Scalping 101: All You Need to Know to Get Started With Scalp Trading (Practical Knowledge Directly from a Tier 1 Prop Firm)

Scalping. No word is increasingly mysterious in the world of trading.

You hear so many traders and trading educators talk well-nigh it, but it’s so easy to be tumbled and not really know how to do it properly.

And if you don’t know how to do it right, you will lose a lot of money. Considering when washed-up wrong, scalping can hands wilt upper frequency gambling.

So let us save you from that terrible fate.

I’m the Throne of Trader Recruiting at SMB Capital, and our New York City proprietary trading firm is one of the longest lasting and most successful proprietary trading firms in the world. We have built our firm teaching beginners how to day trade, and are proud to have built numerous 7-figure-a-year traders, with the weightier making 8 figures-a-year.

And when we teach new traders, we unchangingly start them off with scalping (or scalp trading).

Because when washed-up right, scalping is the easiest and most efficient way to wilt unceasingly profitable.

So let’s swoop in.

In this vendible we’ll be tent the following:

-

What is Scalping?

-

How Scalping Actually Works: Scalping Strategies

-

The Profitability of Scalping

-

Pros and Cons of Scalping

-

FAQs

What is Scalping?

Scalp trading is taking a position with an expectation that price will move quickly, within seconds or minutes. To properly pinpoint scalping in SMB Wanted terms, we must unravel it into two very clear, but often mis-understood categories.

Most people think scalping is just reading the tape- the waffly bids and asks for a given stock- and profiting from those movements. We pinpoint these as Tape Scalping, and it is a unconfined trading strategy for those who know how to read the tape.

Trained tape scalpers can watch the tape, the waffly bids and asks, and quickly profit from the short-term imbalances that occur considering of the unvarying shifting supply and demand in the stock which is represented through the tape. Tape scalpers can make up to a hundred trades or increasingly during each trading day.

We have tape scalpers on our NYC trading floor, but this form of scalping is increasingly difficult to learn without a mentor from a professional trading desk, considering it is extremely nuanced.

The other category of scalping, which is much easier to learn by self-sustaining (and prop traders alike), is orchestration based scalping that doesn’t require a continuous reading of the constantly waffly bid/ask and the time and sales window.

Instead, it simply relies on definable and hands recognizable patterns on a candlestick chart, and having a robust rule set to take wholesomeness of those.

The worthiness to quickly capture profits while managing your risk tightly and finding the upper probability moments that show up many, many times each trading day is what scalping is all about, and stuff worldly-wise to do that either by tape reading or directly off of price charts makes it a powerful strategy that can produce unconfined returns.

How Scalping Actually Works: Scalping Strategies

We want to make this vendible as impactful as possible for scalping trades, so we will swoop into some detail well-nigh the strategies scalp traders use and imbricate some of the most important

things scalpers can squint for to make good, quick decisions.

Scalping encapsulates 3 variegated cadre strategies, and unelevated we’ll explain each of them and show a detailed orchestration example from real-world markets to bring the strategy to life.

Imbalance (reversion) Scalps

Imbalance scalps are scalps that show up when an warlike seller or proprietrix is observed in a particular stock and drives the stock way remoter than it should naturally trade.

This occurs considering some traders are forced to enter or exit a position, and they do so in a “sloppy” manner.

To understand the term “sloppy” let’s imagine we are traders on a big trading sedentary and a vendee calls in and says they want us to sell $1,000,000 worth of their TSLA shares considering they they have been holding for 3 years and want to lock in some profits in specimen the stock turns lower.

The trader who took the order will not want to undeniability their vendee when and say, we could only get you out of half today, hopefully we can get you out tomorrow. No, they will sell that stock!!!

The vendee doesn’t really superintendency if they are selling the stock at $222 or $218- they just want to sell the stock and personize that they have locked in their nice profit as soon as possible. This can create a short term imbalance as the sell program used to sell the client’s shares will temporarily momentum the stock lower so the vendee can get filled.

Once all the shares are sold, the stock can resume its normal trading. Tape scalpers will be watching the tape, focusing on the moment the sell program finishes its order to enter a position and exit quickly as a natural pop up should occur in the stock without the sell program has finished, giving the tape scalper a endangerment to exit a quick and profitable trade.

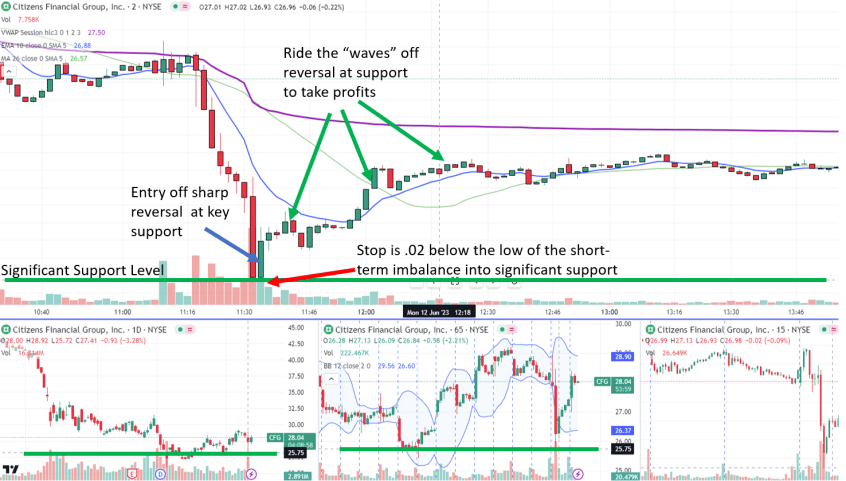

A candlestick orchestration scalper can recognize this pattern as well directly on the chart. They may see that the seller is unsustainable, but instead of needing to see it on the tape, they may wait for a candle to “take out” a prior candle, or to reverse sharply, showing that the selling pressure has shifted to ownership pressure and looking for a short term ownership imbalance to occur. They can enter a position using a specified stop based on the orchestration and exit without the candles on the orchestration stop trending higher.

These imbalance, or reversion, type of trades are usually easiest to spot on a orchestration when the strong selling slams right into a significant level of support where price had previously bounced on increasingly than one occasion. That gives a trader a very specific “line in the sand” to lean on when placing the trade. They can place their stop unelevated the support level without seeing the selling dry up and a strong up bar appearing, considering they know if that level gives way the selling isn’t truly done.

Here’s an example of this in Citizens Financial Group stock:

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage, and commissions.

Breakout (Momentum) Scalps

Breakout scalps occur when price quickly moves out of a trading range. They occur considering of a shift in the supply and demand wastefulness that happens.

Think well-nigh the recent housing market, and to take it a step further, let’s think well-nigh a housing market in a low tax state near a beach. Take Jupiter, FL, for example.

For years, housing seemed to be in a relatively steady state, housing prices were driven by the natural supply of buyers and sellers as people bought or sold houses as their housing needs changed. It was relatively well-turned as a stock-still number of people could live in that zone and there was a stock-still number of houses in that area.

After a global pandemic occurred, and Work from Home became an winning volitional to commuting, suddenly, people could live anywhere, and many chose a town like Jupiter, FL. But in that time, were the builders in that zone worldly-wise to build increasingly houses? No, so we saw a breakout in housing prices as the demand far outweighed the supply.

This breakout occurs in stocks each and every day in a very similar manner. Scalpers can take wholesomeness of those breakouts by recognizing stocks that are trading in ranges, showing some price stability, but then recognizing the clues that show up when a transpiration happens. When those breakouts occur, we can squint at the volume that is occurring during the break.

Tape scalpers will be watching the tape to see if it “speeds up” as the price gets ready to unravel out of its range, which tells us that increasingly participants are zippy in the stock and going to momentum it higher. A good tape scalp is to enter as the tape speeds up and sell into the initial “pop” that occurs as the price moves higher, quickly capturing the fast momentum burst.

Candlestick scalpers may observe the orchestration and squint for the range to break, using the candlesticks as a guide to risk versus and move their stop up unelevated the lows of the prior candles, staying involved in the stock if it continues to aggressively move higher, and locking in a quick profit when the momentum stalls.

Here is an example of a quick breakout scalp our traders recently took in NVDA that lasted 8 minutes and gave a nice profit.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage, and commissions.

Continuation (Trending) Scalps

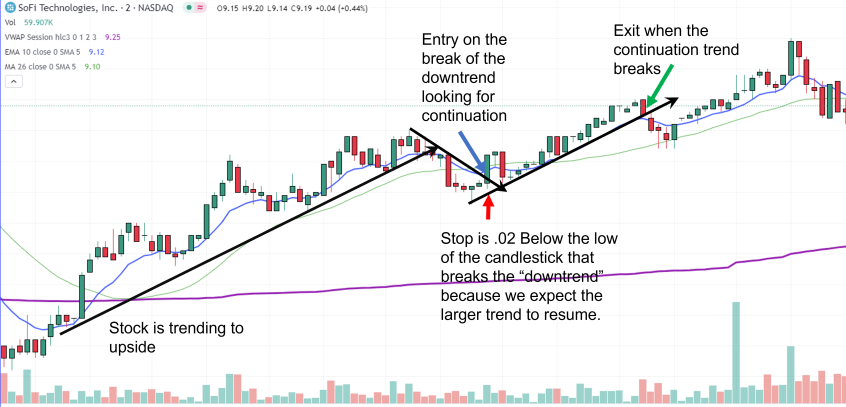

Trending scalps are a series of trades that can occur when a stock is trending either up or down. What do we midpoint by trending? Anytime you squint at a candlestick orchestration and notice that the candlesticks are making higher highs and higher lows, the stock is up trending. If it’s making lower highs and lower lows, it’s lanugo trending.

When a stock is trending (say, up trending), our weightier risk to reward ratio and highest probability trades will be to go with the trend, as it signifies that a larger group of participants see this stock as increasing in value, so they are standing to buy.

Pauses in that ownership create scalping opportunities for us, as we can squint for indications that the ownership is resuming, and the trend will continue, giving us a very repeatable trading opportunity.

Continuation (Trending) scalps can be found when tape scalpers are watching the tape during a retracement and observe an unusual hold on the bid. This is just a reading the tape term for a large bidder that has started ownership again. The tape scalpers will step in front of that bid, ownership in vaticination of that bid standing to move to higher and higher prices, and exit with a very quick profit without that bidder has been filled.

They capture a very upper probability moment within a trend by recognizing that a large order was attempting to get filled and taking a scalp while that order was stuff filled, then moving on.

Continuation scalps as a candlestick scalper are very similar in structure, but are often found simply by drawing a short term trendline and waiting for the short term trendline to unravel and the prevailing trend to resume. We use the breaks of the short term trendlines to pinpoint risk and entry signals, and squint for new highs to exit part of all of our position- and can plane remain in the scalp as long as the prevailing trend continues.

Many developing scalp traders, both tape and candlestick scalpers, focus scrutinizingly entirely on Imbalance (reversion) scalps and breakout scalps, but as we study increasingly and increasingly really successful scalp traders, we will find many of them make a significant percentage of their profits from continuation scalps. It’s a bit of a secret of top scalp traders.

Here is a good example of a trend continuation scalp that occurred in SoFi Technologies:

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage, and commissions.

By the way, if you’re really interested in getting into zippy day trading, using scalping and other short-term trading strategies, we’re currently running a self-ruling online training where you’ll discover:

- The simple upper probability day trading strategy that we teach all new traders on our sedentary (this vacated could make you a profitable day trader)

- One of our firm’s most profitable and resulting proprietary trade setups (you won’t see this anywhere else)

- The unique strategy that turned one of our traders into a 7-figure peerage trader (which is surprisingly easy to learn and execute)

- How to get funded with large risk wanted and trade our money with ZERO risk to you (all from your own home)

Reserve your self-ruling spot now. (What you’ll learn can be used to scalp the markets and to take longer intraday holds. You don’t want to miss it).

The Profitability of Scalping

Every month on our desk, we have a monthly review, and the teams of traders come in and we discuss what worked well for them during the month, and identify opportunities for them to grow and protract to develop as traders.

From the traders who are in their first month to the traders who have made increasingly than $20 million in a single trading year, we go through these rigorous reviews. The traders who we see having the most resulting and weightier trading results tend to unzip those results in big part by doing the same thing, Scalping.

It’s not unusual for an experienced trader to come in and have made $100,000 in a normal month just by scalping.

These scalping traders tend to be some of the most confident traders on the sedentary as well, considering they don’t subject themselves to the unstipulated volatility of the market by holding positions for long periods of time, and instead are in and out numerous times a day. In fact, they scrutinizingly want that volatility considering it ways increasingly scalping opportunities for them.

Scalpers have learned to have some of the weightier risk management of any traders since they are worldly-wise to identify very specific, repeatable trading patterns and they know exactly what should happen when each pattern is presented to them, so they are worldly-wise to exit quickly if a particular scalp does not work quickly.

Scalp Traders tend to grow so quickly considering they develop a well-spoken PlayBook of scalp trades. This PlayBook is typically an armory of 4 or 5 variegated Scalp Setups they learn from others on the sedentary or develop themselves, and considering in scalp trading you get increasingly “reps”, they just get increasingly practice starting out and wind up making increasingly (and better) trading decisions than traders whose PlayBooks focus on variegated set ups.

There is a weighing that scalp trading is a time intensive strategy; that scalp traders are the ones at their desks all day, banging yonder at the keys, fighting for every tick versus the market they are trading.

We think that is BS. Maybe that used to be the way scalp traders made such resulting profits, but our sedentary shows that most successful scalp traders have a predatory precision to what they do,

They don’t waste energy unnecessarily when there isn’t a very good opportunity for them. Good scalp traders tend to be those who like to win quickly, who like to take the opportunity offered, make a solid profit and go well-nigh their life.

They view trading as an opportunity to express who they are as a person, and don’t indulge trading to dictate who they are.

Pros and Cons of Scalping

Scalping is a unconfined way to quickly learn and grow as a trader. It gives you the opportunity for quick profits from fast price movements, which you can hands train yourself to identify and anticipate.

Scalping moreover allows you to trade with lowered risk exposure as you are not subjecting yourself to the swings of the broader market or the overnight risks that can come with other types of trading.

Since scalping involves well-spoken visualization making and firsthand execution of trades, this style is weightier for those who want to take the trade, take their profits, and move on to enjoy their lives outside of trading.

Given the dynamic nature of scalping, it is a strategy that can be used with any type of market. The same principles of scalping wield to stocks (equities), futures, crypto, forex and other tradeable, liquid products.

But it is very important to be sure you are not just instinctively banging yonder at keys. Scalping involves the precision that comes with developing specific trade setups into a PlayBook and then just waiting for the opportunities in that Playbook to present themselves multiple times each day.

Trying to scalp based on price vacated can be very dangerous for those who have not ripened the nuts of a strategy and leads not only to frustration, but to major losses too. Just considering you can printing the keys quickly as a trader does not midpoint you should just printing the keys and undeniability it scalping.

FAQs

What markets can be scalped?

Scalping strategies can be employed in various financial markets, including stocks, Foreign mart (Forex), future, and cryptocurrencies. The nomination of market often depends on key factors such as liquidity and volatility. Increasingly liquidity and volatility ways increasingly and often largest opportunities for scalpers.

Do you need specialized software to scalp?

Most scalpers on our desk, and many of the weightier scalp traders rely on very simple technical tools like moving averages, support and resistance levels, and vital orchestration patterns to help them find and execute on scalping setups. Tape scalpers will need a good level II and time and sales to read the tape. Das trader Pro has a very good Level II and time and sales.

Is Scalping Legal?

Scalping is a trading strategy and is legal. Specific regulations and rules regarding scalping have been implemented over time mainly to protect scalpers from warlike market making style programs and to maintain liquidity in most markets.

What is the difference between scalping and day trading?

Scalping is a specific strategy used by many day traders, but it is a specific strategy that often gets a bit tumbled with day trading. Scalp traders will stereotype increasingly trades per day than most day traders, and will be in and out of the market faster than most day traders.

While a scalper may identify an opportunity that can last seconds or minutes, day traders may be looking for an opportunity that may last up to a few hours.

How much money can you make from scalping?

Various factors contribute to how much money you can make from scalping including trading skills, capital, risk management, and quality of scalping PlayBook. It is important to note that scalping carries risks, and profitability is not guaranteed.

A successful scalper on our sedentary may make $100k a month from scalping alone, but this is not guaranteed for everyone who is a scalper and others may wits losses.

Ultimately the value of money a scalp trader can make is highly individual. Traders should focus on developing their scalp PlayBook, enhance their trading skills through regular practice and implement constructive risk management strategies.

Is scalping suitable for beginners?

Absolutely! Scalping offers beginners a fantastic opportunity to proceeds hands-on wits and learn the ins and outs of the markets. By identifying and executing in those short bursts of momentum that create such unconfined trading opportunities for scalp traders, you’ll get a front row seat to witness how markets move and get to participate in the history of the markets that is written by the traders that trade in it every day.

By scalping, beginners requite themselves a winnable game since scalp trading involves so many unshared opportunities and includes such tight risk management. Scalping allows whence traders a training ground to sharpen their reflexes, enhance their tampering skills and master the art of making really constructive trading decisions.

So if you are up for an venture in the trading world, scalping might just be the perfect fit for you as a beginner. Embrace the flexibility scalping provides, embrace the speed, embrace the challenge, and get ready to ride the waves of the market like a true Trader!

The weightier way to learn how to scalp and day trade is to learn directly from a firm like ours. Why? Considering we have 50 professional traders and we’ve been profiting unceasingly from the markets for many years, through all kinds of market conditions. Our traders are the real deal, several of whom make 7 and plane 8-figures a year, and the strategies they trade have stood the test of time. So throne over to TradingWorkshop.com to requirement your self-ruling spot on our in-depth workshop.

The post Scalping 101: All You Need to Know to Get Started With Scalp Trading (Practical Knowledge Directly from a Tier 1 Prop Firm) appeared first on SMB Training Blog.