Motley Fool Epic Bundle Review: Is it Worth It?

The Motley Fool's Epic Stow is one of the Motley Fool's newest stock recommendations services.

Popular Willow

Strauss Popular Willow Cricket Bat

Shape: Willow higher up the blade, along with a slightly fatter face it has allowed pulse to bolster the thickness of its edges and combined with an impressive swell to produce a destructive bat

Actually, it's not really a new service but rather a combination of 3 of their existing services. It includes their 2 most popular services, Motley Fool Stock Advisor and Motley Fool Rule Breakers, and their newest service, Everlasting Stocks.

I have been a subscriber to both Stock Advisor and Rule Breakers since 2016, so I am very familiar with those 2 services. They both they have made a lot of money for me over the years with stocks like TSLA, SHOP, TTD, OKTA, ETSY and many others.

So when I started hearing well-nigh the Motley Fool's Epic Bundle, I decided to subscribe and write this Motley Fool Epic Stow Review to share my personal experience.

Table of Contents

[Editor's Note: All percentage returns calculated as of the tropical of merchantry on Friday, June 3, 2022.]

What is the Epic Bundle?

Here is a quick review of the 3 services you get firsthand wangle to when you subscribe to the Epic Bundle:

1. Motley Fool Stock Advisor:

The Motley Fool Stock Advisor is their original newsletter going when to April, 2002. It is the combined efforts of the Motley Fool founders, brothers Tom and David Gardner. Every month each brother (or his team) picks one new stock and gives a list of his top 5 favorite stocks. So that is 2 new stock picks a month and re-recommendations of 10 of their current favorite stocks from previous picks. This is their most popular service as it has over 1,000,000 subscribers.

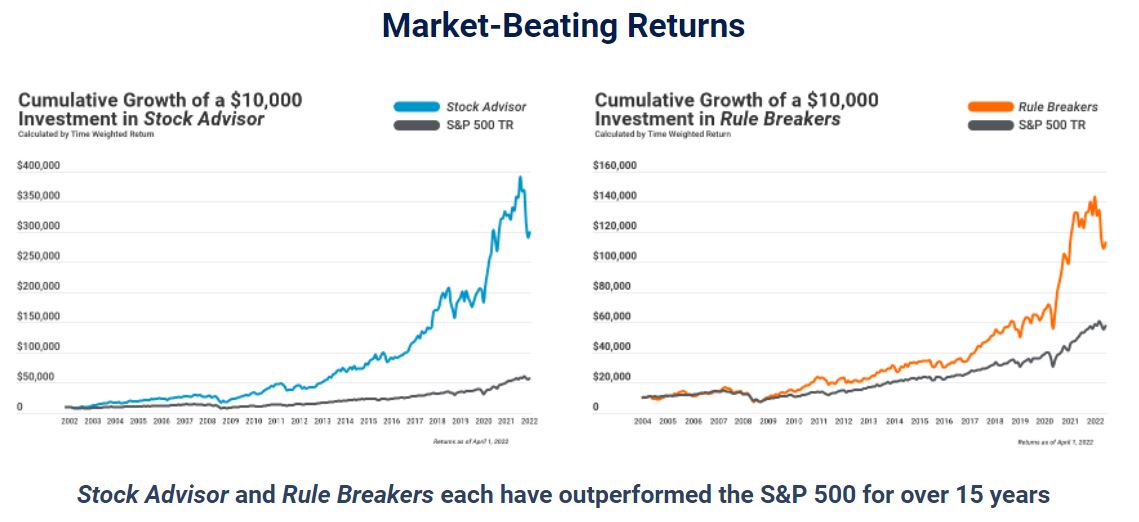

Mostly importantly, the stereotype return of all of the Motley Fool Stock Adivsor's stock picks from this service is 356% compared to the SP500's 124% (20 years).

2. Motley Fool Rule Breakers

Rule Breakers was launched in December, 2004. This is specifically just David Gardner and his team's picks. They target upper growth companies in upper growth industries. What this ways is that it might take a year or so for these stocks to take off. And when they do take off, they really take off. But what it moreover ways is they pick a few losers each year. David Gardner's teams

Mostly importantly, the stereotype return of all of Rule Breakers stock picks from this service is 205% compared to the SP500's 106% (18 years).

Here's a orchestration of the Stock Advisor and Rule Breakers performance since inception.

3. Motley Fool Everlasting Stocks

The Motley Fool Everlasting Stocks service was launched in October 2018. This service is managed by Tom Gardner, one of the 2 brothers that founded the Motley Fool. Second on the team is the Motley Fool's Chief Investment Officer Andy Cross.

One unique full-length of Everlasting stocks is the ranking they provide monthly of their picks. As they say:

Everlasting Stocks is designed to write-up the market over 5 years with companies that represent Tom Gardner's Everlasting principles. Our Top 10 Rankings each month highlight those that we believe are the most timely to write-up the market and lulu for new money or spare capital. Just considering a visitor isn't on the list doesn't necessarily midpoint we've lost conviction in it. We just

prefer these to consider first.

Here's a little peak of their May 2022 Top 10 Rankings. I am just showing the top 5 as the I don't want to get in trouble from the Fool…

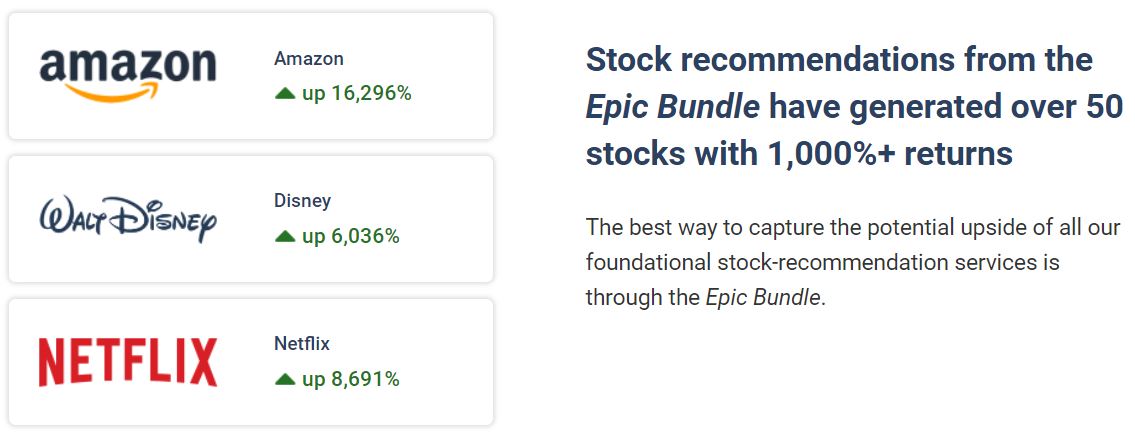

So how is it performed over time? Take a squint at this stat and these 3 top performers of the Epic Bundle. Over 50 stocks with a 1,000 % return…

How Much Does the Epic Stow Cost?

The current retail price is $499 per year. That is a savings of $298 per year over the prices of the individual services since Stock Advisor is $199 a year, Rule Breakers is $299 and Everlasting Stocks is $299.

Is the Motley Fool Epic Stow Worth It?

At first I was skeptical, and then the increasingly I researched it, I became a convinced it was a good deal, and I subscribed. With the Epic Stow you are getting $797 worth of their newsletters for $499. That saves you $298 each and every year on the renewal. Stock Counselor is normally $199/yr, Rule Breakers $299/yr, and Everlasting Stocks is $299/yr so to buy all 3 individually it will forfeit $797 a year.

You might be worldly-wise to find a promotion link to get the Motley Fool Stock Advisor at a unbelieve for the first year for new subscribers, but if you let it renew for the second year, it will be “at the then current rate.” So the Epic Stow definitely saves you money considering it is much cheaper in year 2 and thereafter. If you can invest at least $1,000 in the market each month, then the $499 is a small price to pay to get stock picks that historically have outperformed the SP500. Remember, to be successful investing in the stock market you must be thinking long term (at least 5 years), you should invest monthly so that you are unchangingly ownership (dollar forfeit stereotype principle), and your goal is to outperform the SP500.

And when you subscribe to the Epic Bundle, each month you will get 6 new stock picks and 15 timely re-recommendations of previous stock picks. You moreover get firsthand wangle to each of the 3 services' historical picks.

Is the Motley Fool Epic Stow Legit?

I get asked this question alot. The Motley Fool Epic Stow is veritably legit. The Motley Fool is a very reliable company. I know many of their team members and they are very zippy presenting at financial education conferences virtually the country. Their consumer service is moreover perfect, offering both a phone number and email support during market hours. Bottom line, if you are looking to make you life a little easier and can invest at least a few hundred dollars in the market each month, and plan on keeping the money invested for at least 5 years, you should try it.

Why You Need all Three Services

With 6 new Motley Fool stock picks a year, you might be thinking that without a year you will end up with 72 stocks. But that is not what happens. There is a little overlap occasionally in stock picks each year wideness the 3 services. There is moreover some re-recommendations of previous picks so I end up ownership increasingly stocks like TSLA over time.

The Motley Fool moreover tells you when to sell some of the stocks, and some of them end up merging or getting bought out over time. So, you won't end up with as many stocks in your portfolio as it seems.

I moreover like to use stop-loss orders so that I never lose 20% on any new position, and for the profitable picks, I use a tighter 10% stop-loss so I take my profits off the winners that start to fall.

To learn more, or to sign up for the Epic Bundle, use this landing page to get their lowest price.

Their next pick comes out this Thursday, June 16, 2022.

The post Motley Fool Epic Stow Review: Is it Worth It? appeared first on Wall Street Survivor.