Weekly Closed-End Fund Roundup: September 6, 2020

Author's note: This article was released to CEF/ETF income Laboratory members on September 8, 2020. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Most of the information has been sourced from CEFInsight or the Closed-End Fund Center. I will also link to some articles from Seeking Alpha that I have found for useful reading over the past week. The searchable tag for this feature is "cildoc". Data is taken from the close of Friday, September 4th, 2020.

Weekly performance roundup

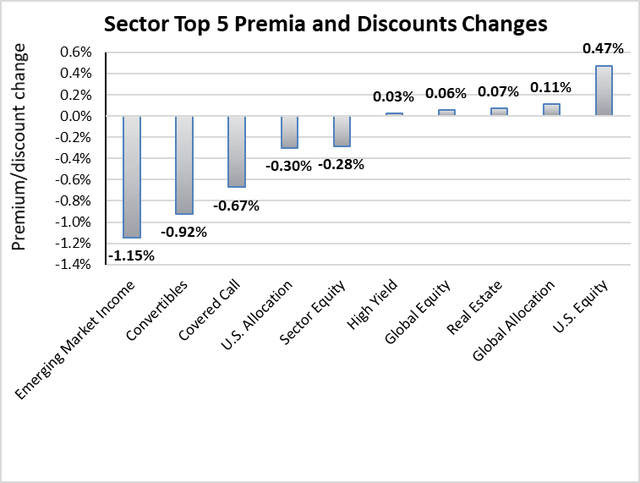

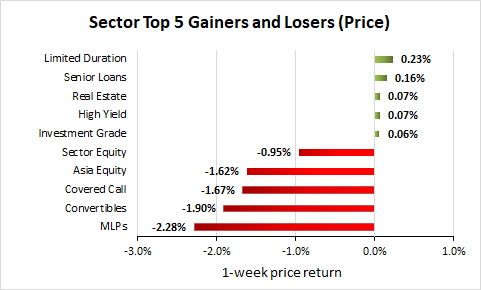

5 out of 23 sectors were positive on price (down from 13 last week) and the average price return was -0.46% (down from -0.13% last week). The lead gainer was Limited Duration (+0.23%), followed by Senior Loans (+0.16%) and Real Estate (+0.07%), while the weakest sectors by Price were MLPs (-2.28%), followed by Convertibles (-1.90%) and Covered Call (-1.67%).

(Source: Stanford Chemist, CEFConnect)

7 out of 23 sectors were positive on NAV (down from 16 last week), while the average NAV return was -0.27% (down from +0.23% last week). The top sectors by NAV were Emerging Market Income (+1.07%), Limited Duration (+0.31%) and Senior Loans (+0.26%). The weakest sectors by NAV were MLPs (-1.94%), Asia Equity (-1.34%) and Covered Call (-0.97%).

(Source: Stanford Chemist, CEFConnect)

There were only three premium sectors this week, the leader was Taxable Munis (+2.93%), while the sector with the highest discount is MLPs (-23.92%). The average sector discount is -8.33% (down from -7.78% last week).

(Source: Stanford Chemist, CEFConnect)

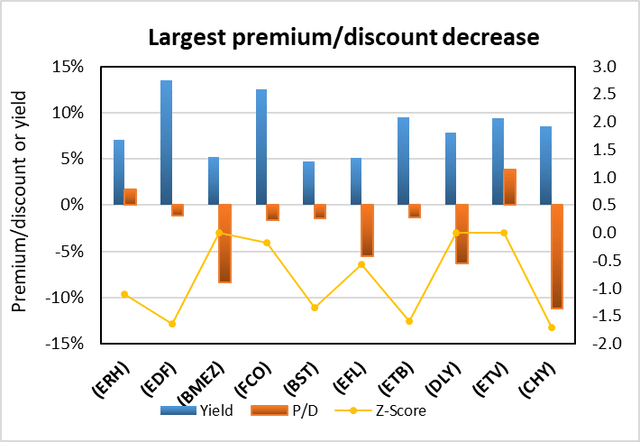

The sector with the highest premium/discount increase was U.S. Equity (+0.47%), Emerging Market Income (-1.15%) showed the lowest premium/discount decline. The average change in premium/discount was -0.17% (down from -0.48% last week).

(Source: Stanford Chemist, CEFConnect)

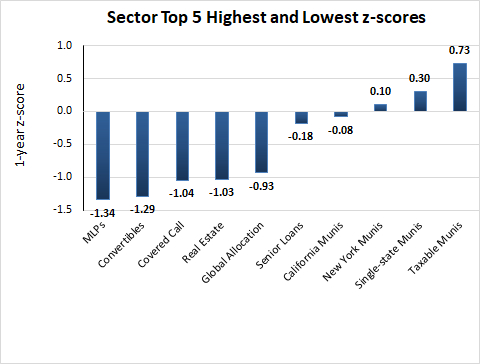

The sector with the highest average 1-year z-score is Taxable Munis (+0.73), followed by Single-state Munis (+0.30). The sector with the lowest average 1-year z-score was MLPs (-1.34), followed by Convertibles (-1.29). The average z-score is -0.50 (down from -0.37 last week).

(Source: Stanford Chemist, CEFConnect)

The sectors with the highest yields are MLPs (17.89%), Global Allocation (11.28%), Limited Duration (9.33%), Multisector Income (9.01%) and Real Estate (8.96%). Discounts and z-scores for the sectors are included for comparison. The average sector yield is +7.45% (up from +7.43% last week).

(Source: Stanford Chemist, CEFConnect)

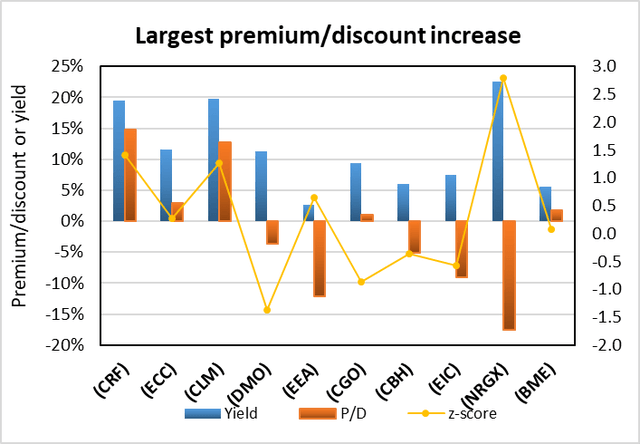

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

Fund | Ticker | P/D decrease | Yield | P/D | Z-Score | Price change | NAV change |

Wells Fargo Util & High In | (ERH) | -4.93% | 7.10% | 1.66% | -1.1 | -4.23% | 0.42% |

Stone Harbor Emerg. Mkts Income Fund | (EDF) | -3.53% | 13.52% | -1.11% | -1.6 | -1.11% | 2.43% |

BlackRock Health Sciences Trust II | (BMEZ) | -3.46% | 5.16% | -8.32% | 0.0 | -6.12% | -2.56% |

Aberdeen Global Income Fund, Inc. | (FCO) | -3.39% | 12.54% | -1.62% | -0.2 | -2.47% | 0.89% |

BlackRock Science and Technology Trust | (BST) | -3.02% | 4.76% | -1.44% | -1.4 | -6.63% | -3.73% |

Eaton Vance Float-Rate 2022 Target Term | (EFL) | -2.96% | 5.09% | -5.54% | -0.6 | -2.07% | 1.01% |

Eaton Vance Tax-Managed Buy-Write Income | (ETB) | -2.57% | 9.47% | -1.30% | -1.6 | -3.59% | -1.07% |

DoubleLine Yield Opportunities Fund | (DLY) | -2.48% | 7.82% | -6.33% | 0.0 | -2.24% | 0.37% |

Eaton Vance Tax-Managed Buy-Write Opp | (ETV) | -2.40% | 9.38% | 3.81% | 0.0 | -3.54% | -1.30% |

Calamos Convertible & High Income Fund | (CHY) | -2.34% | 8.51% | -11.19% | -1.7 | -4.01% | -1.46% |

(Source: Stanford Chemist, CEFConnect)

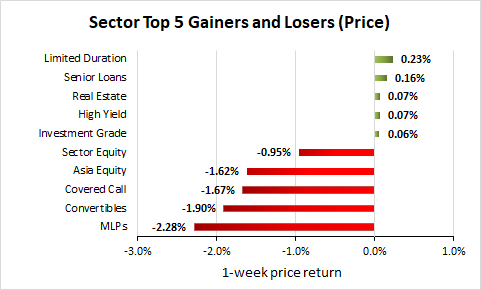

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

Cornerstone Total Return Fund | (CRF) | 4.77% | 19.49% | 14.85% | 1.4 | 1.38% | -2.83% |

Eagle Point Credit Company LLC | (ECC) | 3.95% | 11.62% | 2.92% | 0.3 | 3.98% | 0.00% |

Cornerstone Strategic Value | (CLM) | 3.86% | 19.73% | 12.70% | 1.3 | 0.71% | -2.72% |

Western Asset Mortgage Defined Opp | (DMO) | 3.75% | 11.28% | -3.69% | -1.4 | 4.63% | 0.57% |

European Equity Fund | (EEA) | 2.58% | 2.60% | -12.18% | 0.7 | 0.42% | -2.52% |

Calamos Global Total Return | (CGO) | 2.43% | 9.37% | 1.03% | -0.9 | 0.47% | -1.93% |

AllianzGI Convert & Inc 2024 Target Term | (CBH) | 1.85% | 6.09% | -5.07% | -0.4 | 1.55% | -0.41% |

Eagle Point Income Co Inc | (EIC) | 1.76% | 7.42% | -9.09% | -0.6 | -0.15% | 0.00% |

PIMCO Energy & Tactical Credit Opps | (NRGX) | 1.61% | 22.54% | -17.55% | 2.8 | -0.42% | -2.35% |

BlackRock Health Sciences | (BME) | 1.26% | 5.59% | 1.71% | 0.1 | -0.60% | -1.79% |

(Source: Stanford Chemist, CEFConnect)

Distribution changes announced this month

The September distribution changes haven't been updated in our database yet. In the meantime, check out acamus' thread over at the Morningstar forums for cuts announced so far. Of note are two high-yield target term funds, Eaton Vance High Income 2021 Target Term (EHT) and Nuveen Corporate Income November 2021 Target Term Fund (JHB), which reduced their distributions by 33% and 22% respectively in an effort to conserve NAV. None of our portfolio holdings announced cuts so far this month.

CEF analysis from around Seeking Alpha...

ADS Analytics presents CMU: A Look At One Of The Highest-Yielding Muni CEFs (Aug. 31)

Alpha Gen Capital presents PIMCO Monthly Update August 2020: Coverage Scares Investors, Providing An Opportunity (Sep. 2)

Bridger Research presents TYG: This CEF Has Been Devastated By The COVID-19 Pandemic (Sep. 4)

*Juan de la Hoz presents AOD: Global Equities Fund With Stable 8% Distribution, Massive 14% Discount To NAV (Aug. 30), Beware Of Underperforming General Equity CEFs (Aug. 31)

*Nick Ackerman presents Closed-End Funds: 4 Municipal Bond Funds For Your Portfolio (Aug. 28), Income Lab Ideas: Section 19a Notice Can Be Misleading (Aug. 31), KMF: Strategic Policy Shift Provides A Potentially Brighter Future (Sep. 1), JRS: Fund For Buying The Beaten Down REIT Sectors (Sep. 2), HYI: Fully Covered 7.69% Yield At A Discount (Sep. 2), DSL: Jeffrey Gundlach's Efforts In A CEF - 11%+ Yield Looks Enticing (Sep. 3)

Patrick Kroneman presents Invest At A Discount In The Rothschild's Listed Family Office: RIT Capital Partners (Sep. 2)

*Stanford Chemist presents Weekly Closed-End Fund Roundup: August 23, 2020 (Aug. 31)

Steven Bavaria presents Aberdeen Income Credit Strategies - Hardly A 'Senior Loan' Fund (Sep. 3)

Tom Roseen presents The Month In Closed-End Funds: August 2020 (Sep. 4)

*To subscribers: these link to the public version of the article, which you will already have seen in the members section.

Macro/market section

Fear & Greed Trader presents S&P 500 Weekly Update: The Pause Is Here And The Talk Of A 'Market Crash' Is Everywhere (Sep. 6)

Jeff Miller presents Weighing The Week Ahead: The Start Of Something Big? (Sep. 6)

Lance Roberts presents Market Finally Cracks. Is The Bull Market Rally Over? (Sep. 6)

Labor Day Sale - only 10 spots left!

Our Labor Day sale is limited to this week only, or until the first 50 members have signed up, whichever comes first.

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

Disclosure: I am/we are long BMEZ, EIC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.