The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of October 16, 2023

Happy Sunday, Traders!

As I mentioned in the blog last week, I will be traveling until the end of October, so the posts will be shorter than usual until I return.

Last week’s whoopee kept day traders and, increasingly specifically, small-cap traders extremely rented and on their toes, with several stocks throughout the week doubling, tripling, or plane going up as much as 4000% (TPST).

For newer traders, risk management is the key takeaway from this action. All it takes is for one outsized move to occur to wipe out an account. Therefore, surpassing inward a position, unchangingly ask yourself: Do I have an whet in this, and do I know where I am wrong in this position, i.e., where I will place my stop?

Sometimes, plane if I have an edge, but the stock is too illiquid / ‘spready,’ I will stave it considering it isn’t worth the risk!

Before inward a position, I unchangingly ensure that I have a predetermined value I am okay risking, withal with having an whet present in the trade and a positive risk: reward.

Now, for this week, I am interested in going short several small-cap stocks that surged higher last week surpassing lightweight dramatically. Now that supply overhead exists, and there are levels to risk versus (backside), I would be interested in shorting bounces.

Earnings season is moreover well underway, and one stock that has set up interestingly superiority of earnings is Tesla.

So, let’s get into it.

Backside Short-Term Short Swings, The Sufferer Cat Vellicate Setup

Several small-cap stocks that ran last week gave when an enormous value of the move into the end of the week. Such a move now paves the way for a unenduring liquidity trap / sufferer cat vellicate higher, bringing a secondary opportunity to get short on a lower high.

For this particular setup and opportunity, I am looking at a basket of names from last week: OPGN, TPST, SECO, MTNB.

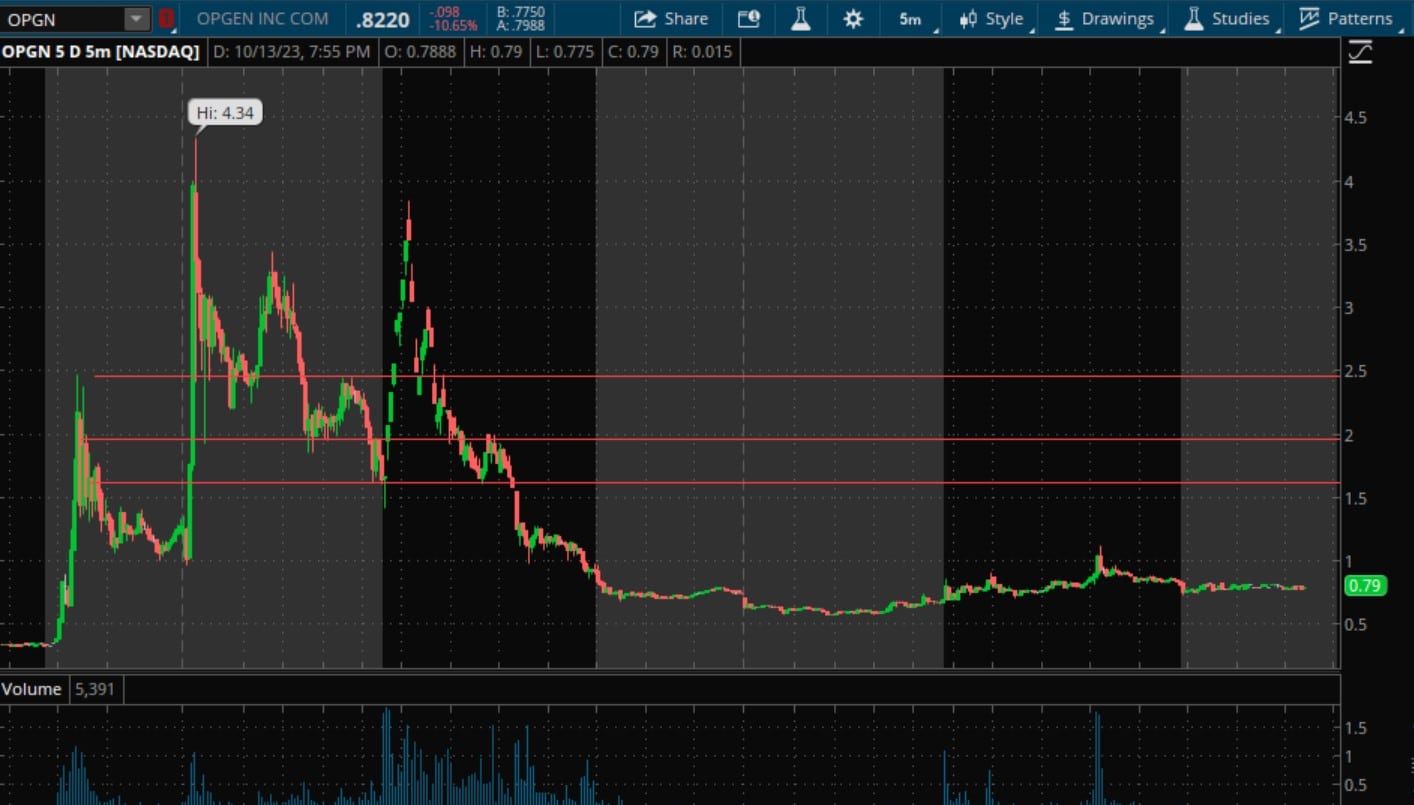

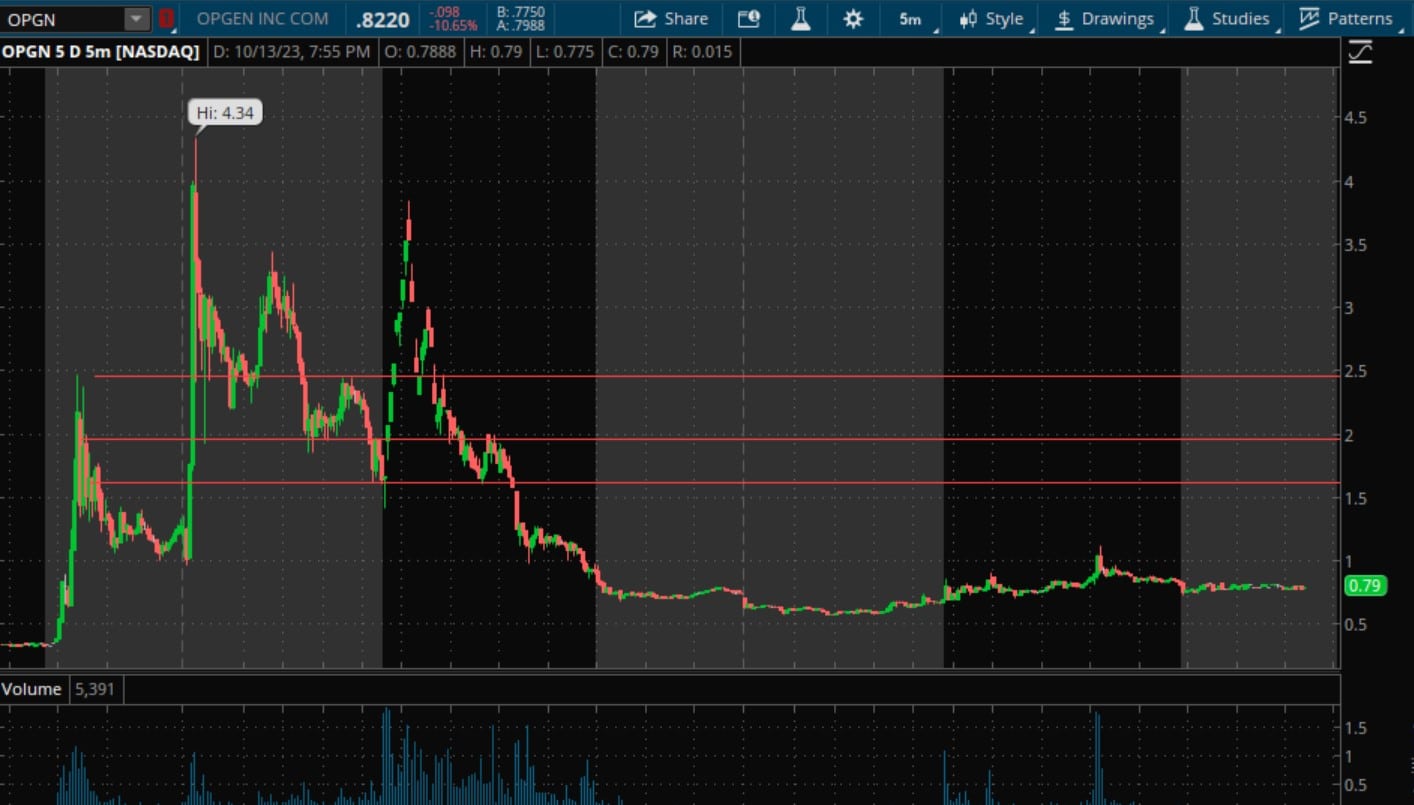

To largest explain my thinking for this opportunity, let’s squint at one of these stocks, OPGN.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage and commissions.

As you can see, the stock, like many others last week, surged uncommonly upper and then, without topping out near $4 on Thursday, gave when scrutinizingly the unshortened move.

So, going forward, I will have alerts set in OPGN in specimen it pops into possible supply zones. Supply zones? If I were stuck long, I would sell my shares if the stock bounced when a bit. Then, you moreover have potential dilution and shorts looking to enter. This all creates an overhead supply.

I would squint to get short into $1.50 if the stock confirmed resistance and gave an intraday level to risk against. Although I don’t think the stock can reach them, the next potential supply levels are $2 and $2.50.

With such a setup, the goal for me is to wait for intraday confirmation surpassing putting on any risk/size versus the upper of the day. My timeframe on such a swing trade would be 1 – 2 days, looking for a $0.50 – $0.75 target.

Tesla to Report Earnings on Wednesday, Stock is Coiled

With Tesla set to report earnings on Wednesday, a swing position superiority of earnings does not make sense to me, as I could not manage risk effectively.

However, with the stock coiling on a higher time frame, a momentum swing trade opportunity might present itself AFTER the visitor reports.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage and commissions.

So, if Tesla gaps whilom resistance on a bullish report and successfully hold the extended hour’s support levels, I will squint for the stock to personize a higher low. I would squint to buy the stock increasingly carefully. For example, I want to see a unenduring pullback be met with buyers and a VWAP reclaim. Such price whoopee indicates buyers have stepped up, and multi-day momentum might occur.

Similarly, I would squint for the same price whoopee to personize surpassing going short if Tesla gaps unelevated the wedge’s support and holds extended hours lows.

Now, how would I manage risk for such a position? Once a trend develops and I enter the position upon receiving confirmation, I place my stop at the low of the day if I am long.

I would be looking for just over 1 ATR for my target, as the range should widen post earnings. However, with that stuff said, If I am unable to unzip at least a 1:3 risk-reward, then I will not enter the position.

Key levels to be enlightened of in Tesla:

Breakout level: $260

Breakdown level: $240

Potential Target / Resistance: $280

Potential Target / Support $220

Remember, as I mentioned at the whence of this post, risk management is everything in this game.

Important Disclosures