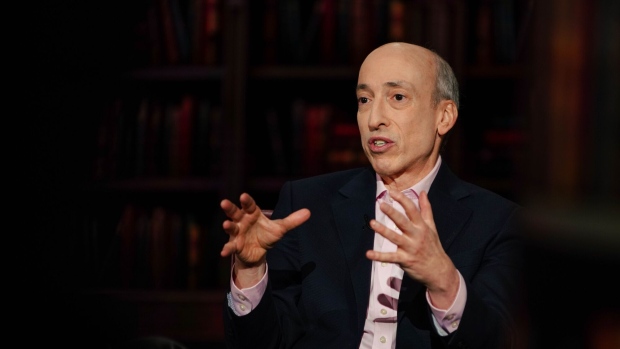

SEC Chair Gary Gensler signals that disclosure will be a key issue in the year ahead

The yearly two-day "SEC Talks" occasion started off Tuesday, offering signs to what the needs will be for the Protections and Trade Commission in the approaching year.

Supported by the Specializing in legal matters Foundation, it is a gathering where the SEC gives direction to the legitimate local area on rules, guidelines, requirement activities and claims. The occasion permits the SEC to make its clear, and this year a central question is "divulgence."

″[W]e have a commitment to refresh the principles of the street, consistently with an eye toward advancing trust as well as effectiveness, contest, and liquidity in the business sectors," SEC Seat Gary Gensler said in first experience with the meeting. Other than Gensler, all the SEC division heads and ranking staff will talk.

In view of Gensler's basic comments, there will be conversations about the impending move to abbreviate the protections settlement cycle from two days to one (T+1, which happens May 28), the development of the meaning of a trade to incorporate later exchanging stages (like solicitation for-quote, or RFQ, electronic exchanging stages), thought of an adjustment of the ongoing one-penny increase for citing stock exchanges to sub-penny levels, making of a best execution standard for merchant sellers, and production of more contest for individual financial backers orders (supposed installment for request stream).

The SEC's main goal

You frequently hear SEC authorities say the job of the SEC is to "safeguard financial backers, keep up with fair, systematic and effective business sectors, and work with capital development."

That sounds like an expansive order, and it is. Purposely so. It emerged from the debacle of the 1929 securities exchange crash, which was the underlying occasion in the best monetary fiasco of the most recent 100 years: the Economic crisis of the early 20s.

Preceding 1933, and especially during the 1920s, a wide range of protections were offered to the general population with wild cases behind them, a lot of which were false. After the accident of 1929, Congress went searching for a purpose, and deceitful cases and absence of revelation were high on the rundown.

Congress then passed the Protections Demonstration of 1933, and the next year passed the Protections Trade Demonstration of 1934, which made the SEC to uphold every one of the new regulations. It additionally required everybody associated with the protections business (principally financier firms and stock trades) to enroll with the SEC.

The 1933 Demonstration didn't make it against the law to sell a terrible venture. It basically required divulgence: all pertinent realities about a speculation should be unveiled, and financial backers could make up their own personalities.

The 1933 Demonstration was the primary significant government regulation to control the proposition and offer of protections in the US. This was trailed by the Speculation Organization Demonstration of 1940, which managed shared reserves (and at last ETFs), and the Venture Counsels Demonstration of 1940, which expected speculation guides to enroll with the SEC.

On the plan

Tuesday's meeting is an opportunity for Gensler and his staff to let everybody know what they are doing more meticulously. The office has six divisions, however they can be reduced to divulgence, risk observing and implementation.

Risk observing. To satisfy its order to safeguard financial backers, it's basic to comprehend what the dangers to financial backers are. There is a monetary and risk examination division that does that.

Exposure. At the core of the entire game is exposure. That is the first prerequisite of the 1933 Demonstration. The SEC has a division of organization money to ensure that Corporate America gives divulgences on issues that could tangibly influence organizations. This beginnings with a first sale of stock and proceeds when the organization turns out to be public.

There's likewise a division of assessments that directs the SEC's Public Test Program. It's exactly what it seems like. The SEC recognizes areas of high concern (network protection, crypto, illegal tax avoidance, environmental change, and so forth) and afterward screens Corporate America (speculation counselors, venture organizations, merchant sellers, and so on) to ensure they are in consistence with every one of the expected divulgences. Current hotly debated issues incorporate environmental change, crypto and network safety.

The issue is that the meaning of what ought to be uncovered has advanced throughout the long term. For instance, there is a harsh lawful battle preparing over the new sanctioning of guidelines expecting organizations to reveal environment gambles. Many fight this was not piece of the first SEC command. The SEC dissents, contending it is essential for the command to "safeguard financial backers."

Requirement. The SEC can utilize the data they accumulate to make strategy proposals, and in the event that they feel an organization isn't in consistence, they can likewise allude them to the feared division of implementation.

These are the police. They lead examinations concerning protections regulations infringement, and they arraign the common suits in the government courts. This division will give a report on the suit the SEC is engaged with, which is developing.

Common assets, ETFs and speculation counsels. We'll likewise hear from the division that screen common assets and speculation counsels. The vast majority put resources into the business sectors through a venture guide, and they generally purchase common assets or ETFs. This is undeniably administered by the Venture Organization Demonstration of 1940 and the Speculation Guides Demonstration of 1940. There's a division of speculation the board that screens all the venture organizations (that incorporates shared reserves, currency market reserves, shut end assets, and ETFs) and speculation counsels. This division will be sharing experiences on a portion of the new exposure necessities that have been established in the two or three years, especially manages embraced in August 2023 for counselors to private assets.

Exchanging. At long last, the division of exchanging and advertises screens everybody in question in exchanging: specialist vendors, stock trades, clearing organizations, and so on. We can expect refreshes on record-keeping necessities, shortening the exchanging cycle (the U.S. goes to a one-day settlement from a three-day settlement on May 28, which is no joking matter), and short deal divulgence.

Did we specify SPACs?

Donald Trump will probably not come up at the meeting, however the SEC in January impressively fixed the principles around exposure of particular reason procurement organizations, or SPACs. Trump's organization, Truth Social, opened up to the world on Walk 22 through a consolidation with a SPAC known as Computerized World Procurement Corp. It is currently exchanging as Trump Media and Innovation (DJT)

, what's more, it made exposures Monday that made the stock drop around 22%.

Preceding the new rule changes, chiefs showcasing an organization to be procured by a SPAC frequently made wild cases about the future productivity of these organizations — claims that couldn't have ever been feasible to make had a customary first sale of stock course been utilized. The new SPAC decides that the SEC took on made the objective organization legitimately obligated for any assertion made about future outcomes by taking care of revelations.

Moreover, organizations are furnished with a "protected harbor" security when they offer forward-looking expressions, which give them insurance against specific legitimate liabilities. Nonetheless, Initial public offerings are not managed the cost of this "protected harbor" assurance, which is the reason forward-looking articulations in an Initial public offering enlistment are generally mindfully phrased.

The guidelines explained that SPACs likewise don't have "safe harbor" lawful securities for forward-looking explanations, and that implies the organizations could all the more effectively be sued.

Like I said, Trump will probably not come up at the meeting, yet the message: "Revelation!" will probably be the prevailing refrain.