Buying a Treasury Marketable Security

With the arrival of high rates we haven't seen since before the extraordinary downturn, nothing unexpected more individuals are putting resources into U.S. Depository protections. As a matter of fact, the Protections Business and Monetary Business sectors Affiliation revealed that $8.0 trillion of U.S. Depository protections were given as of May 2023, up 12.3% from the earlier year.

Treasury Bonds are perhaps of the most well known security, offering an okay venture choice with terms of 20 or 30 years. Despite the fact that they give a better return than a few different choices, they may not be the most ideal decision for all financial backers. You really want prior to putting away your cash, this to realize about Treasury Bonds and how to get them.

Treasury Bonds vs. Treasury Bills vs. Treasury Notes

There are three fundamental sorts of Depository protections:

Treasury Bonds: Treasury Bonds are long haul speculations with terms of 20 or 30 years. They pay a decent pace of revenue at regular intervals until they mature, and the rate doesn't shift over the existence of the security.

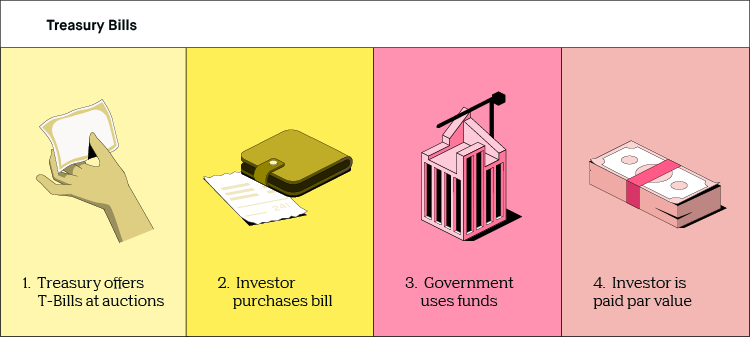

Depository Bills: Financial backers with more limited time skylines might be keen on Depository bills over Treasury Bonds. These bills — frequently alluded to as T-Bills — mature in four, eight, 13, 17, 26 or 52 weeks. Bills are sold at a rebate or at standard, meaning their presumptive worth. When the bill develops, you are paid the whole presumptive worth.

Depository Notes: Depository Notes are the fair compromise for those with more limited time skylines than they'd get with Treasury Bonds, however who actually need to contribute for longer than the developments on T-Bills permit. Depository notes have developments of two to 10 years, and they pay a decent pace of interest at regular intervals until development.

| Treasury Bonds | Treasury Bills | Treasury Notes | |

|---|---|---|---|

|

Maturities |

20 or 30 years |

4, 8, 13, 17, 26 and 52 weeks |

2, 3, 5, 7 or 10 years |

|

Interest Rate |

The rate is fixed at auction and doesn’t change, and it will never be less than 0.125% 20-year bonds issued 6/30/2023 have a rate of 3.875% |

Fixed at auction; for bills, interest is the difference between what you paid for the bill’s face value and what you get when it matures |

The rate is fixed at auction and doesn’t change. It will never be less than 0.125% 10-year notes issued 6/15/2023 have a rate of 3.375% |

|

Interest Paid |

Every six months until maturity |

Paid when the bill matures |

Every six months until maturity |

|

Minimum Purchase |

$100 |

$100 |

$100 |

Advantages of Treasury Bonds

There are a few unmistakable benefits to putting resources into Treasury Bonds.

Money Is Safe

At the point when you put resources into conventional corporate or civil securities, the backer consents to pay the financial backer interest. Securities that have higher credit chances will generally pay higher rates, yet you risk the backer defaulting on the premium installments or the presumptive worth of the security.

With Treasury Bonds, the bonds are upheld by the full confidence and credit of the U.S. government. The public authority has never neglected to meet its commitments, so there's less gamble of the backer defaulting on the installments or not respecting the bond. While there are no ensures, your cash is reasonable more secure in a Depository Bond than elsewhere.

High Yield

Individuals searching for okay ways of developing their cash frequently go to bank accounts and endorsements of store (Discs). As per the Government Store Protection Organization (FDIC), the typical yearly rate yield (APY) on bank accounts is 0.42%, and Compact discs with year terms normal 1.6% as of June 27, 2023.

Conversely, the rates on Depository securities are as high as possible 3.875%, so putting resources into Depository securities could assist your cash with becoming quicker.

Exempt From State and Local Taxes

With Treasury Bonds, you need to pay government burdens every year on the premium that you procure. Be that as it may, the interest is absolved from state or neighborhood charges. Maintain as a top priority that this benefit could be a hindrance relying upon your pay level and assuming you're in a space with high state or nearby expense rates.

Premium from Treasury Bonds is charged at your common government personal expense level which could be basically as high as 35%. Contrast that with other venture choices that are burdened when you sell them at the capital increases charge rate, which tops out at 20% for speculations held for no less than one year. On the off chance that your essential objective with effective financial planning is to save money on charges, investigate your government, state and neighborhood charge rates to ensure you'll save by going with Depository securities.

Risks of Treasury Bonds

In spite of the fact that Treasury Bonds can be a protected venture choice, there are a few disadvantages to consider:

Interest Rate Risk

Financing cost risk is a typical issue for all securities, particularly for securities with fixed rates like Depository securities. Securities commonly have an opposite relationship with loan costs; when rates increment, the worth of fixed-rate securities fall, as well as the other way around.

For instance, on the off chance that you have a security at 3% and loan fees ascend to 4% or higher, your security will have less worth on the off chance that you attempt to sell it on the optional market. In the event that you want to sell a security before its development date, you could lose cash.

Inflation Erodes Value

Rising expansion is another gamble component to consider. Higher paces of expansion can disintegrate the worth of the premium the security acquires and bring down your general return. While your cash is "protected" you're effectively losing cash to expansion.

Opportunity Cost

Depository securities can be a decent choice for financial backers searching for a generally safe method for developing their cash at a humble rate. Yet, for long haul financial backers, there might be better choices.

As indicated by the U.S. Protections and Trade Commission (SEC), the financial exchange has generally delivered yearly returns of around 10% (roughly 6% to 7% while representing expansion). Placing your cash in the market by putting resources into list assets might assist you with procuring more significant yields over the long haul.

How To Buy Treasury Bonds?

There are two fundamental ways of purchasing Depository securities: straightforwardly from the U.S. government and through an intermediary.

Buying Treasury Bonds From the Government

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

You can buy Treasury Bonds from the public authority by visiting TreasuryDirect.gov. The base measure of cash you really want to buy a bond is $100, and you'll must have your Government managed retirement number or citizen recognizable proof number helpful.

Visit the site and make a TreasuryDirect account. The site will ask you for your own data, banking subtleties and will incite you to make a username and secret key. The site is a piece dated for all intents and purposes and capability, which can make individuals self-conscious, however have confidence it is genuine. While imparting delicate data to an administration element, consistently guarantee that you are visiting a site that closures in ".gov"

Whenever you've made a record, you can buy Treasury Bonds through the site and determine the sum you need to contribute — with Treasury Bonds, you can purchase bonds in augmentations of $100.

Buying Treasury Bonds From a Broker

Many trade exchanged reserves (ETFs) and shared reserves put resources into government bonds, including Treasury Bonds. By putting resources into these assets through a dealer, you can get openness to a scope of protections with a solitary venture.

To purchase security reserves, you'll require a money market fund, and you need to set aside an underlying installment to subsidize your record. When the record is made, you can enter the exchanging stage and enter the name of the asset you need to put resources into and the quantity of offers you need to purchase.