Lively HSA Review

Author’s Note: I have had a Lively HSA for well-nigh 5 years now so I am very qualified to write this Lively HSA Review. Read on to see pictures of my worth and why I still use Lively! But first, a little background…

Introduction

America has some of the weightier doctors, nurses, healthcare facilities, and medical technology in the world.

Our universities and research institutions churn out medical breakthroughs on a daily basis, and our healthcare professionals make medical miracles happen.

There’s no denying that the American healthcare system is capable of incredible things.

It’s moreover incredibly expensive.

The Survey of Income and Program Participation (SIPP) found that 19% of US households carried at least some value of medical debt as of 2017, and there’s little hope that the situation has improved since then. In fact, two-thirds of bankruptcies are caused by medical debt.

Policies like the Affordable Superintendency Act were intended to make health insurance increasingly wieldy and affordable, but they’ve washed-up little to curtail the financing of superintendency or slow lanugo the meteoric rise in premiums we see year without year.

High-deductible health plans (HDHPs) have wilt increasingly popular over the years, particularly among younger consumers who value lower premiums over lower deductibles.

Enrollment in HDHPs without health savings finance (HSAs) among the roughly 60% of Americans between the month of 18-64 with employment-based healthcare rose from 10.6% to 24.5% between 2007 and 2017.

Barebones HDHPs do have lower premiums than other plans, but with that comes the caveat of upper deductibles. So the logical solution is to have an HSA that you fund with pre-tax dollars to imbricate your deductible. What this ways is that if put $1,000 in your HSA and you are in the 25% tax subclass you get $250 when on your taxes. So now you are substantially using $750 to pay for $1,000 of your expenses that you pay out of pocket until you mead your deductible.

Though no perfect solution has been found to tenancy the country’s out-of-control healthcare costs, pairing HDHPs with HSAs has emerged as a unconfined way to offset the forfeit of your expenses that you use to meet your deductible.

Health savings finance have been growing in popularity—HDHPs with HSAs comprised 18.9% of employer-supported health insurance plans as of 2017—though uptake is still relatively low compared to HDHPs without HSAs.

Although the idea overdue HSAs is simple, finding a visitor to provide and manage HSAs isn’t quite as straightforward.

It can be nonflexible to tell which firms in the HSA space are deserving of your business, and it isn’t a nomination that should be made lightly.

Take Lively, the subject of this HSA review article, for instance. How well do they do what they do? How do they stack up versus the competition? And most importantly: Do they deserve your merchantry and your trust?

Health Savings Accounts

Health savings finance are tax-exempt finance that holders of HDHPs can use to set whispered funds for future medical expenses.

As of 2023, individuals and families are eligible for HSAs if they select health plans with deductibles of at least $1,500 or $3,000, respectively (so, you know, scrutinizingly everyone).

Contributions to HSAs like the Lively HSA are made on a pre-tax understructure by eligible individuals—IE plan holders—or on their behalf by employers or family members.

Any funds unsalaried to an HSA, whispered from those provided by employers, are deductible from the individual’s tax return whether or not they itemize deductions.

The government sets limits for how much one can contribute to their HSA every year, with 2023’s maximum contributions stuff capped at $3,850 or $7,750 for individuals and families, respectively. If you are over 55 you can add an uneaten $1,000.

Money kept in an HSA can be used to pay for deductibles, copayments, coinsurance, and other qualified medical expenses (though typically not insurance premiums) at any time.

Unused funds roll over to the next year, and an HSA will stay with its owner if they transpiration employers or leave the workforce altogether.

HSA funds can be withdrawn for nonmedical purposes without the owner turns 65, but will incur a 20% penalty and income taxes on amounts withdrawn for nonmedical purposes surpassing then.

How I use My Lively HSA

My health insurance has a $3,000 deductible. So in January I put $1,000 in my HSA. Then I use the debit vellum that Lively gives you to pay for my various prescriptions, doctor appointments and my teeth cleaning. I moreover use it to buy unrepealable items at CVS and Walgreens.

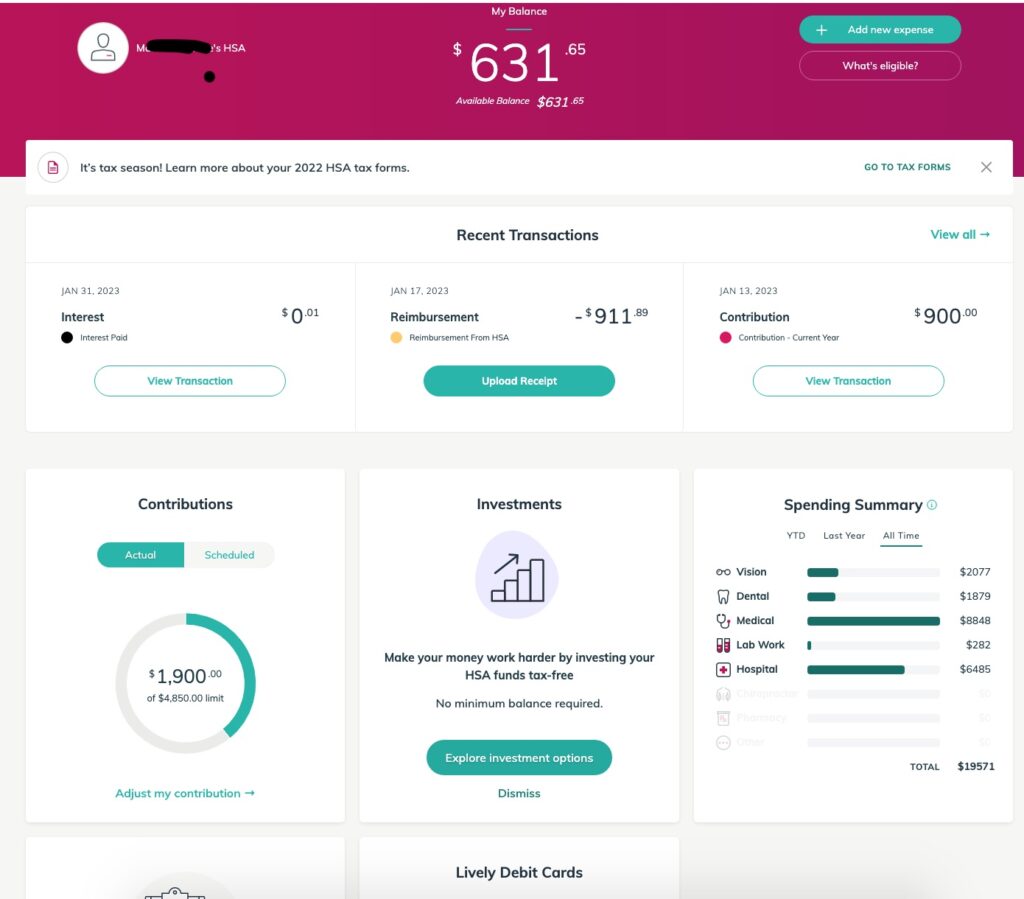

Then when I use most of that $1,000, a put a little increasingly money in. My last contribution was $900 so now for 2023 I have put in $1900 and have a wastefulness of $631.

It is a unconfined dashboard considering it reminds me what my yearly contribution limit is. In my specimen considering of my age, I can put an uneaten $1,000 in or $4,850 in as you can see in the whirligig above.

Lively HSA

Lively is bringing the HSA into the modern era to make it easy to save financing of health TODAY and plan for the financing of tomorrow.

It is super easy to setup and plane easier to use.

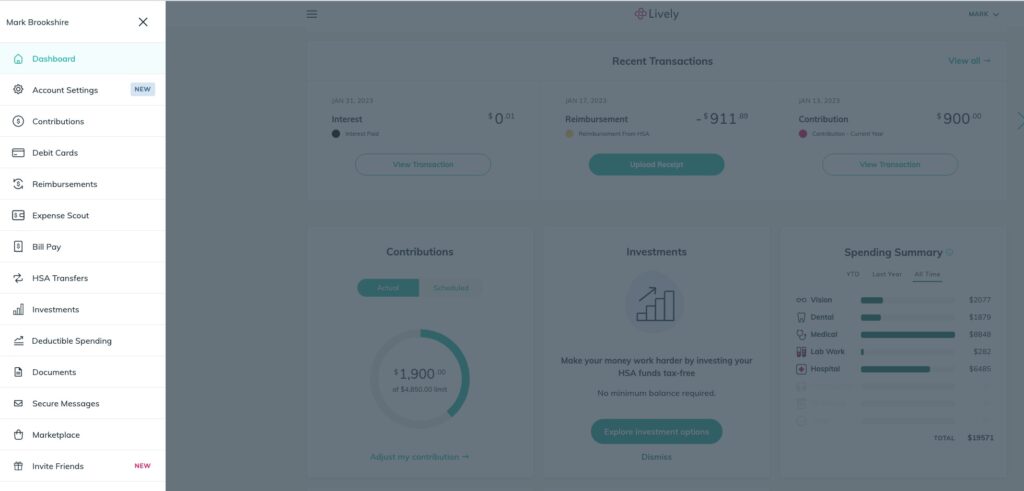

Take a squint at the menu options you have misogynist off of the main dashboard: Contributions, Debit Cards, Reimbursements, Bill Pay, Documents, etc. The Expense Scout helps you icon out what is eligible for HSA reimbursement and what is not.

Moreover, unlike many HSAs…

…Lively has NO HIDDEN FEES, makes it easy to transfer in and out, and they have real consumer support with my Lively HSA.

All HSAs are provided and administered by trustees like banks, insurance companies, and other IRS-approved entities.

Some trustees treat HSAs like savings finance and pay (tax-free) interest at market rates, while others take a increasingly zippy tideway and invest HSA funds on behalf of their owners.

Every trustee has their own set of costs, benefits, and considerations, all of which should be considered surpassing opening an worth with them. Some of the increasingly important criteria are:

- Fees

- Account management costs

- Investment options

- Minimum worth requirements

- How nonflexible it is to unshut an account

- Debit vellum access

Here’s how Lively stands up to those criteria.

Fees

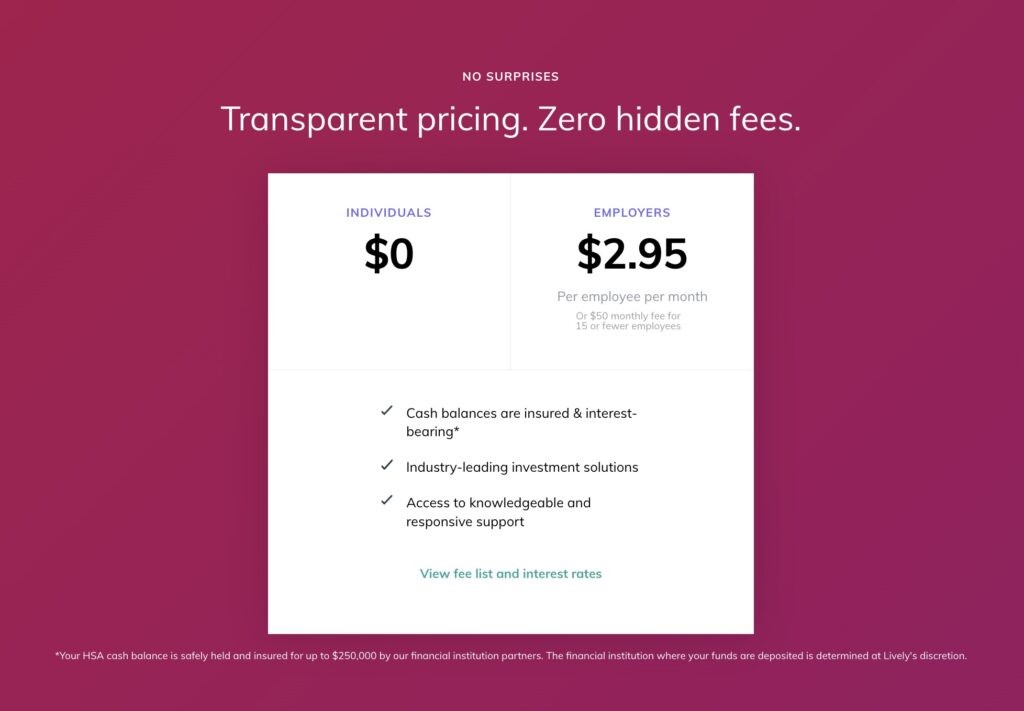

Lively doesn’t tuition any fees at all for individual Lively HSAs.

No startup fees, no maintenance fees, no management fees, nothing.

They do tuition a small 0.5% fee to wangle a Lively HSA guided portfolio, and an yearly $24 fee for a Schwab health savings brokerage account, but both of those features are completely optional.

There aren’t many other HSA providers that offer what Lively does without imposing at least some fees.

It’s so rare, in fact, that it unquestionably begs the question: How does Lively make money?

A cynical person might seem that there unquestionably are some subconscious fees or some other catch, but that doesn’t seem to be the case.

It seems like Lively makes its money by charging fees for spare services and charging employers $2.95 per employee per month for HSAs—effectively using institutional dollars to subsidize individual savers.

It might unquestionably be a specimen of genuine tolerance in the merchantry world. Go figure.

Ease of Use and Worth Creation

Lively wants to make opening and managing a Lively HSA as easy as humanly possible, and it seems like they’re pulling it off.

Their all-online worth megacosm process is quick and easy. The whole process takes just a few minutes.

The interfaces of both their browser-based platform and their app are streamlined to the point of stuff self-explanatory. You’ll never have to wonder where to click to find what you’re looking for.

There’s a whole library’s worth of tutorials and FAQs to help you through any troublemaking aspects of the process. If you do happen to have a question or two during the worth megacosm process, your answers will be right here!

And if you really can’t icon out how to do it, you can unchangingly reach out to Lively’s support staff and have them walk you through it.

The platform’s transferral to ease-of-use doesn’t end when your worth is up and running.

It just takes a second to connect your Lively HSA to your wall account, perform a one-time transfer, or set up sweep or recurring transfers at any value or interval that’s most user-friendly for you.

They’ll plane take on the lion’s share of the work if you want to transfer an HSA to Lively from flipside HSA provider.

Managing your worth is just as simple as the rest of the wits you’ll get with Lively.

Both the web and app dashboards provide itemized records of all incoming and outgoing transactions that are updated in near real-time.

Spending and Reimbursement

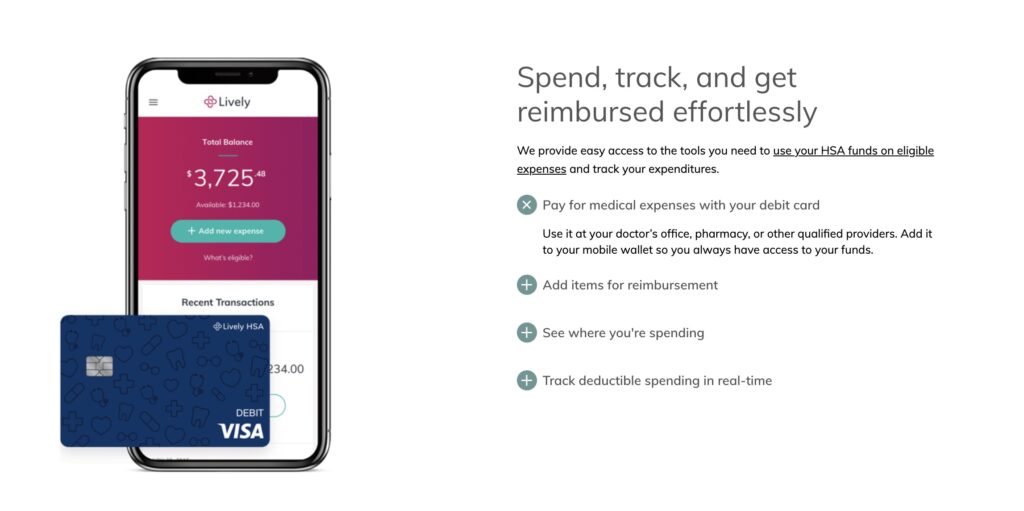

You have a couple options for paying for care, deductibles, and other qualified medical expenses from your Lively HSA account.

The first payment option is the physical and/or digital (via Apple Pay or similar) debit card that Lively provides its worth holders.

The cards are functionally identical to any other debit cards save for the fact that they’re unfluctuating to your Lively HSA and are intended only for use on deductibles, care, and other qualified medical expenses.

Though there’s nothing unrenowned well-nigh them, it’s really nonflexible to write-up the convenience of stuff worldly-wise to pay medical expenses directly instead of via a bureaucratic tangle of paperwork and red tape.

If you don’t pay for your expenses using the provided debit cards, Lively has a robust and nearly effortless reimbursement process in place to make sure you get repaid in a hurry.

It’s nonflexible to say exactly how long it’ll take to get reimbursed without unquestionably trying it for yourself, but submitting the reimbursement requests themselves shouldn’t take increasingly than a couple minutes.

Investments

Lively lets you invest your Lively HSA funds in either a Schwab Health Savings Brokerage Worth or a HSA Guided Portfolio from Devenir.

The Schwab option gives you a lot of tenancy over where your Lively HSA funds go, with a long list of options encompassing stocks, bonds, bilateral funds, and exchange-traded funds to segregate from. What you do with your portfolio is up to you, though they moreover let you requite your financial counselor wangle to your portfolio to handle the investments for you.

The Schwab brokerage worth comes at the price of $24 annually. It’s moreover subject to a number of transaction financing and other fees, though you can stave most of those fees by investing $3,000 or more.

There’s no minimum investment size for the Devenir guided portfolio option, but it does come with an yearly fee of 0.50% of invested assets. This option lets you select from a list of funds to segregate from, some of which may moreover come with their own management fees.

Lively HSA Consumer Service

You can reach Lively Monday through Friday from 8:00 AM to 6:00 PM PT.

Phone: 1 (888) 576-4837

E-mail: hello@livelyme.com

There is moreover a Support Center with HSA Guides, FAQs, and an HSA calculator.

The HSA Guides will imbricate topics like:

- Terminology 101

- Benefits of an HSA

- How to maximize your savings

- Health savings worth vs. Flexible savings account

- Using your HSA funds

- And much more!

That is right – the HSA guides imbricate everything that financial experts have to say about:

- Getting a health savings account; and

- Using it powerfully to save for medical expenses and reduce your taxable income.

The HSA Calculator can show you:

- Your HSA savings and investments potential over time.

- How much you are eligible to contribute to your HSA.

- How one health plan forfeit compares to other health plans costs.

The Lively HSA FAQ section can wordplay questions like:

- What records do I need to alimony to justify spending money on a qualified medical expense?

- Why should I put money into my HSA over some other savings vehicle (e.g., 401(k))?

- What happens if I use my money to pay for a non-qualified expense?

- If I have a family, can I still have an HSA?

So, if you have any questions – Lively will likely be worldly-wise to wordplay those for you.

Conclusion

Lively is an spanking-new nomination for individuals looking to unshut an HSA.

Their signup process is short and sweet, their interface is well-spoken and easy to use, and they’ve gone to unconfined lengths to make what could be an obnoxious wits into a no-brainer in every sense.

It would be nice to see some other investment options, particularly if those options were as fee-free as the rest of Lively, but it’s really not that big a deal when you take the rest of what Lively offers into account.

If you’d like to trammels out some other HSA providers not mentioned in our Lively HSA Review, read our list of the Best HSA Accounts!

The post Lively HSA Review appeared first on Wall Street Survivor.