Corporate Bond Interest Rates in India: A Simple Guide for Smart Investors

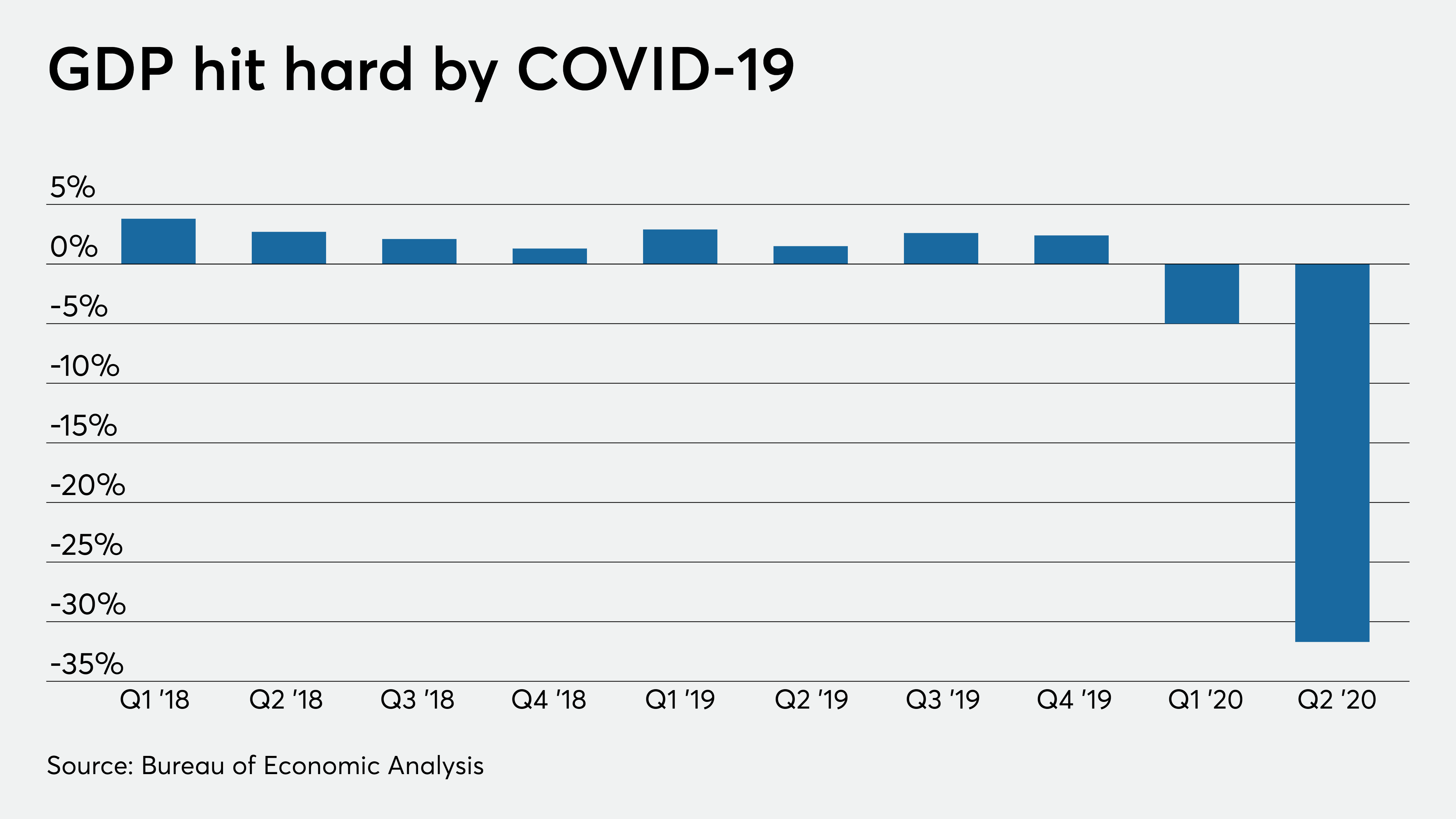

Corporate bonds are quick becoming a favored venture road for Indians looking for higher returns than conventional bank stores. With rising intrigued rate variances and unstable stock markets, corporate bonds...