Morningstar Investor Review

Investing is a game of informed risk taking.

You have to pay tropical sustentation to the markets, price in changes in sentiment or economic conditions, and take in as much information and as many perspectives as you possibly can.

It’s untellable to predict the future, of course, but the investor’s job is to use everything at their disposal to narrow lanugo the possibilities to a profitable few.

An investor needs impeccable instincts.

They need a wide, deep knowledge wiring encompassing a thousand variegated subjects.

Most of all, though, they need a unvarying stream of high-quality information to help them make the decisions that will bring them and their clients the largest returns possible.

There are dozens of services out there that purport to provide the best, most potentially profitable investing advice.

Some are free, while others tuition an arm and a leg for the pleasure.

Every one of them has their own roster of peerage investors and thought leaders that share their thoughts on everything from Treasuries to cryptocurrencies, and every last one of them claims to be the best.

As many investment translating and research firms there are, only a few have the kind of status to requite them a legitimate requirement to the crown.

One such firm was founded in May of 1984.

It Called Itself Morningstar

Joe Mansueto founded Morningstar vacated in his suite 38 years ago.

Today, it’s a billion-dollar enterprise with over 6,000 employees and provides in-depth research for over 620,000 variegated investments.

Morningstar is known as one of the top providers of investment research in the industry, and they show no signs of slowing.

This Morningstar Investor review will tell you well-nigh Morningstar’s flagship service, what it offers, and how much it costs.

What Morningstar Offers for Free

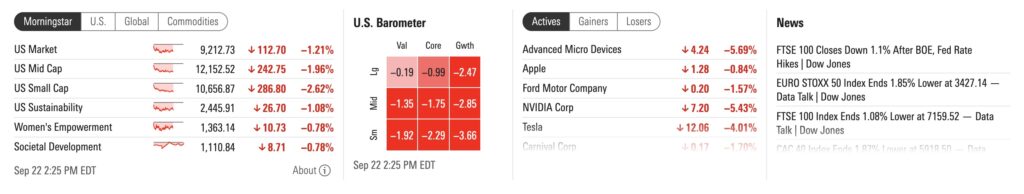

Morningstar’s website has a lot to offer for self-ruling users.

There are trackers for well-nigh any market and security you can think of, high-level financial news and market updates, unstipulated investing advice, insights from some of their analysts and advisors, and a selection of stories and insights for bilateral funds, stocks, ETFs, bonds, and other categories of securities.

There’s a lot on offer on Morningstar.com, maybe plane increasingly than you’d expect from a self-ruling service.

It’s all pretty surface-level stuff, though; Morningstar’s real insights and translating are tucked overdue a paywall.

Morningstar Premium

Morningstar has a whole range of memberships wrenched into three categories: Professional Products, Managed Investment Products, and Individual Investor Products.

Their flagship product, Morningstar Investor, is aimed at providing the research and tools that individual investors need to make informed decisions and maximize their returns.

The plan offers a free seven-day trial for new users, an ongoing subscription for $34.95 per month, and an yearly plan for $249 per year.

But right now, Morningstar is offering their yearly plan for just $199

(and you still get a 7 day self-ruling trial)

Budget-conscious investors willing to pony up the $249 $199 up front save well-nigh 53% over a monthly plan, so we highly recommend the yearly plan

It moreover might not be a bad idea to take the self-ruling trial and maybe one or two months surpassing committing to an yearly membership, just to be sure it’s the right product for you.

What Morningstar Investor Has to Offer

Morningstar Investor offers a lot of value to zippy traders and value investors.

An Investor membership will get you full wangle to research and wringer from over 150 self-sustaining analysts, all of whom are industry veterans with proven track records on Wall Street.

The wringer encompasses a range of investment types and is geared toward stuff as violating and up to stage as possible.

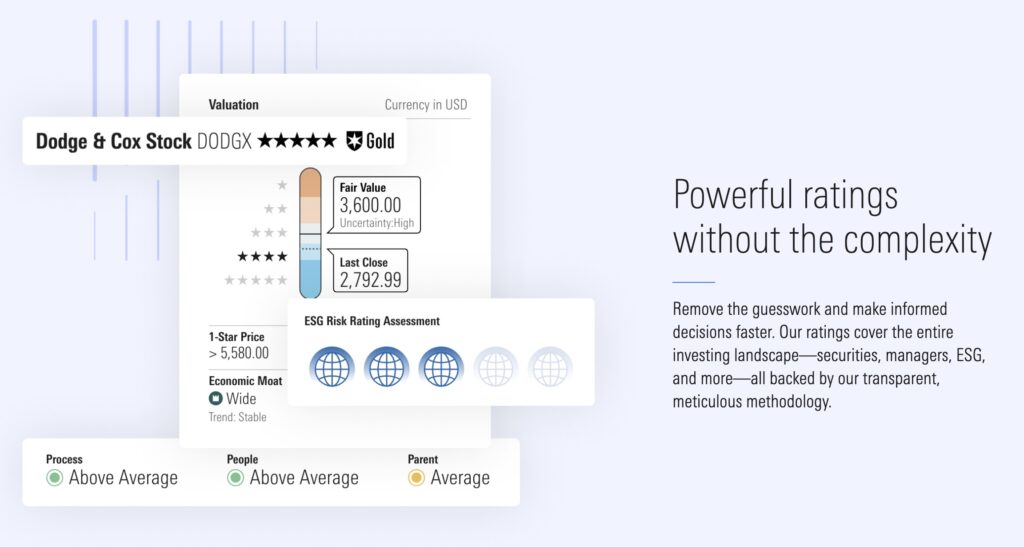

Investor memberships moreover requite you wangle to a frankly insane list of Morningstar ratings on all variegated kinds of securities, individual managers, socially and environmentally conscious investments, and pretty much anything else that you can think of.

Morningstar moreover makes their methodology misogynist to subscribers, so you can go superiority and run the numbers yourself if you aren’t convinced of any given rating.

In wing to all the research and ratings, Morningstar Investor moreover comes with a full suite of portfolio management and wringer tools.

You can evaluate potential investments based on a comprehensive list of performance and valuation metrics, wangle pre-filtered investment lists that meet your preferred criteria, and tailor your portfolio to your word-for-word specifications with just a few clicks.

Finally, Morningstar Investor enables you to evaluate your portfolio from any wile using their Portfolio X-Ray tool, which provides a set of user-friendly tools that make it easy to trammels a number of metrics like windfall typecasting and sector weightings.

You’ll plane be given special analysis, commentary, and news that’s tailored to your specific portfolio.

Is Morningstar Investor Worth the Price?

The short wordplay seems to be: Yes. It is worth the price equal to a whole slew of financial websites.

– Wallet Hacks: Worth it

– Well Kept Wallet: 4.3/5

– Credit Donkey: 3.8/5

– NerdWallet: Worth it

– Investor Junkie: 8/10

– Money Under 30: 9/10

– Day Trade Review: 4/5

You get the picture. The consensus is that Morningstar Investor provides a ton of valuable research and analysis—more than unbearable to justify the price—and that it mostly loses points for its somewhat cumbersome tools and less than stellar mobile app.

Who Would Benefit the Most from Morningstar Investor?

Morningstar is aimed primarily at increasingly zippy value investors.

You won’t find many technical wringer charts on Morningstar.com, so technical wringer wonks probably won’t want to spend the money.

Fundamental investors, on the other hand, will find a wealth of hands wieldy and in-depth wringer on the fundamentals underpinning an veritably crazy number of stocks, bilateral funds, ETFs, and other securities.

Conclusion

Morningstar Investor is the perfect tool for investors who love research and fundamental analysis.

With their free trial, it doesn’t make any sense not to try it.

Plus with $50 off their yearly plan, that knocks the yearly price lanugo to just $199 – basically the price of a Netflix subscription

The price might be nonflexible to justify for most unstudied investors, and plane some experienced traders that don’t spend a lot of time researching might want to try other services.

You won’t find much wringer on cryptocurrencies, technical wringer tools, or prescriptive translating if you go with Morningstar Investor.

If you want someone to tell you exactly how to invest you probably won’t find much to love well-nigh Morningstar Investor. In that case, you might want to squint at a service like the Motley Fool instead.

But if you like the idea of getting all the fundamental information and in-depth wringer that you need to make informed decisions, however, Morningstar Investor may be just the ticket.

After reading this Morningstar Investor review, what are your thoughts on the product? Let us know in the scuttlebutt section!

The post Morningstar Investor Review appeared first on Wall Street Survivor.