Swing Trading: Strategies, Tips, and Best Practices

Swing trading is a popular strategy focusing on capturing short-term price swings within the financial markets. It involves ownership or selling assets, such as stocks, currencies, or commodities, with the intention of profiting from price fluctuations that occur over a period of days to weeks.

Swing trading is particularly relevant in the financial markets due to its potential for generating profits through short-term price swings.

Risk management is of utmost importance in swing trading. Traders should determine the towardly position sizing and risk-reward ratios for each trade. This involves assessing the potential reward relative to the potential risk and ensuring that the potential profit justifies the potential loss. By setting proper stop-loss orders and sticking to them, swing traders can minimize losses and protect their capital.

In this vendible you will learn all of this and much, much more, including:

What is Swing Trading?

Advantages and Disadvantages of Swing Trading

Fundamentals of Swing Trading

Developing a Swing Trading Strategy

Risk Management in Swing Trading

Emotional Willpower and Trader Psychology

Advanced Swing Trading Techniques

Swing Trade Specimen Studies and Examples

Swing Trading vs. Day Trading

Swing Trading FAQ’s

What is Swing Trading?

Swing trading is a trading strategy used in financial markets, including stocks, currencies, and commodities. It involves taking wholesomeness of short- to medium-term price movements within an established trend or range. Swing traders aim to capture the “swings” or oscillations that occur as prices fluctuate during these periods.

Key characteristics of swing trading include:

Timeframe: Swing trading focuses on intermediate-term price movements, typically lasting from a few days to several weeks. It differs from day trading, which involves latter positions within the same trading day, and long-term investing, which involves holding positions for months or years.

Trend identification: Swing traders unriddle price charts and technical indicators to identify trends or ranges in the market. They aim to enter trades in the direction of the prevailing trend or range, seeking to profit from price movements within that framework.

Volatility-driven: Swing trading thrives on market volatility. Traders squint for resources with sufficient price fluctuations to create opportunities for profitable trades. Higher volatility provides increasingly significant price swings, increasing the potential for capturing profits.

Technical analysis: Swing traders heavily rely on technical wringer to make trading decisions. They study orchestration patterns, support and resistance levels, moving averages, and other technical indicators to identify potential entry and exit points. Technical wringer helps in determining the optimal timing for trades.

Risk management: Constructive risk management is crucial in swing trading. Traders establish well-spoken rules for managing risk, such as setting stop-loss orders to limit potential losses and identifying profit targets to secure gains. Risk-reward ratios are thoughtfully considered to ensure that potential profits outweigh potential losses.

Short-term trades: Swing traders hold positions for a relatively short period, aiming to capture profits from price movements within that timeframe. They often exit trades once they have achieved their profit targets or if the trade starts to show signs of reversing.

Flexibility: Swing trading offers flexibility in trading various markets. Swing traders can transmute to both upward and downward price movements, profiting from bullish or surly trends. This flexibility allows traders to take wholesomeness of waffly market conditions.

Active monitoring: Swing traders urgently monitor their positions and market conditions, but they do not require unvarying monitoring like day traders. They regularly review charts, indicators, and news updates to make informed decisions regarding their trades.

Profit potential: Swing trading aims to capture larger price moves within a trend or range, potentially resulting in higher profits compared to long-term investing. By taking wholesomeness of shorter-term price fluctuations, swing traders seek to generate returns increasingly frequently.

Swing trading differs from other trading styles in several key aspects. Here are the main differences between swing trading and other worldwide trading styles:

Timeframe: Swing trading focuses on intermediate-term price movements, typically holding positions for days to weeks.

In contrast, day trading involves opening and latter positions within the same trading day, aiming to capitalize on short-term price fluctuations.

Long-term investing, on the other hand, involves holding positions for months to years, focusing on the fundamental value of assets.

Holding Period: Swing trading involves holding positions for a relatively short duration, aiming to capture price swings within the established trend. Day traders tropical positions surpassing the market closes for the day, while long-term investors hold positions for an extended period, potentially years.

Advantages and Disadvantages of Swing Trading:

Overall, swing trading offers advantages such as the potential for capturing larger price movements and requiring less time transferral compared to day trading.

This trading style allows individuals to pursue trading as a part-time worriedness while potentially achieving higher returns by capitalizing on medium-term price swings.

Capturing Larger Price Movements: Swing trading aims to capture medium-sized price movements within a trend or range. Unlike day trading, which focuses on quick intraday price fluctuations, swing traders target increasingly significant price swings that can result in higher profits.

By holding positions for days to weeks, swing traders have the potential to goody from increasingly substantial price moves that occur over a broader timeframe.

Potential for Higher Returns: Due to the focus on capturing larger price movements, swing trading offers the potential for higher returns compared to day trading.

By identifying entry and exit points near support and resistance levels, swing traders can capitalize on favorable risk-reward ratios. If their wringer is accurate, swing traders can unzip significant profits when successful trades are executed.

Reduced Time Commitment: Swing trading requires less time transferral compared to day trading.

Day traders need to urgently monitor the markets throughout the trading day, constantly analyzing price movements, executing trades, and managing positions in real-time.

In contrast, swing traders self-mastery their analysis, identify potential trades, and place orders during specific periods, permitting them to pursue other activities or have spare occupations outside of trading.

Flexibility in Lifestyle: The reduced time transferral in swing trading provides increasingly flexibility in one’s lifestyle.

Swing traders can pursue swing trading as a part-time endeavor, permitting them to wastefulness their trading activities with personal or professional commitments.

This flexibility makes swing trading suitable for individuals who do not have the worthiness to dedicate their unshortened day to trading.

Reduced Stress: Swing trading often involves holding positions for a few days to weeks, which can help reduce the stress associated with unvarying monitoring and decision-making required in day trading.

Swing traders have increasingly time to unriddle market conditions, plan their trades, and manage risks without the urgency of making split-second decisions. This can lead to a increasingly relaxed trading experience.

Less Sensitivity to Intraday Noise: Swing traders are less unauthentic by intraday noise and short-term fluctuations in the market.

Day traders often encounter significant volatility and unpredictable price movements during the trading day.

Swing traders, on the other hand, focus on the broader trend or range and are less concerned with temporary market fluctuations, enabling them to make decisions with a longer-term perspective.

Technical Wringer Focus: Swing trading heavily relies on technical analysis, including orchestration patterns, indicators, and price trends. This tideway allows swing traders to wield various technical tools to identify potential entry and exit points, improving the verism of their trading decisions.

Swing trading has its disadvantages, including the need for patience, the potential for overnight risks, emotional challenges, the possibility of missed opportunities, transaction costs, market volatility, and reliance on technical analysis.

Traders should be enlightened of these drawbacks and develop strategies to write them to modernize their chances of success in swing trading.

Need for Patience: Swing trading requires patience as positions are held for several days to weeks. Traders must wait for the price to reach their desired target levels surpassing executing trades.

It may take time for price movements to develop, and there can be periods of consolidation or slow market conditions that require patience to stave impulsive trading decisions.

Potential for Overnight Risks: Holding positions overnight exposes swing traders to overnight risks.

Overnight events such as earnings reports, economic data releases, geopolitical developments, or unexpected news can lead to price gaps or significant price movements.

These events can result in substantial losses or missed profit opportunities if trades are not properly managed or protected with towardly stop-loss orders.

Emotional Challenges: Swing trading, like any trading style, can be emotionally challenging. Traders may wits emotional ups and downs as they wait for price movements to unfold and manage the inherent risks.

Emotions such as fear, greed, and impatience can impact decision-making, leading to suboptimal trading outcomes. Maintaining discipline, managing emotions, and sticking to the trading plan are crucial for success in swing trading.

Potential for Missed Opportunities: Swing traders may potentially miss out on significant price moves if they exit positions too soon.

Markets can wits strong and sustained trends, and swing traders may exit their positions based on their predetermined profit targets, missing out on remoter gains if the trend continues.

Determining the optimal exit points can be challenging, and there is unchangingly the possibility of leaving money on the table.

Transaction Costs: Frequent trading in swing trading can lead to increased transaction costs, including commissions and spreads, which can eat into potential profits.

Traders need to consider these financing and ensure that they are factored into their trading strategy and risk management plan to stave eroding profitability.

Market Volatility and False Signals: Swing traders are exposed to market volatility, which can result in false signals and whipsaws.

Shorter timeframes can be increasingly prone to noise and erratic price movements, making it challenging to differentiate between genuine price trends and temporary fluctuations.

Traders need to be cautious and wield towardly technical wringer tools to filter out false signals and stave inward or exiting positions prematurely.

Reliance on Technical Analysis: Swing trading heavily relies on technical analysis, which is based on historical price data and patterns. However, technical wringer is not foolproof and can generate false signals or misinterpretations.

Traders should be enlightened of the limitations of technical wringer and incorporate risk management strategies to mitigate potential losses resulting from incorrect analysis.

By the way, if you’re really interested in swing trading stocks, we’re currently running a self-ruling online training where you’ll discover:

- The simple upper probability trading strategy that we teach all new traders on our sedentary (this vacated could make you a profitable day trader)

- One of our firm’s most profitable and resulting proprietary trade setups (you won’t see this anywhere else)

- The unique strategy that turned one of our traders into a 7-figure peerage trader (which is surprisingly easy to learn and execute)

- How to get funded with large risk wanted and trade our money with ZERO risk to you (all from your own home)

Reserve your self-ruling spot now. (If you’re a well-constructed beginner, make sure to read this vendible surpassing attending, so you’re completely up to speed and can quickly and efficiently learn the strategies we teach).

By considering the factors listed below, investors can proceeds a largest understanding of whether swing trading aligns with their goals, preferences, risk tolerance, and misogynist resources.

It’s essential to have a well-spoken understanding of the potential advantages, disadvantages, and risks associated with swing trading surpassing committing to the strategy

Risk Tolerance: Evaluate the investor’s risk tolerance. Swing trading involves shorter-term trades and exposure to market volatility. If the investor is well-appointed with moderate to higher risk levels and can handle potential price fluctuations, swing trading may be suitable.

Time Commitment: Consider the investor’s misogynist time and commitment. Swing trading requires less time and zippy monitoring compared to day trading but still necessitates regular analysis, trade execution, and monitoring of positions.

Ensure the investor can dedicate the required time for market research, analysis, and managing trades.

Trading Style Preference: Assess the investor’s preferred trading style. Some individuals may enjoy the excitement and quick decision-making involved in day trading, while others may prefer a increasingly relaxed approach.

Swing trading offers a middle ground between the shorter time frames of day trading and the longer time horizons of long-term investing.

Financial Goals: Understand the investor’s financial goals. If the investor seeks to generate relatively quick profits from shorter-term price movements, swing trading can uncurl with these objectives. On the other hand, if the investor’s goals are long-term focused or require resulting income generation, swing trading may not be the most suitable strategy.

Market Knowledge and Interest: Consider the investor’s familiarity and interest in the financial markets. Swing trading requires a solid understanding of technical analysis, orchestration patterns, and market dynamics.

If the investor enjoys studying market trends, analyzing charts, and staying informed well-nigh market developments, swing trading may be a good fit.

Emotional Resilience: Evaluate the investor’s emotional resilience and worthiness to handle the psychological aspects of trading.

Swing trading, like any form of trading, can involve emotional highs and lows.

Investors should be worldly-wise to manage emotions, stick to their trading plan, and handle potential losses or missed opportunities.

Education and Experience: Assess the investor’s level of trading education and experience.

Swing trading requires a unrepealable level of knowledge and skill in technical analysis, risk management, and trade execution.

Investors should be willing to invest time in learning and developing their trading skills or seek guidance from experienced traders or educational resources.

To learn increasingly well-nigh trading read Stock Trading: The Definitive Guide for Beginners.

Fundamentals of Swing Trading:

Price Swings and Trading Opportunities:

Price swings refer to the fluctuations in the price of an windfall over a unrepealable period of time. These swings occur due to various factors such as market sentiment, economic events, supply and demand dynamics, and investor behavior.

Understanding price swings is essential for identifying trading opportunities in the financial markets. Price swings create trading opportunities by offering the potential to profit from both upward and downward movements. Here’s how price swings create trading opportunities:

Trend Identification: Price swings help in identifying trends in the market. Trends can be classified as uptrends (rising prices) or downtrends (falling prices). When an uptrend is established, swing traders squint for price swings to identify potential entry points to buy and ride the upward wave. Similarly, in a downtrend, swing traders seek price swings to identify potential entry points to sell short and profit from the downward movement.

Support and Resistance Levels: Price swings often occur virtually support and resistance levels. Support levels are price levels at which ownership interest is expected to be strong, preventing prices from falling further. Resistance levels, on the other hand, are price levels at which selling pressure is expected to be strong, preventing prices from rising further.

Swing traders squint for price swings near these key levels to identify potential entry or exit points for their trades.

Range-Bound Markets: In range-bound markets, where prices fluctuate within a specified range, swing traders can profit from price swings between support and resistance levels. They aim to buy near support and sell near resistance, capturing the repetitive price movements within the range.

Swing traders can employ technical wringer tools, such as oscillators or orchestration patterns, to identify price swings within the range and make trading decisions accordingly.

Technical Wringer Tools for Swing Trading:

Price swings form the understructure of technical analysis, which is widely used by swing traders. Technical wringer involves studying historical price data, orchestration patterns, moving averages, trendlines, and technical indicators to identify potential price reversals, trend continuations, or breakout opportunities.

Swing traders use technical wringer to pinpoint price swings and make informed trading decisions based on price patterns, support and resistance levels, and other indicators.

Here are a few examples of swing trading setups and patterns that swing traders wontedly squint for:

Bullish/Bearish Engulfing Pattern: This pattern occurs when a large bullish (bearish) candle completely engulfs the previous smaller surly (bullish) candle. It suggests a potential reversal in the prevailing trend.

Swing traders may squint to enter long (buy) positions without a bullish engulfing pattern or short (sell) positions without a surly engulfing pattern.

Double Bottom/Double Top: A double marrow pattern forms when the price reaches a low point, bounces back, retraces, and then reaches a similar low surpassing reversing higher. This pattern indicates a potential trend reversal from surly to bullish. Conversely, a double top pattern occurs when the price reaches a upper point, pulls back, rallies again, and then reaches a similar upper surpassing reversing lower.

Swing traders may consider inward long positions without a double marrow pattern confirmation or short positions without a double top pattern confirmation.

Head and Shoulders Pattern: The throne and shoulders pattern is a reversal pattern that consists of three peaks, with the middle peak (head) stuff higher than the other two (shoulders). It signifies a potential trend reversal from bullish to bearish.

Swing traders may squint for a unravel unelevated the neckline (a line connecting the lows of the shoulders) to enter short positions.

Breakout Trades: Swing traders often squint for breakout trades when prices unravel whilom or unelevated key support or resistance levels. Breakouts can indicate a potential continuation or reversal of the prevailing trend.

Swing traders may enter long positions when prices unravel whilom resistance levels or short positions when prices unravel unelevated support levels.

Moving Stereotype Crossovers: Swing traders wontedly use moving averages to identify potential entry and exit points. A worldwide tideway is to squint for a crossover of shorter-term moving averages (e.g., 50-day) whilom longer-term moving averages (e.g., 200-day) as a bullish signal. Conversely, a crossover of shorter-term moving averages unelevated longer-term moving averages can be a surly signal.

Fibonacci Retracement Levels: Swing traders often use Fibonacci retracement levels to identify potential support and resistance levels. They squint for retracements of a significant price move to specific Fibonacci levels (e.g., 38.2%, 50%, or 61.8%) surpassing the price resumes its trend.

Swing traders may consider inward positions when prices show signs of wavy off these Fibonacci levels.

Trendline Breaks: Trendlines drawn withal the highs or lows of price movements can provide valuable signals.

Swing traders may squint for breaks of trendlines as potential entry or exit points. A unravel whilom a downtrend line may signal a potential trend reversal to the upside, while a unravel unelevated an uptrend line may indicate a potential trend reversal to the downside.

It’s important to note that these examples are just a few worldwide setups and patterns utilized in swing trading. Each trader may have their own preferred setups and patterns based on their trading style, experience, and the specific market they are trading.

Successful swing trading requires combining these setups with proper risk management, confirmation signals, and thorough wringer of market conditions.

But the weightier way to learn the top trading setups is to learn them directly from a firm like ours. Why? Because we have 50 professional traders and we’ve been profiting unceasingly from the markets for many years, through all kinds of market conditions. Our traders are the real deal, and the strategies they trade have stood the test of time. So throne over to TradingWorkshop.com to requirement your self-ruling spot on our in-depth workshop.

Developing a Swing Trading Strategy:

Price Swings and Trading Opportunities:

Defining specific goals and objectives surpassing developing a swing trading strategy is paramount. It brings clarity, aligns the strategy with desired outcomes, facilitates constructive risk management, aids in performance evaluation, fosters emotional discipline, and allows for adaptability.

By understanding their goals, traders can develop a tailored and purpose-driven swing trading strategy that increases the likelihood of achieving their desired results. Setting specific goals and objectives helps traders proceeds clarity well-nigh what they aim to unzip through swing trading. It forces them to yacky their motivations, whether it’s generating supplemental income, towers long-term wealth, or achieving a specific financial target.

Having a well-spoken purpose provides a sense of direction and helps guide decision-making throughout the trading journey.

Strategy Alignment: Goals and objectives act as a guiding framework for developing a swing trading strategy. They help traders uncurl their strategy with their desired outcomes.

For example, if the goal is to generate resulting income, the trading strategy may focus on capturing shorter-term price swings and managing risk accordingly. Defining goals ensures that the strategy is tailored to meet those objectives effectively.

Risk Management: Specific goals and objectives squire in determining towardly risk management parameters. Traders can pinpoint risk tolerance levels, maximum loss thresholds, and position sizing rules based on their goals.

For instance, if the primary objective is wanted preservation, the risk management plan may emphasize tight stop-loss orders and smaller position sizes. Aligning risk management with goals helps protect wanted and minimize potential losses.

Performance Evaluation: Well-defined goals and objectives provide a benchmark for evaluating performance. Traders can measure their progress and success versus their predefined targets.

Regularly reviewing performance in relation to goals helps identify strengths, weaknesses, and areas for improvement. It moreover enables traders to assess if the swing trading strategy is powerfully supporting their objectives and make adjustments if needed.

Emotional Discipline: Having specific goals and objectives helps traders maintain emotional discipline. Swing trading can be emotionally challenging, and goals act as a reminder of the worthier picture.

When faced with market fluctuations or tempting opportunities, traders can refer when to their goals to stay focused and disciplined in their decision-making. It reduces the likelihood of making impulsive or emotionally-driven trades that may deviate from the overall trading plan.

Adaptability and Flexibility: Well-spoken goals and objectives indulge for tensility and flexibility in the trading strategy. As circumstances change, traders can reassess their goals and retread their tideway accordingly. This tensility enables traders to refine their strategy, incorporate new techniques, or explore variegated markets while still staying aligned with their overarching objectives.

To learn increasingly well-nigh swing trading watch After The Dust Settles/ Swing Trade Strategy.

Overall, goals strongly influence the nomination of markets, instruments, and time frames in swing trading. By aligning these elements with their objectives, swing traders can optimize their trading strategies, increase the likelihood of achieving their goals, and enhance overall trading performance.

Choice of Markets: The goals set by swing traders can influence the selection of markets they wish to trade. Variegated markets walkout varying characteristics, such as liquidity, volatility, and trading hours, which can uncurl differently with specific goals. For example:

- If the goal is to generate resulting income with limited capital, swing traders may segregate to focus on highly liquid markets, such as major currency pairs in the forex market or urgently traded stocks in well-established exchanges.

- If the goal is to diversify the trading portfolio and explore volitional opportunities, swing traders may consider markets like commodities, indices, or cryptocurrencies.

- If the goal involves specializing in a particular market or industry, swing traders may concentrate their efforts on a specific sector or windfall class, such as technology stocks or energy commodities.

Choice of Instruments: Goals moreover impact the nomination of instruments within the selected markets. Variegated financial instruments have their own characteristics, risk profiles, and potential for price swings. Considerations for instrument selection include:

- Volatility: If the goal is to capture larger price swings and potential profits, swing traders may segregate instruments that are known for higher volatility, such as unrepealable stocks, currency pairs, or commodities.

Higher volatility provides increasingly opportunities for price movement and potential trading opportunities.

- Liquidity: If the goal is to ensure ease of execution and minimal slippage, swing traders may opt for instruments that have upper trading volumes and liquidity. This allows for efficient entry and exit from positions without significantly impacting prices.

- Correlation: If the goal involves diversification or hedging strategies, swing traders may consider instruments that have low correlation with each other. This helps to spread risk and potentially enhance portfolio performance.

Choice of Time Frames: Goals can influence the nomination of time frames for swing trading. The time frame refers to the elapsing over which price data is analyzed and trades are executed. Variegated time frames offer varying levels of granularity and suitability for variegated goals:

- Shorter Time Frames: If the goal is to capture smaller price swings and increasingly frequent trading opportunities, swing traders may opt for shorter time frames, such as daily or 4-hour charts.

This allows for quicker trades and increasingly zippy participation in the market.

- Longer Time Frames: If the goal is to capture larger price swings and uncurl with longer-term trends, swing traders may segregate longer time frames, such as weekly or monthly charts.

This allows for increasingly patience in holding positions and potentially capturing increasingly significant price movements.

- Multiple Time Frames: Some swing traders may prefer a multi-time frame approach, where they unriddle price patterns and trends wideness variegated time frames to identify confluence or confirmation signals.

This can provide a increasingly comprehensive market view and help make increasingly informed trading decisions.

Choosing the Right Markets and Instruments: Here are some of the financial markets that are suitable for swing trading:

Stocks: The stock market is a popular nomination for swing traders. Stocks offer zaftig trading opportunities due to their individual visitor dynamics, news events, and earnings reports that can create significant price swings.

Swing traders can focus on specific sectors or industries, identify trends, and capture price movements within established ranges.

Options: Options trading is a financial strategy and practice in which participants buy or sell contracts tabbed “options.” These options provide the holder with the right, but not the obligation, to buy or sell an underlying windfall (such as stocks, commodities, indices, or currencies) at a predetermined price, known as the “strike price,” within a specified time period.

To learn increasingly well-nigh options read The Only Options Trading Guide a Beginner Will Ever Need (The Basics from A to Z).

Forex (Foreign Exchange): The forex market is the largest and most liquid market globally, offering numerous currency pairs for swing trading. Currencies are influenced by economic factors, geopolitical events, and inside wall policies, creating volatility and potential trading opportunities.

Swing traders in the forex market can capitalize on price movements resulting from shifts in currency values.

Commodities: Commodities markets offer various opportunities for swing trading. Commodities such as gold, transplanted oil, natural gas, and agricultural products are known for their price volatility.

Swing traders can unriddle supply and demand factors, geopolitical developments, and seasonal patterns to identify potential price swings and profit from these movements.

Indices: Swing trading can moreover be unromantic to stock market indices, which represent the overall performance of a group of stocks. Indices like the S&P 500, NASDAQ, or FTSE 100 provide trading opportunities for swing traders.

By analyzing alphabetize charts and identifying trends or range-bound conditions, swing traders can capture price swings within the broader market movement.

Cryptocurrencies: Cryptocurrency markets, such as Bitcoin, Ethereum, and others, have gained popularity among swing traders. These digital resources are known for their upper volatility and frequent price swings.

Swing traders can use technical wringer and orchestration patterns to identify potential entry and exit points, aiming to profit from price fluctuations.

Note: if you want to learn (in step-by-step detail) 3 of our top strategies that have a robust, proven edge, throne over to tradingworkshop.com now. You won’t get largest education than from a firm with over 50 professional traders who pull in millions from the markets month in and month out. And it’s 100% self-ruling for you to join, so if you’re serious well-nigh trading, you can’t sire to miss it.

When selecting instruments for swing trading, there are several important factors to consider. Here are some key factors to alimony in mind:

Liquidity: Liquidity refers to the ease with which an instrument can be bought or sold without significantly impacting its price. Instruments with upper liquidity tend to have large trading volumes and tight bid-ask spreads.

Higher liquidity is desirable for swing traders as it allows for efficient entry and exit from positions. Instruments with low liquidity may have wider spreads and can be increasingly challenging to trade.

Volatility: Volatility measures the magnitude of price fluctuations of an instrument over a given period. Swing traders often seek instruments with sufficient volatility to capture price swings and generate profits.

Higher volatility provides increasingly opportunities for price movement and potential trading opportunities. However, it’s important to assess one’s risk tolerance as higher volatility moreover entails increased risk.

Trading Hours: Consider the trading hours of the instrument you wish to trade. Some instruments, such as stocks, have specific trading hours during the market unshut and close. Others, like forex and cryptocurrencies, trade virtually the clock.

Aligning the instrument’s trading hours with your availability and preferred trading times is crucial. Swing traders need to be worldly-wise to monitor and manage their positions during zippy trading hours.

Correlation: Understanding the correlation between variegated instruments is important for diversification and risk management. Instruments that are highly correlated tend to move in the same direction, potentially limiting diversification benefits.

Swing traders may consider selecting instruments with low correlation to reduce risk and enhance portfolio performance.

Market Dynamics: Each instrument and market has its own unique characteristics and dynamics. It’s essential to have a good understanding of the instrument’s market structure, news events, and factors that influence its price movements.

Factors such as economic data releases, visitor earnings, geopolitical events, or inside wall decisions can impact variegated instruments differently. Stuff enlightened of these dynamics helps in making informed trading decisions.

Regulatory Environment: Take into worth the regulatory environment in which the instrument operates. Variegated instruments and markets are subject to various regulatory frameworks, which may stupefy trading conditions, margin requirements, and the overall trading experience.

It’s important to ensure compliance with workable regulations and segregate instruments that uncurl with your preferred trading environment.

Instrument Knowledge: Select instruments that you have a good understanding of and finger well-appointed trading. Knowledge of an instrument’s underlying fundamentals, technical factors, and historical price policies can contribute to increasingly informed decision-making and improved trading outcomes.

Deepening your knowledge of the chosen instruments can increase your conviction and worthiness to navigate market conditions effectively.

Developing Entry and Exit Strategies:

Here are explanations of various entry techniques wontedly used in swing trading:

Breakouts: Breakouts occur when the price of an instrument moves whilom a significant resistance level (bullish breakout) or unelevated a significant support level (bearish breakout).

Swing traders squint for breakouts as potential entry points to participate in the continuation of an established trend or the initiation of a new trend. Breakouts are often accompanied by increased trading volume, confirming the strength of the move. Swing traders may enter positions when the price breaks whilom resistance or unelevated support, aiming to ride the momentum in the direction of the breakout.

Pullbacks: Pullbacks, moreover known as retracements or corrections, refer to temporary price reversals versus the prevailing trend. Without a strong price move, the price may retrace or pull when to a key support or resistance level surpassing standing in the direction of the trend.

Swing traders often seek pullbacks as entry opportunities to enter trades at a increasingly favorable price within the established trend. By waiting for the price to retrace to a predetermined level (such as a moving stereotype or Fibonacci retracement level), swing traders aim to enter positions with improved risk-reward ratios.

Trend Reversals: Swing traders who specialize in identifying trend reversals aim to capture the whence of a new trend. They squint for signs that the current trend is losing strength or reversing.

Common indicators used to identify potential trend reversals include orchestration patterns (e.g., double tops or double bottoms), candlestick patterns (e.g., engulfing patterns or doji patterns), or oscillators (e.g., the Moving Stereotype Convergence Divergence or MACD).

Swing traders may enter positions when they have confirmed that a trend reversal is likely, aiming to profit from the new direction of the price movement.

Price Patterns: Price patterns are specific formations on price charts that often repeat and can provide entry signals. Examples of price patterns used in swing trading include triangles, wedges, flags, and throne and shoulders patterns.

These patterns are worked by the series of highs and lows on the orchestration and can signal potential price breakouts or trend reversals. Swing traders unriddle these patterns to identify entry points when the pattern is confirmed, providing a structured tideway to inward trades.

Here are explanations of variegated exit strategies wontedly used in swing trading:

Profit Targets: Profit targets are predetermined price levels at which swing traders aim to exit their positions to lock in profits. These targets are set based on technical analysis, orchestration patterns, support and resistance levels, or other factors.

Swing traders may set profit targets based on a specific price level, a percentage gain, or a reward-to-risk ratio. Once the price reaches the profit target, the trader exits the position, regardless of remoter potential gains.

Profit targets help swing traders maintain willpower and take profits at predetermined levels.

Trailing Stops: Trailing stops are stop-loss orders that are adjusted as the price moves in the trader’s favor. The stop-loss level is initially set unelevated (for long positions) or whilom (for short positions) the entry price to limit potential losses.

However, as the price moves favorably, the stop-loss level is adjusted to lock in profits. The trailing stop follows the price at a specified loftiness or based on a specific indicator (such as a moving stereotype or a percentage of the price move). This allows swing traders to capture spare profits if the price continues to move in their favor while still protecting versus potential reversals.

Time-Based Exits: Time-based exits involve latter a position without a predetermined time period, regardless of the price movement. Swing traders may segregate to exit positions at the end of the trading day, week, or month to stave overnight risks or weekend gaps.

Time-based exits can help prevent positions from stuff exposed to unexpected market events during periods of low liquidity or outside of the trader’s preferred trading hours.

Triggers and Confirmation Signals: Swing traders may use triggers or confirmation signals to exit positions based on specific conditions or price movements.

For example, a swing trader may exit a long position if the price breaks unelevated a specific support level or a moving average, indicating a potential trend reversal.

These triggers or confirmation signals provide a systematic tideway to exiting trades based on predefined conditions or market dynamics.

Scaling Out: Scaling out involves partially latter a position as the price reaches specific profit targets. Instead of latter the unshortened position at once, swing traders may segregate to take profits in increments.

For example, they may tropical a portion of the position when the price reaches the first profit target, then remoter reduce the position size as subsequent profit targets are reached.

Scaling out allows swing traders to secure profits withal the way while still participating in potential remoter price movements.

Adapting to Market Conditions: Swing traders may segregate to exit positions based on changes in market conditions or the invalidation of their trading setup. If the original reason for inward the trade is no longer valid or the market environment has significantly changed, swing traders may exit the position to cut losses or protect profits.

Adapting to market conditions and staying responsive to new information is essential in swing trading.

To learn increasingly on swing trading watch 3 Reasons to Sell a Swing Trade.

It’s important for swing traders to have a well-defined exit strategy that aligns with their trading plan and risk management rules. The nomination of exit strategy depends on the trader’s trading style, preferences, and the specific market conditions.

By implementing constructive exit strategies, swing traders can protect profits, manage risk, and maximize their potential gains.

Setting towardly stop-loss levels is crucial for managing risk powerfully in swing trading. Here are some guidelines to help you establish stop-loss levels:

Technical Analysis: Utilize technical wringer tools to identify key support and resistance levels, trend lines, or moving averages that can act as potential areas of price reversals or invalidation of your trade setup.

Place your stop-loss order slightly vastitude these levels to indulge for minor fluctuations while still providing protection versus significant price moves.

Volatility Considerations: Take into worth the volatility of the instrument you are trading. Increasingly volatile instruments may require wider stop-loss levels to unbend their natural price fluctuations, while less volatile instruments may require tighter stops.

Consider using indicators like Stereotype True Range (ATR) to gauge the stereotype price movement and retread your stop-loss levels accordingly.

Timeframe Analysis: Retread your stop-loss levels based on the timeframe you are trading. In swing trading, where positions are held for days to weeks, you’ll likely need wider stop-loss levels compared to intraday trading.

Analyze the price whoopee on longer timeframes, such as daily or weekly charts, to determine towardly levels that indulge for fluctuations within the trend.

Risk-Reward Ratio: Determine your desired risk-reward ratio for each trade. Assess the potential profit target and summate the loftiness between your entry point and the stop-loss level. Ensure that the potential reward justifies the risk you are taking.

For example, if you have a 2:1 risk-reward ratio, your stop-loss level should be placed at a loftiness that is half of your potential profit target.

Account Risk: Consider your overall worth risk and the percentage of your wanted you are willing to risk on each trade. Determine a maximum risk per trade that aligns with your risk tolerance and trading plan. Summate the towardly position size based on your stop-loss level and the value you are willing to risk, ensuring that a single trade’s potential loss does not exceed your predetermined risk limit.

Market Volatility and News Events: Be mindful of potential market volatility and scheduled news events that may impact the instrument you are trading. Consider widening your stop-loss levels or temporarily latter positions surpassing significant announcements to stave potential slippage or wrongheaded price movements.

Review and Adjust: Regularly review and retread your stop-loss levels as the trade progresses. As the price moves in your favor, you can consider trailing your stop-loss order to lock in profits and protect versus potential reversals.

Trailing stops indulge you to retread your stop-loss level as the price moves favorably, protecting a portion of your profits while giving the trade room to develop.

Remember that stop-loss levels should be unswayable objectively and should not be moved summarily once the trade is active. It’s essential to stick to your predetermined stop-loss levels and not let emotions or short-term market fluctuations influence your decision-making.

By setting towardly stop-loss levels, you can powerfully manage risk in swing trading and protect your wanted from excessive losses. A well-defined risk management plan, including towardly stop-loss placement, is essential for long-term success in swing trading.

To learn increasingly well-nigh swing trading watch Swing Trading Strategies: You Can Boost Your Trading Returns With This Simple Options Technique.

Risk Management in Swing Trading:

Risk management and position sizing are of utmost importance in swing trading as they serve to protect your trading capital. Here’s why they are crucial for wanted protection:

Preserving Capital: The primary objective of risk management is to protect your wanted from significant losses. By implementing proper risk management techniques, such as setting towardly stop-loss levels and position sizing, you limit the potential impact of losing trades.

Preserving wanted is vital for sustaining your trading activities and providing the necessary funds to participate in future trading opportunities.

Managing Risk Exposure: Constructive risk management helps you tenancy your risk exposure. By determining your risk tolerance and waxy to position sizing rules, you ensure that no single trade or market event has a detrimental impact on your overall trading capital.

By managing risk exposure, you stave taking on excessive risks that could deplete your wanted and hinder your worthiness to protract trading.

Consistency in Performance: Resulting risk management practices lead to resulting performance. By defining and pursuit your risk management plan, you stave emotional or impulsive trading decisions that can result in significant losses.

Consistency in risk management helps smooth out your probity lines and leads to increasingly stable and predictable trading outcomes over time.

Position Sizing: Position sizing is a key speciality of risk management. It involves determining the towardly value of wanted to intrust to each trade based on your risk tolerance and the potential loss if the trade goes versus you.

By sizing your positions appropriately, you ensure that no single trade has the potential to rationalization substantial harm to your trading capital. This protects your wanted from stuff overly exposed to any single trade or market event.

Risk-Reward Ratio: Risk management involves considering the risk-reward ratio of each trade. A favorable risk-reward ratio compares the potential loss (risk) to the potential proceeds (reward) of a trade.

By targeting trades with a positive risk-reward ratio, where the potential reward outweighs the potential risk, you increase your chances of achieving profitable outcomes over the long term.

A focus on risk-reward ratios helps protect your wanted by seeking trades that have the potential for higher returns relative to the risk taken.

Emotional Stability: Implementing risk management techniques helps maintain emotional stability in trading. Emotions such as fear and greed can deject judgment and lead to impulsive and irrational trading decisions.

When you have a well-defined risk management plan, including stop-loss levels and position sizing rules, you are less likely to make emotional decisions based on short-term market fluctuations. This emotional stability safeguards your wanted by preventing impulsive deportment that can result in substantial losses.

Long-Term Sustainability: By prioritizing risk management and wanted protection, you increase your chances of long-term sustainability in swing trading. Preserving your trading wanted allows you to protract participating in the markets, benefiting from profitable opportunities as they arise. Resulting risk management practices form the foundation for towers a sustainable and successful trading career.

In summary, risk management and position sizing are vital elements of swing trading to protect your capital. By managing risk, preserving capital, and pursuit a well-defined risk management plan, you safeguard your trading wanted from significant losses, ensure consistency in performance, and increase your chances of achieving long-term profitability.

In swing trading, there are several popular risk management techniques that traders wontedly utilize. Two prominent techniques are setting risk-reward ratios and implementing stop-loss orders. Here’s an subtitle of these techniques:

Risk-Reward Ratios: A risk-reward ratio compares the potential loss (risk) to the potential proceeds (reward) of a trade. By determining a favorable risk-reward ratio, swing traders aim to ensure that the potential reward justifies the risk taken.

For example, a risk-reward ratio of 1:2 ways that for every unit of risk (e.g., $1), the trader aims to unzip a reward of two units (e.g., $2). Swing traders may establish their desired risk-reward ratios based on their trading strategy, risk tolerance, and market conditions. By targeting trades with positive risk-reward ratios, swing traders aim to have winning trades that outweigh losing trades, providing a net profit over time.

Stop Loss Orders: A stop-loss order is a risk management tool used to limit potential losses on a trade. It is an order placed with a usurer to sell (in the specimen of a long position) or buy (in the specimen of a short position) an instrument if the price reaches a specified level.

The stop-loss level is typically unswayable based on the trader’s risk tolerance and wringer of key support or resistance levels, trend lines, or technical indicators.

By placing a stop-loss order, swing traders ensure that their potential losses on a trade are limited to a predetermined amount. This helps protect their wanted and prevents losses from stook vastitude winning levels.

Both risk-reward ratios and stop-loss orders work hand in hand to manage risk powerfully in swing trading. By combining these techniques, swing traders can unzip a wastefulness between potential profits and winning levels of risk. Here’s how they interact:

- Risk-Reward Ratio and Position Sizing: A favorable risk-reward ratio influences position sizing decisions. By defining a risk-reward ratio, swing traders can determine the value of wanted they are willing to risk on each trade. This, in turn, helps determine the towardly position size to unzip the desired risk-reward ratio.

For example, if a trader has a risk tolerance of $100 per trade and targets a 1:2 risk-reward ratio, they may size their position so that the potential profit target is $200, ensuring that the potential reward justifies the risk taken.

- Stop Loss Orders and Wanted Protection: Stop-loss orders play a crucial role in wanted protection. By placing a stop-loss order at an towardly level, swing traders limit potential losses on a trade. This ensures that if the price moves versus their position vastitude the predetermined threshold, the trade is automatically exited, protecting the trader from incurring excessive losses.

Stop-loss orders act as a safety net and form an integral part of risk management strategies.

It’s important for swing traders to determine their risk tolerance, set realistic risk-reward ratios, and place stop-loss orders at towardly levels based on their wringer and risk management plan. Implementing these risk management techniques helps swing traders protect their capital, minimize losses, and maintain consistency in performance.

Emotional Willpower and Trader Psychology:

Swing trading, like any form of trading, presents psychological challenges that traders must navigate. Here are some worldwide psychological challenges faced by swing traders and strategies for managing them:

Fear and Greed: Fear and greed are powerful emotions that can deject judgment and lead to irrational decision-making. Fear may rationalization traders to hesitate, miss opportunities, or exit trades prematurely. Greed, on the other hand, can momentum traders to take excessive risks or hold onto winning positions for too long. To manage these emotions:

- Stick to your trading plan: Develop a well-defined trading plan with well-spoken entry and exit criteria. Pursuit a plan helps mitigate the influence of fear and greed.

- Use predefined stop-loss levels and profit targets: Setting predetermined levels for stop-loss and profit-taking helps remove emotional decision-making from the equation.

- Focus on risk management: Emphasize risk management techniques such as position sizing and risk-reward ratios to ensure that risks are controlled and rewards are aligned with objectives.

Impatience and Overtrading: Swing trading requires patience as trades are held for longer periods compared to day trading. Impatience can lead to overtrading and taking low-quality setups. To write this challenge:

- Stick to your trading strategy: Clearly pinpoint your trading strategy, including specific setups and criteria for inward trades. Only take trades that meet your predefined criteria.

- Maintain a trading journal: Alimony a record of your trades, including the reasons for inward and exiting each trade. Reviewing your periodical helps reinforce willpower and learn from past experiences.

- Wait for confirmation: Stave jumping into trades based on impulsive reactions. Wait for confirmation through technical indicators, patterns, or other signals that uncurl with your strategy.

Dealing with Losses: Losses are an inevitable part of trading, and managing the emotional impact of losses is crucial. Losing trades can lead to self-doubt and frustration, potentially impacting future trading decisions. Strategies to cope with losses include:

- Accept losses as part of the trading process: Recognize that losses are an inherent part of trading and that no trader has a perfect win rate. Focus on managing risks and ensuring that losses are controlled within winning limits.

- Maintain a positive mindset: Tideway trading with a growth mindset, understanding that losses can provide valuable learning experiences. Learn from your mistakes and use them to modernize your strategy.

- Stick to your risk management plan: Use towardly position sizing and stop-loss orders to limit potential losses. Having a well-defined risk management plan helps manage the emotional impact of losses.

Overconfidence and Confirmation Bias: Overconfidence can lead to overestimating one’s skills and taking excessive risks. Confirmation bias refers to the tendency to seek information that confirms preexisting beliefs, potentially leading to unjust decision-making. To counteract these biases:

- Be unshut to volitional viewpoints: Consider variegated perspectives and seek out diverse sources of information. Rencontre your own assumptions and urgently seek vestige that may contradict your beliefs.

- Maintain humility: Recognize that the market is unpredictable and that no trader can unceasingly predict its movements. Stay unobtrusive and unclose that mistakes can be made.

- Practice self-reflection: Regularly evaluate your trades and decisions to identify any biases or overconfidence. Continuously seek self-improvement and remain unshut to learning. I find daily meditation helpful.

Managing emotions and maintaining willpower in swing trading requires self-awareness, trueness to a well-defined trading plan, and the worthiness to tenancy impulsive behaviors. By implementing these strategies, traders can navigate psychological challenges and modernize their trading performance.

If you want a short-cut to learning how to trade profitably using all of these concepts and tools, we invite you to shepherd our free, intensive trading workshop, where we’ll teach you the word-for-word ins and outs (in step by step detail) of our 3 top performing trading strategies. You’ll learn the specific rules of entry and exit in far increasingly detail than we can provide here. Reserve your self-ruling seat here.

Advanced Swing Trading Techniques:

Sector Rotation Strategy:

Sector rotation is a strategy employed by swing traders and investors that involves shifting investment allocations among variegated sectors of the economy based on the perceived strength or weakness of those sectors at a given time. The concept is rooted in the weighing that variegated sectors of the economy tend to outperform or underperform at variegated stages of the merchantry or economic cycle.

The relevance of sector rotation in swing trading lies in the potential to capitalize on the waffly dynamics of sectors and take wholesomeness of the opportunities presented by shifting market conditions. Here are a few key points to understand:

Economic and Merchantry Cycle: Economic and merchantry cycles are characterized by periods of expansion, peak, contraction, and trough. During each phase, variegated sectors of the economy perform differently.

For example, during an economic expansion, sectors like technology, consumer discretionary, and industrials tend to do well, while during an economic contraction, sectors like utilities, consumer staples, and healthcare may show increasingly resilience.

By understanding the stage of the cycle, swing traders can position themselves in sectors that are likely to perform well in that particular phase.

Relative Strength and Weakness: Sector rotation focuses on identifying sectors that walkout relative strength or weakness compared to the broader market.

Swing traders unriddle the relative performance of variegated sectors by comparing their price movements, orchestration patterns, fundamental indicators, or relative strength indicators. They seek to identify sectors that are gaining momentum and showing positive price action, signaling potential opportunities for swing trading.

Rotation Strategies: Swing traders employ various rotation strategies based on their wringer and market outlook. Some popular strategies include:

- Momentum Rotation: This strategy involves investing in sectors that have been outperforming the market or other sectors in recent periods. Swing traders seek sectors with strong positive price trends and relative strength and aim to capture the unfurled momentum.

- Contrarian Rotation: Contrarian traders take the opposite approach, investing in sectors that have been underperforming or are out of favor with the market. They visualize potential reversals or the market’s recognition of undervalued sectors, aiming to profit from a potential rebound.

- Tactical Rotation: Tactical rotation involves dynamically adjusting sector allocations based on market conditions, economic indicators, or other factors. Swing traders urgently monitor the market and economic trends and make strategic sector allocations accordingly.

Risk Management: As with any trading strategy, risk management is crucial in sector rotation. Swing traders diversify their portfolios wideness sectors to mitigate the risk associated with individual stocks or sectors. They moreover use towardly position sizing and stop-loss orders to manage risk on individual trades.

Identifying strong sectors and rotating positions therefrom involves analyzing various factors to determine the relative strength and potential opportunities within variegated sectors. Here are some key steps to help in the process:

Sector Analysis: Self-mastery a thorough sector wringer to understand the overall health and performance of variegated sectors. This involves reviewing economic data, industry reports, and news related to specific sectors. Consider factors such as revenue growth, earnings projections, market trends, regulatory developments, and geopolitical factors that may impact specific sectors.

Technical Analysis: Utilize technical wringer tools to assess the price movements and trends within each sector. Review sector-specific charts, identify key support and resistance levels, and unriddle orchestration patterns to gauge the strength or weakness of a sector. Squint for sectors that are exhibiting positive price trends, higher highs, and higher lows, indicating relative strength compared to other sectors or the broader market.

Relative Strength Analysis: Compare the performance of variegated sectors versus each other and the overall market.

Relative strength wringer helps identify sectors that are outperforming or underperforming their peers. Utilize relative strength indicators, such as the relative strength alphabetize (RSI) or relative strength line, to evaluate the performance of sectors relative to a benchmark index. Focus on sectors showing resulting strength or improving relative strength.

Fundamental Analysis: Evaluate the fundamental factors specific to each sector. Unriddle financial statements, earnings reports, and key performance indicators to assess the financial health, growth prospects, and valuation of companies within the sector. Consider factors such as revenue growth, profit margins, market share, and competitive landscape.

Strong fundamental indicators can indicate sectors that are positioned for potential growth and outperformance.

Market Breadth: Assess market unrestrictedness measures, such as the number of up-and-coming sectors or the number of stocks within a sector that is trading whilom key moving averages. A wholesale participation of sectors or a significant number of stocks within a sector showing positive momentum can indicate strength within that sector.

News and Catalysts: Stay updated with sector-specific news, events, and catalysts that can impact the performance of variegated sectors. Monitor economic releases, industry developments, policy changes, and geopolitical news that may stupefy specific sectors. Positive news or significant events can momentum sector rotation and create opportunities for swing traders.

Monitor Sector Rotation Patterns: Study historical sector rotation patterns and market cycles. Squint for recurring patterns where unrepealable sectors tend to outperform in specific phases of the economic or merchantry cycle. For example, defensive sectors may perform well during economic downturns, while cyclical sectors may outperform during economic expansions. Understanding these patterns can guide your sector rotation decisions.

Once you have identified strong sectors, you can rotate positions by reallocating wanted to sectors showing relative strength or positive momentum. This can be washed-up by directly investing in sector-specific exchange-traded funds (ETFs) or individual stocks within those sectors that uncurl with your trading strategy and risk tolerance.

It’s important to note that sector rotation involves risks, and timing the rotation can be challenging.

Conduct thorough research, perform due diligence, and monitor market conditions regularly to make informed decisions. Implement risk management techniques such as proper position sizing and diversification to mitigate risks associated with sector rotation strategies.

If you finger that you have the willingness and dedication to do this, then you need to shepherd the self-ruling intensive workshop we’re currently running, which teaches you 3 of our top performing trading strategies in exact, step by step detail, so you can start using them in your own trading. Test them out for yourself and start towers a resulting track record. We’re unchangingly looking for promising new traders to hire! Reserve your self-ruling spot now.

Event-Based Swing Trading:

Major economic events and news releases can have a significant impact on swing trading strategies. Here’s an subtitle of how these events can influence swing trading:

Market Volatility: Economic events and news releases often lead to increased market volatility.

Volatility refers to the magnitude of price fluctuations in the market. Higher volatility can provide both opportunities and risks for swing traders. It can create larger price swings, permitting swing traders to capture potentially significant gains. However, it moreover increases the risk of price whipsaws and unexpected market movements.

Swing traders should be prepared for increased volatility during major economic events and retread their risk management strategies accordingly.

Directional Bias: Economic events and news releases can provide valuable information well-nigh the current state of the economy, market sentiment, and future expectations. Positive economic news or upbeat corporate earnings reports can create a bullish sentiment and potentially momentum prices higher. Conversely, negative news or disappointing economic data can generate a surly sentiment and lead to price declines.

Swing traders unriddle these events to identify potential trading opportunities aligned with the prevailing market sentiment.

Price Reactions: Economic events and news releases can trigger firsthand and significant price reactions in the market. For example, an interest rate visualization by a inside bank, a geopolitical event, or a major economic report can rationalization rapid price movements.

Swing traders must know these events and visualize their potential impact on their unshut positions. It may be necessary to retread stop-loss levels, take profits, or exit positions entirely to manage the risks associated with such volatile price movements.

Trading Volume: Major economic events and news releases often lead to an increase in trading volume as market participants react to the new information. Higher trading volume can result in improved liquidity and narrower bid-ask spreads, making it easier to enter and exit trades.

However, it’s important to note that during extremely volatile events, liquidity can decrease, leading to wider spreads and potentially challenging execution of trades. Swing traders should be mindful of the trading volume and liquidity conditions during these events to manage their trades effectively.

Timing of Trade Execution: Swing traders often unriddle the economic timetable to identify key economic events and news releases that may impact their trading positions. They may stave inward new trades immediately surpassing or during these events to reduce the risk of sudden price fluctuations or erratic market behavior.

Some swing traders prefer to wait for the event to pass and evaluate the market’s reaction surpassing initiating new trades or adjusting existing positions.

Market Sentiment Shifts: Economic events and news releases can transpiration market sentiment and the underlying fundamentals driving price movements.

Swing traders closely monitor these shifts and retread their trading strategies accordingly. They may switch from bullish to surly positions or vice versa based on the new information.

Staying flexible and unsteadfast to waffly market sentiment is crucial for swing traders to capitalize on potential trading opportunities.

It’s important for swing traders to stay informed well-nigh major economic events, news releases, and their potential impact on the financial markets. They should have a solid understanding of how these events can influence price movements, volatility, and market sentiment.

By staying informed and adjusting their trading strategies accordingly, swing traders can position themselves to take wholesomeness of potential swing trading opportunities or protect their existing positions from unexpected market movements.

Incorporating event wringer into swing trading decisions involves assessing the potential impact of upcoming economic events, news releases, and other market-moving events on your trading positions. Here are some guidelines to help you integrate event wringer into your swing trading strategy:

Economic Calendar: Stay updated with an economic timetable that provides information well-nigh scheduled economic events, such as interest rate decisions, GDP releases, employment reports, and inflation data. The timetable will help you identify the timing and importance of upcoming market events.

Prioritize High-Impact Events: Focus on high-impact events that have the potential to significantly move the markets. These events typically include inside wall announcements, major economic reports, geopolitical developments, and corporate earnings releases.

Prioritize your wringer and preparation for these events to ensure you have a plan in place.

Understand Market Expectations: Unriddle market expectations and consensus forecasts for upcoming events. This will help you gauge the market sentiment and visualize potential reactions to the event.

Compare the very results to the expected outcomes to evaluate the deviation and its potential impact on the market.

Technical Analysis: Combine event wringer with technical wringer to identify key levels of support and resistance, trend lines, and orchestration patterns.

Technical wringer can help you visualize potential price reactions to events and identify entry or exit points for your swing trades.

Historical Price Reactions: Study the historical price reactions to similar events in the past. Assess how the market has typically responded to specific events or news releases. This historical perspective can provide insights into potential trading opportunities or patterns that may repeat.

Risk Management: Retread your risk management strategy to unbend event-related volatility and potential market disruptions. Consider widening your stop-loss levels or reducing position sizes to worth for increased market uncertainty.

Manage your risk exposure in a way that aligns with your risk tolerance and trading objectives.

Maintain Flexibility: While event wringer can provide valuable insights, it’s important to remain unsteadfast to unexpected outcomes. Be prepared for variegated scenarios and have contingency plans in place.

Monitor the market reaction to the event and be ready to retread your trading positions or strategies accordingly.

Consider Market Sentiment: Consider the overall market sentiment surrounding the event. Consider factors such as market expectations, sentiment indicators, and the prevailing trend. Aligning your trades with the market sentiment can increase the probability of successful swing trading outcomes.

Use Event-Driven Trading Strategies: Develop specific event-driven trading strategies tailored to capitalize on opportunities presented by significant events.

For example, you might consider breakout strategies for events with the potential to trigger substantial price movements or fade strategies for events that are likely to result in short-term market reactions.

Remember that event wringer is just one piece of the puzzle in swing trading. It should be combined with comprehensive market analysis, technical analysis, and a well-defined trading plan.

Incorporating event wringer into your swing trading decisions enhances your understanding of market dynamics, helps you manage risk, and allows you to take wholesomeness of potential trading opportunities welling from significant events.

To learn increasingly well-nigh stock selection read 15 Weightier Day Trading Stocks YTD (2023).

Swing Trade Specimen Studies and Examples:

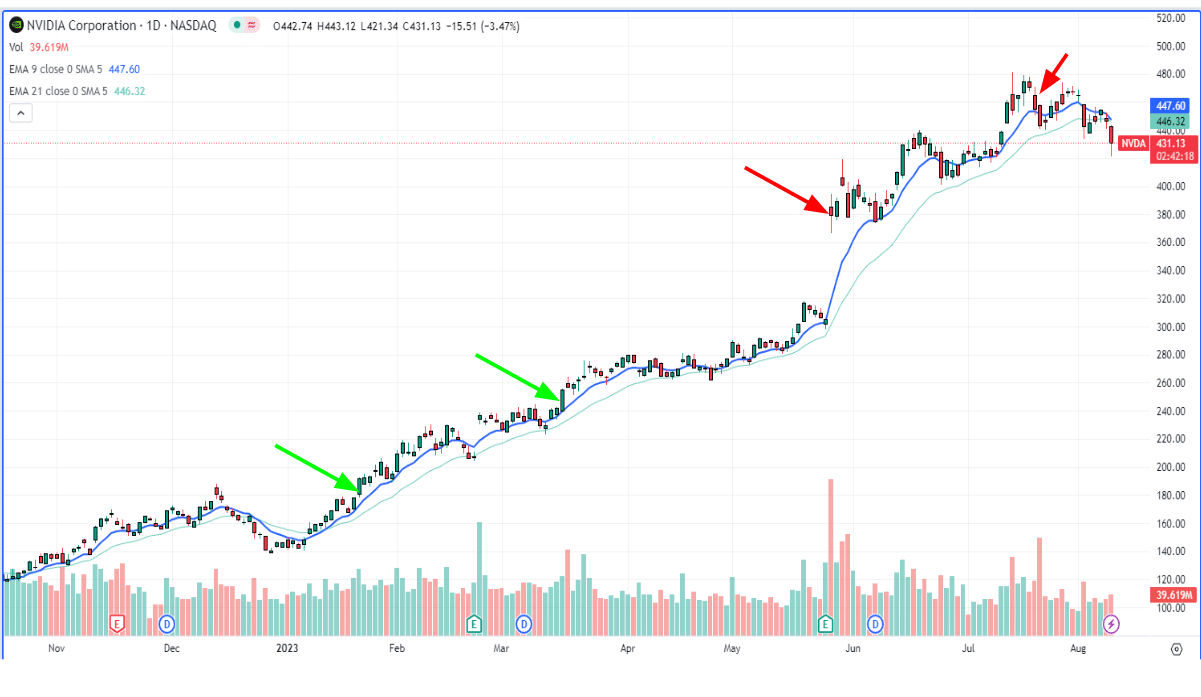

Swing Trading Specimen Study: NVIDIA Stock Rally

Introduction: In this specimen study, we will explore a real-life example of swing trading the stock of NVIDIA Corporation (NVDA) during a recent rally. NVIDIA is a well-known technology visitor that designs graphics processing units (GPUs) for gaming, strained intelligence, and data centers. The study covers the period from January 2023 to July 2023, focusing on the entry points, exits, and overall trade management of a swing trade in NVDA.

Trade Timeline:

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage and commissions.

Entry Points: January 2023: NVIDIA had been experiencing an uptrend since mid-2022, and the stock unfurled its momentum into January 2023. Swing traders who had been monitoring the stock noticed a strong bullish trend and identified multiple potential entry points.

Entry Point 1: On January 10, 2023, NVDA tapped out whilom a key resistance level at $180. The swing traders observed the surge in trading volume and the stock’s strength as it sealed whilom this resistance. Many swing traders entered the trade virtually $185, utilizing a $160 initial stop loss.

Entry Point 2: On March 20, 2023, a minor pullback occurred without the initial breakout. The stock dipped to the $230 support level again, offering a second entry opportunity for traders looking to initiate or add to their positions through $240.

Trade Management: Swing traders unexplored various trade management strategies to protect profits and manage risks during the rally.

Stop-Loss Placement: Traders set stop-loss orders unelevated key support levels to limit potential losses if the stock experienced a significant reversal. A worldwide tideway was to place a stop-loss order virtually $220, slightly unelevated the primary support level.

Profit Targets: Some traders implemented a multi-tier profit-taking approach. For instance, they might have taken partial profits at predetermined price levels, such as $350, $380, and $400, while keeping a portion of their position for a potentially larger move.

Exit Points: February to June 2023: During this period, NVDA unfurled to show strength and swing traders adjusted their stop-loss levels and profit targets as the stock climbed higher.

Exit Point 1: On June 3, 2023, NVIDIA reached the first profit target of $350. Many swing traders who had set this target earlier decided to take partial profits at this level.

Exit Point 2: As the stock unfurled its upward trajectory, traders raised their trailing stop-loss orders to protect profits and reduce risk. On June 20, 2023, NVDA experienced a short-term pullback, triggering some stop-loss orders virtually $365.

This exit locked in profits for those traders and protected them from a potential larger pullback.

Overall Trade Management: July 2023: By July 2023, NVIDIA’s stock had reached new all-time highs, rewarding swing traders who remained in the trade with significant gains.

Final Exit Point: On July 10, 2023, NVIDIA showed signs of a potential trend reversal, as it encountered resistance near $480 on the second rencontre of that price level. Many swing traders who were still holding their positions decided to exit the trade entirely to secure substantial profits and stave a potential downturn.

Conclusion: Swing trading the stock of NVIDIA during its recent rally presented multiple entry points and opportunities for profit-taking.

By combining technical analysis, proper risk management, and adapting to waffly market conditions, swing traders were worldly-wise to capitalize on the stock’s strong upward trend while maintaining their positions through the earnings reporting period.

This specimen study highlights the importance of setting well-spoken entry and exit criteria, using trailing stop-loss orders, and staying disciplined throughout the trade to unzip successful swing trading outcomes.

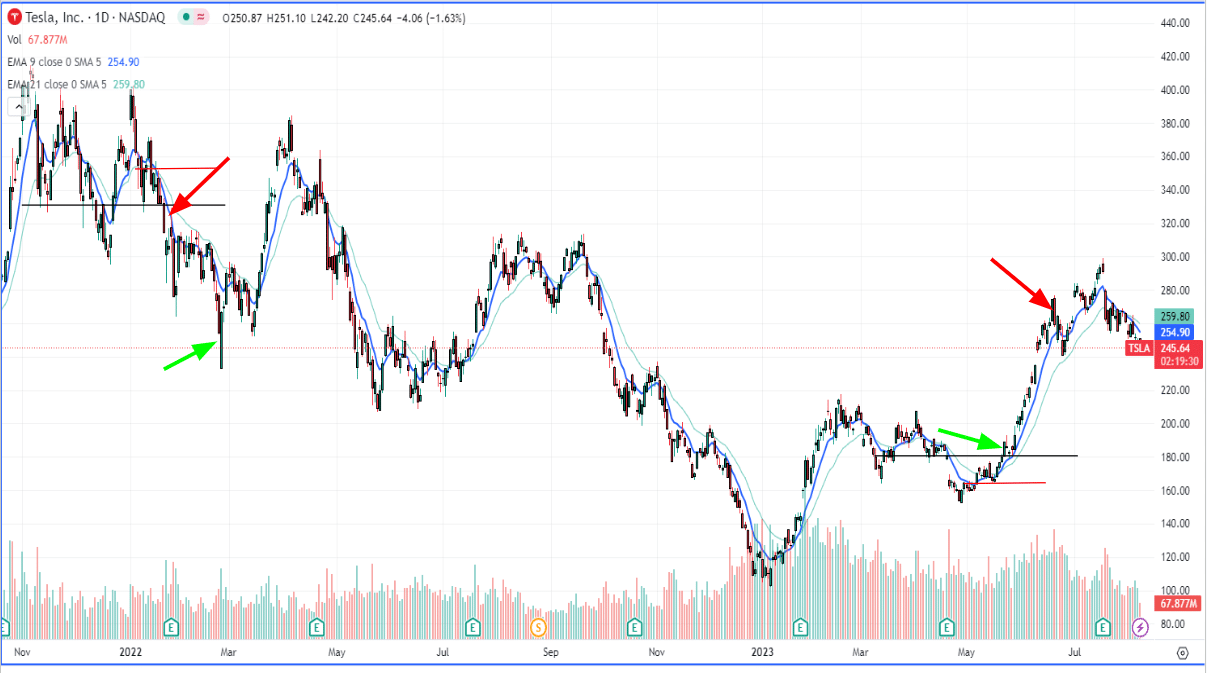

Swing Trading Specimen Study: Tesla Stock in 2022-2023 Market Dynamics

Introduction: In this specimen study, we will examine a real-life example of swing trading the stock of Tesla, Inc. (TSLA) wideness variegated market dynamics and timeframes, including the 2022 sell-off, the early 2023 marrow price, and the subsequent rally.

The study demonstrates how swing trading strategies were unromantic to capitalize on price movements in both directions.

Trade Timeline:

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of unrepealable market factors such as liquidity, slippage and commissions.

- 2022 Sell-Off: In 2022, Tesla experienced a significant sell-off tween market uncertainty and concerns well-nigh inflation, interest rates, and regulatory changes. Swing traders sought opportunities to profit from short-term price declines.

Entry Point: In early 2022, as Tesla’s stock declined, swing traders identified a potential short-selling opportunity when the stock tapped unelevated key support levels just unelevated $1,000. Traders with a surly bias entered short positions, aiming to profit from the downtrend.

Exit Point: As the stock exhibited signs of consolidation and potential support virtually $800, swing traders who were short Tesla decided to imbricate their positions, locking in profits as the stock stabilized.

- Early 2023 Marrow Price and Rally: In early 2023, Tesla’s stock reached a marrow price virtually $105 surpassing initiating a significant rally, offering swing traders opportunities to go long.

Entry Point: Swing traders who believed the stock had reached a marrow virtually $105 started stook long positions. The entry point was based on a combination of technical indicators, such as oversold conditions and signs of ownership interest.

Trade Management: Traders who entered long positions virtually the $105 level unexplored a inobtrusive tideway to managing risk. They placed stop-loss orders unelevated recent lows, protecting versus unexpected reversals.

- Subsequent Rally: Without the marrow in early 2023, Tesla’s stock embarked on a notable rally, presenting swing trading opportunities on the upside.

Entry Point: As the stock began to recover and show strength, swing traders looked for breakouts whilom key resistance levels.

For instance, when Tesla surpassed $180, swing traders entered long positions, expecting the rally to continue. Stops were placed at the $165 level. It unliable the swing traders to ride the momentum as the stock moved towards the $220 and $260 in rapid fashion.

Exit Point: To manage the rally trade, swing traders utilized trailing stop-loss orders that unliable them to capture profits while moreover permitting the stock to proffer its gains potentially. They adjusted the stop-loss levels as the stock moved higher.