses in the bank. Or wield to a prop trading firm, like SMB Capital, to trade firm capital.

How do taxes work for day traders?