Warning Signs In Duration Risk

The VanEck Vectors Muni Allocation ETF (MAAX) tactically allocates among VanEck municipal bond ETFs based on interest rate and credit opportunities to seek capital appreciation plus tax-exempt income. It uses a data-driven, rules-based process that leverages technical and macroeconomic indicators to guide credit and duration exposure, seeking to avoid market risks when appropriate.

Overview

The VanEck Vectors Muni Allocation ETF had a NAV total return -0.24% vs. +0.02% for its benchmark for the month.

September was a bumpy month for many assets, as investors weighed up the risks of COVID-19, uncertainties around further fiscal stimulus and the potential for a contested election. To add even further to the uncertainty, President Donald Trump was diagnosed with the virus on October 1.

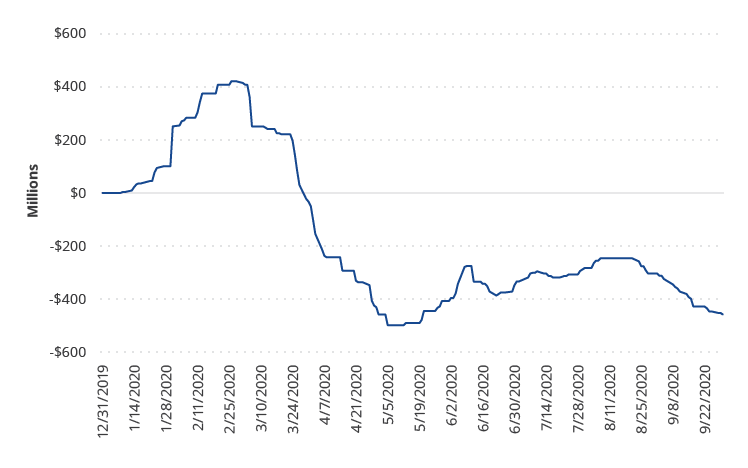

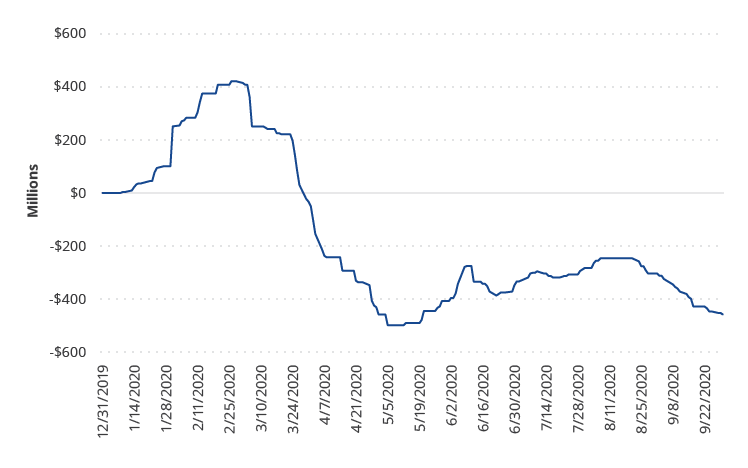

Demand for the riskier segments of the municipal bond market faded in September. Demand for high yield municipal bonds was strong leading up to the pandemic and then fell sharply from February to April. Thereafter, demand ticked up from May through August, but fell, once again, in September. Below is a chart of the asset flows for the VanEck Vectors High Yield Muni ETF (BATS:HYD). HYD is not only the largest high yield muni ETF, according to data from Morningstar, but also a large holding within MAAX. Using this ETF as a proxy for demand in the overall high yield municipal bond market illustrates both the demand for high yield this year and the current climate of risk aversion.

HYD Cumulative Fund Flow

Source: Bloomberg

Although, overall, there was a pessimistic tone in the markets last month, MAAX, with a flat return, held up well. Its best-performing positions were in short-term high yield and long-duration investment grade. The VanEck Vectors Short High Yield ETF (BATS:SHYD) share price returned +0.27% and the VanEck Vectors Long Muni ETF (BATS:MLN) share price returned +0.12%. Conversely, its bottom-performing positions were in high yield and intermediate-term investment grade. HYD share price returned -0.28% and the VanEck Vectors Intermediate Muni ETF (BATS:ITM) share price returned -0.13%.

MAAX will continue to seek to balance both the risks and rewards of the asset class. It maintains a 35% allocation to high yield, a 35% allocation to investment grade long duration and a 30% allocation to intermediate-term investment grade. We believe that this allocation should allow MAAX to continue to benefit from attractive after-tax yields relative to what other asset classes are offering.

The next section highlights the risk factors that led to this positioning.

| 1 Mo† | YTD† | 1 Year | Life | |

| (05/15/19) | ||||

| MAAX (NAV) | -0.24 | -2.45 | -2.08 | 0.69 |

| MAAX (Share Price) | -0.08 | -2.35 | -1.93 | 0.83 |

| Bloomberg Barclays Municipal Bond Index* | 0.02 | 3.33 | 4.09 | 4.74 |

| 1 Mo† | YTD† | 1 Year | Life | |

| (05/15/19) | ||||

| MAAX (NAV) | -0.24 | -2.45 | -2.08 | 0.69 |

| MAAX (Share Price) | -0.08 | -2.35 | -1.93 | 0.83 |

| Bloomberg Barclays Municipal Bond Index* | 0.02 | 3.33 | 4.09 | 4.74 |

† Returns less than a year are not annualized.

Expenses: Gross 0.38%; Net 0.38%. Van Eck Associates Corporation (the "Adviser") will pay all expenses of the Fund, except for the fee payment under the investment management agreement, acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses. Expenses are based on estimated amounts for the current fiscal year. Cap excludes acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses.

The table presents past performance which is no guarantee of future results and which may be lower or higher than current performance. Returns reflect temporary contractual fee waivers and/or expense reimbursements. Had the ETF incurred all expenses and fees, investment returns would have been reduced. Investment returns and ETF share values will fluctuate so that investors' shares, when redeemed, may be worth more or less than their original cost.

* Bloomberg Barclays Municipal Bond Index is considered representative of the broad market for investment grade, tax-exempt municipal bonds with a maturity of at least one year.

Muni Risk Factors

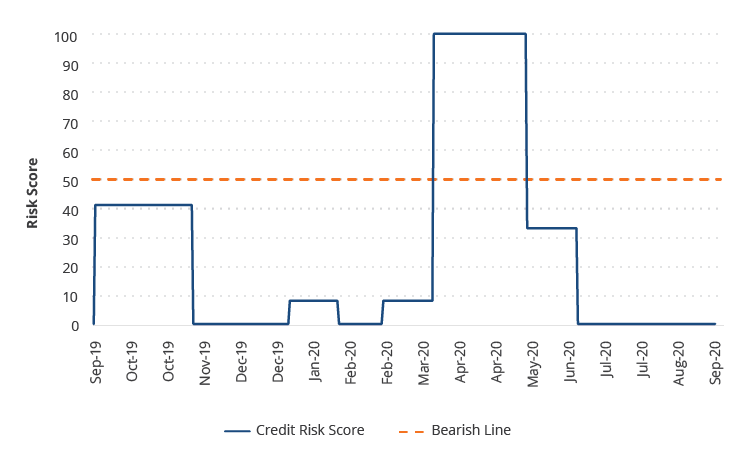

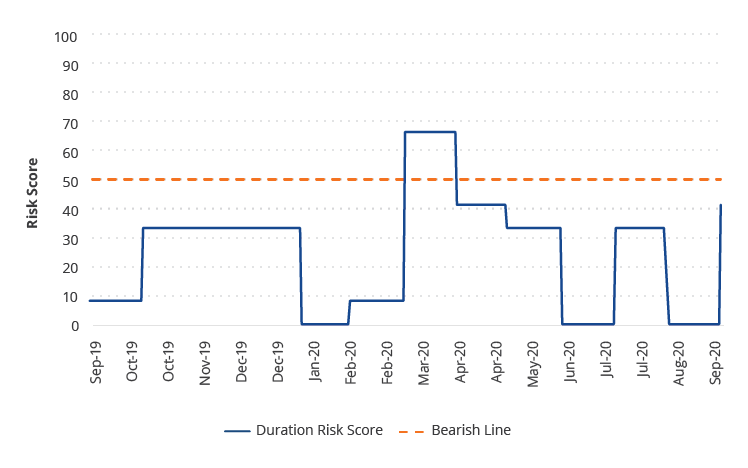

The model that determines the allocations for MAAX considers this to be a stable risk regime as it relates to the two key risks taken by municipal bond investors: credit and duration. It measures risk via price levels, volatility and historical relationships. Risk is scored from 0 to 100. A score of 50 or lower implies that risk is low and a score of 50 or higher implies that risk is high.

The risk score for credit remains 0. This gives us confidence in the near-term stability of the credit markets.

Credit Total Risk Score

The risk score for duration, at 41, is elevated, but not yet at the critical level of 50 that is required to adjust the allocation to municipal ETFs with longer durations.

Duration Total Risk Score

The reasons for the elevated risk score are: (1) long duration bonds are underperforming short-duration bonds over the medium term; and (2) there is a near-term spike in the correlations between bond yields and stocks. Both of these are warning signs that longer duration bonds may be challenged in the near-term.

We will continue to monitor the risk signals, particularly the duration focused indicators, and adjust the allocations next month if needed. However, in the meantime, based on the evidence from our indicators, we believe that municipal bonds are priced attractively and that MAAX is well-positioned to take advantage of the opportunity.

Important Disclosures

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

An investment in the Funds may be subject to risks which include, fund of funds risk, high portfolio turnover, model and data risks, management, operational, authorized participant concentration and absence of prior active market risks, trading issues, market, fund shares trading, premium/discount and liquidity of fund shares and non-diversified risks. The funds may be subject to following risks as a result of investing in Exchange Traded Products including municipal securities, credit, high yield securities, tax, interest rate, call, state concentration and sector concentration risks. Municipal bonds may be less liquid than taxable bonds. There is no guarantee that a Funds' income will be exempt from federal, state or local income taxes, and changes in those tax rates or in alternative minimum tax (AMT) rates or in the tax treatment of municipal bonds may make them less attractive as investments and cause them to lose value. Capital gains, if any, are subject to capital gains tax. A portion of the dividends you receive may be subject to AMT. For a more complete description of these and other risks, please refer to each Fund's prospectus.

Bloomberg Barclays Municipal Bond Index is considered representative of the broad market for investment grade, tax-exempt municipal bonds with a maturity of at least one year.

The VanEck Vectors ETFs are not sponsored by, endorsed, sold or promoted by Bloomberg or Barclays and neither Bloomberg nor Barclays makes any representation regarding the advisability of investing in them. The only relationship to the Adviser with respect to the VanEck Vectors ETFs is the licensing of certain trademarks and trade names of Bloomberg and Barclays and the BLOOMBERG BARCLAYS INDICES that are determined, composed and calculated by Bloomberg without regard to the Adviser or any investor in the VanEck Vectors ETFs.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.