Short-Term Negative Scenario For RSX

Source: Goodfon

Instrument

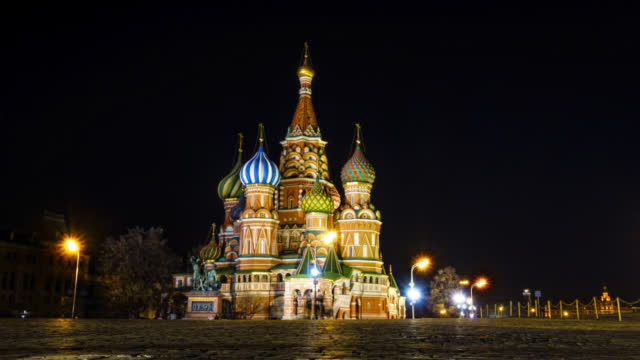

The VanEck Vectors Russia ETF (BATS:RSX) is a fund that offers exposure to equities from Russia, which include publicly-traded companies that are incorporated in Russia or that are incorporated outside of Russia but have at least 50% of their revenues/related assets in Russia.

Source: VanEck

Source: VanEck

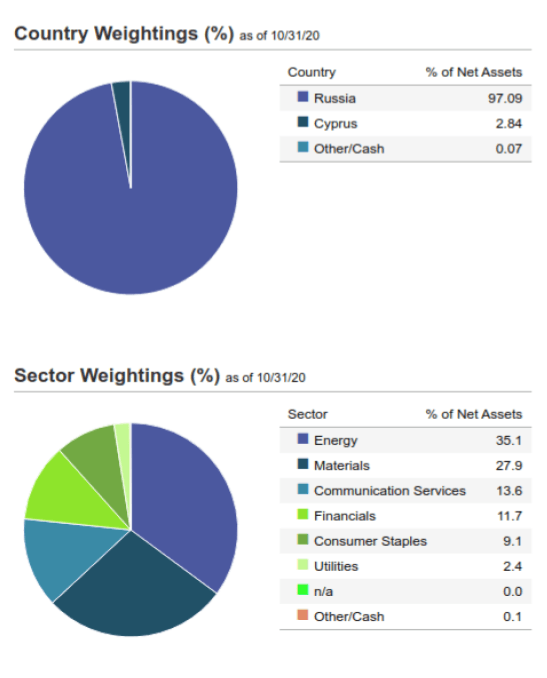

Source: TradingView

Note: The RTS Index is a free-float capitalization-weighted index of 50 Russian stocks traded on the Moscow Exchange, calculated in US dollars (Wikipedia).

Macro Data

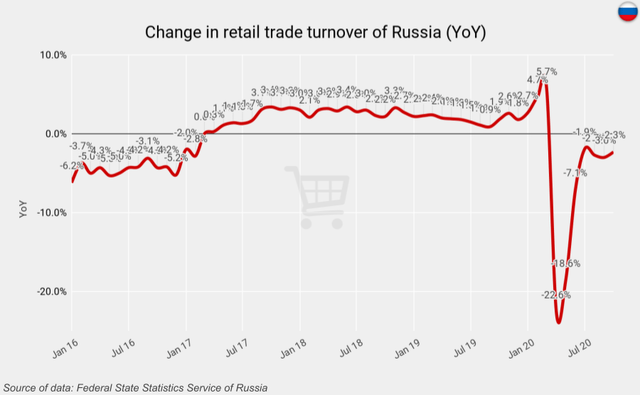

In October, the Russian retail turnover dropped by 2.3% YoY. This result is slightly better than the result of the previous month, but there is still no confident trend for recovery. In general, the population is still cautious about spending. This is partly due to the coronavirus epidemic, and partly due to doubts about the stability of future income.

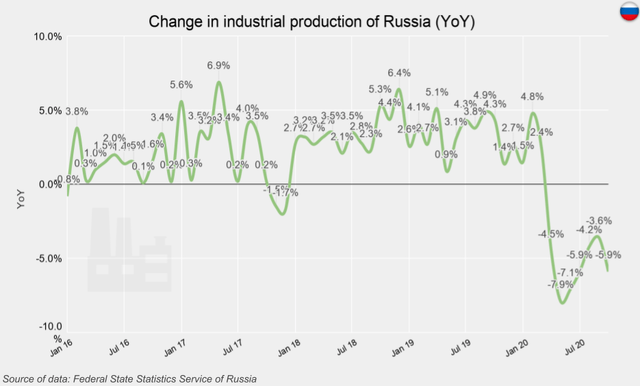

In the last month, the Russian industry fell by 5.9% YoY. This is a disappointing result after four months of steady improvement:

Source: Author

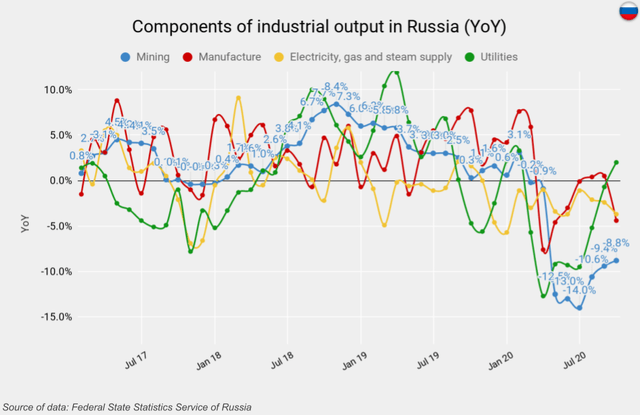

Judging by the structure of this indicator, only the utilities sector grew. The growth rate of the mining industry, the basis of the Russian economy, remained negative:

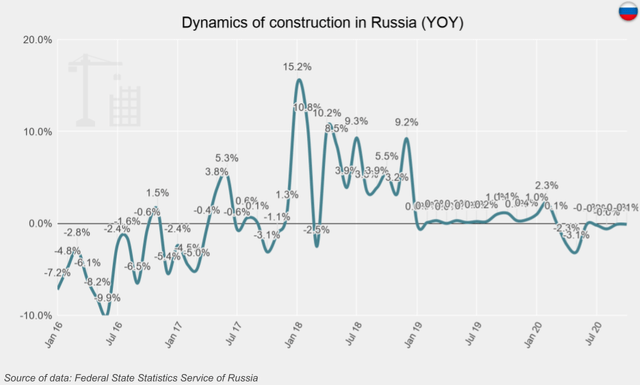

The growth rate of the volume of construction in Russia is still zero. I constantly monitor this indicator because it is a good marker of long-term confidence of businesses in stability. But in this case, it indicates a lack of such confidence:

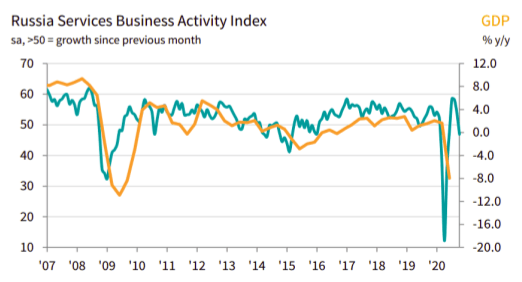

The IHS Markit Russia Services PMI fell to 46.9 in October indicating a renewed contraction in the sector.

...The decline was driven by weaker demand conditions, as a resurgence in coronavirus disease 2019 (COVID-19) cases and restrictions weighed on new sales. New orders from abroad continued to fall, as key export destinations also reimposed tighter virus-related measures...

Source: Markit

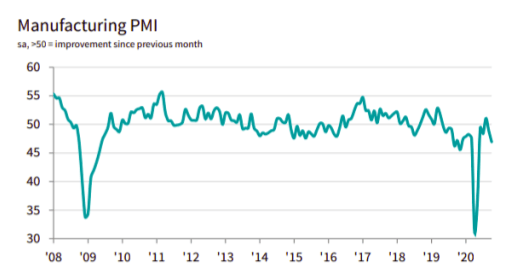

The Manufacturing PMI declined to 46.9 in October 2020 from 48.9 in September. Here the contraction continues for the second month.

... The overall decline was the fastest since May, amid a renewed fall in production and a quicker contraction in new orders. Spare capacity persisted, meanwhile, as firms shed more workers. Weaker client demand weighed on business expectations, as optimism sank to a five-month low...

Source: Markit

From a fundamental point of view, the state of the Russian economy has deteriorated.

Sentiments

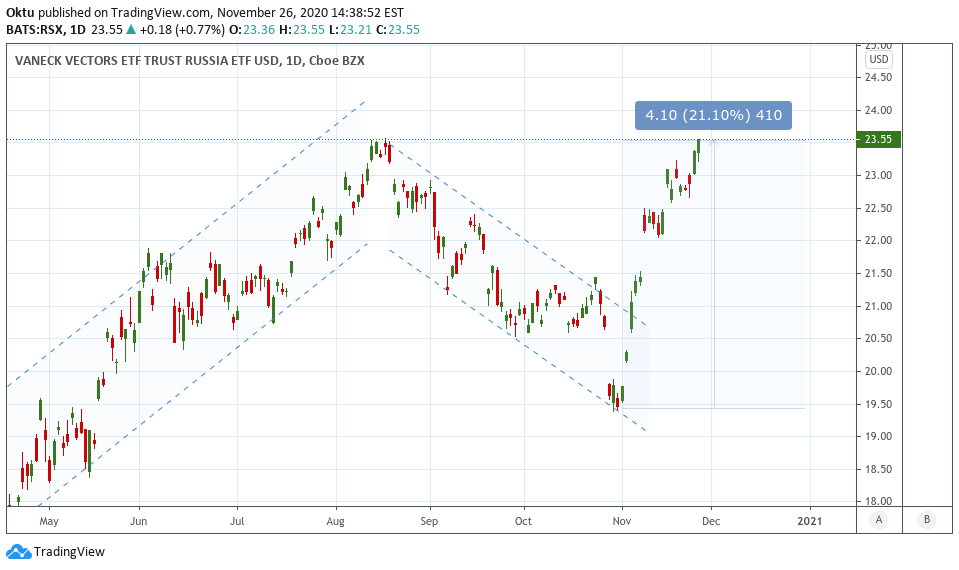

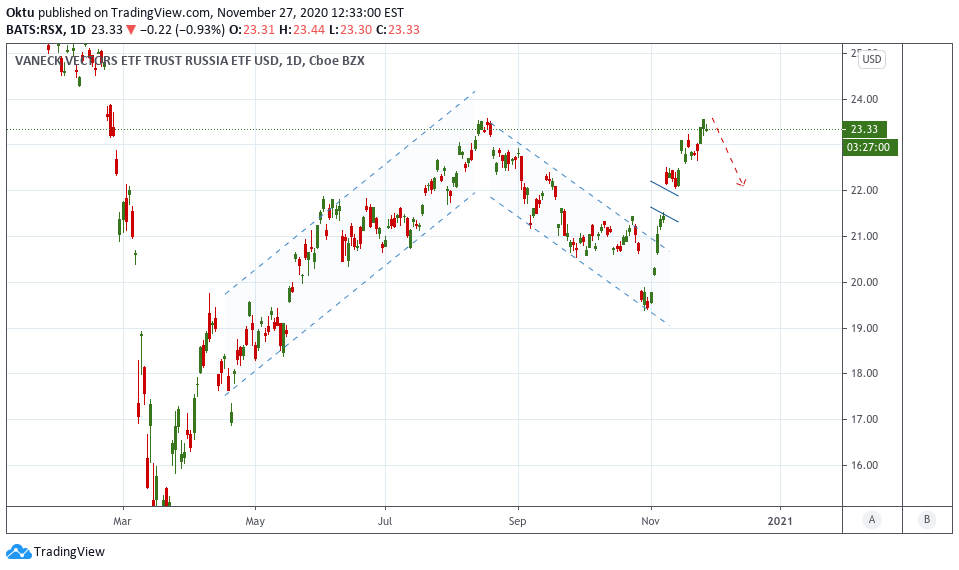

As we can see, nothing optimistic in the Russian economy happened over the past month, and nevertheless, the RSX rose by 21% in November:

Source: TradingView

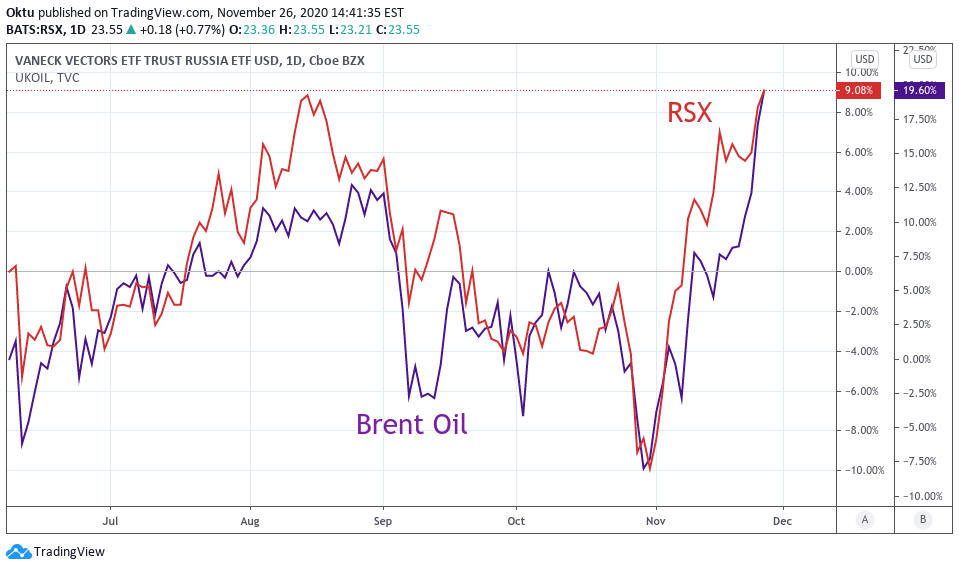

Why? The answer is obvious - because of the oil market:

Source: TradingView

The oil market began to skyrocket after the announcement of effective vaccines against coronavirus. Market participants also expect that OPEC+ may delay oil output rise. But to be honest, maybe these drivers are a little overrated in this case.

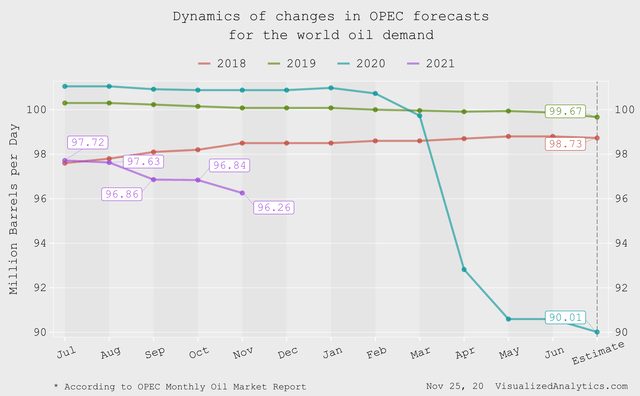

First of all, many experts (CNBC, Voanews) point out that vaccination does not mean a quick end to the pandemic. This means that quarantine measures will continue for a long time. And so the current outlook for the global oil demand next year remains pessimistic:

Source: VisualizedAnalytics.com

Source: VisualizedAnalytics.com

Further. In my opinion, the current oil price already suggests that OPEC will definitely postpone the increase in oil production. But at the current oil price the chances of such a decision are already lower than, for example, a month ago. But that's not even the point...

Let's take a look at both scenarios.

If OPEC, with an eye on the current oil price, decides to start increasing production, it is likely that there will be a correction in the oil market. And in this case, the RSX price will also decline.

Otherwise, Russian oil companies will not be able to increase oil production for several more months. This means that earnings growth for these companies will be delayed again. I want to remind you that Russian energy companies form 35% of the RSX's portfolio, and they are, in turn, mainly represented by oil companies.

As you can see, in this case, there is no clearly good option for the Russian market and RSX index.

Bottom line

So, in my opinion, in the next 15 days the chances of a decline in the RSX index price are greater than of growth. Please note that this is a short-term forecast.

Source: TradingView

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.