American High Income Municipal Bond Fund: A Simple Guide for Everyone

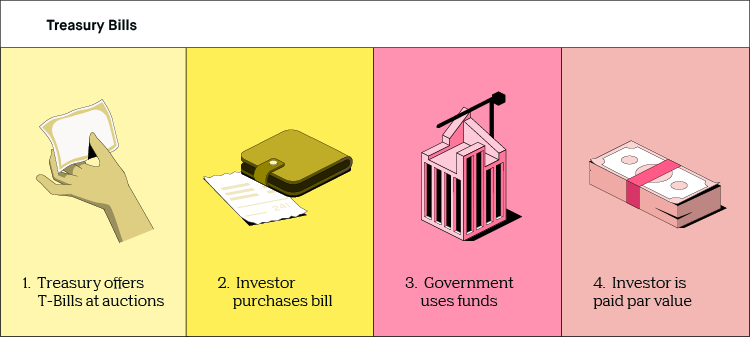

The American High Income Municipal Bond Fund may sound like a enormous, difficult title, but it is straightforward to get it. This finance puts cash into numerous bonds from cities and states...