VGT: How The Vanguard IT ETF Compares To The QQQ And IGV

The Vanguard IT ETF (VGT) is up 23% YTD and 38% over the past year. It has been driven by a COVID-19 impacted market that has been rewarding the large-cap tech stocks for demonstrating excellent top- and bottom-line growth. This article will compare VGT with two leading technology ETFs and attempt to answer the most relevant question: has "big tech" come too far too fast and will there be a significant rotation out of technology and into the the more cyclical sectors, like industrials and/or materials?

Top-10 Holdings Comparison

The chart below compares the top-10 holdings of VGT with that of the Invesco QQQ ETF (QQQ), basically a proxy for the NASDAQ-100, and the iShares Expanded-Tech Software ETF (IGV):

TOP-10 HOLDINGS:

| VGT | QQQ | IGV |

| Apple - 23.2% | Apple - 13.22% | Adobe - 8.41% |

| Microsoft - 16.8% | Microsoft - 10.85% | Microsoft - 8.31% |

| Visa - 3.5% | Amazon - 10.84% | Salesforce - 8.23% |

| Nvidia - 3.4% | FaceBook - 4.24% | Oracle- 6.91% |

| Mastercard - 3.3% | Tesla - 3.49% | ServiceNow - 5.33% |

| Adobe - 2.6% | GooGL - 3.48% | Zoom Video - 5.29% |

| Salesforce - 2.5% | GooG - 3.38% | Intuit - 4.90% |

| PayPal - 2.4% | Nvidia - 2.75% | Activision-Blizzard - 3.76% |

| Intel - 2.2% | Adobe - 2.06% | Autodesk - 2.97% |

| Cisco Systems - 1.8% | PayPal - 1.94% | Docusign - 2.30% |

Sources: Vanguard, Invesco, iShares

As can be seen from the list, VGT has a ~40% of its portfolio in just two stocks: Apple (OTC:APPL) and Microsoft (MSFT). That's a big overweight ~16% more in those two stocks as compared to the QQQ. IGV doesn't even own Apple in the top-10. Interestingly enough, VGT not only doesn't have a large position in Amazon, it's not in the top-10 holdings at all. Meanwhile, VGT's top-10 bets in hardware/semiconductors (other than Apple) are with Nvidia (NVDA) Intel (INTC) and Cisco (CSCO), in aggregate only a 7.4% top-10 weighting, while Nvidia (NVDA) is the QQQ's top semiconductor company with a 2.75% weight, that is unless you consider Tesla (TSLA) a "hardware" company. Tesla has a ~3.5% weighting in the QQQ but is not owned in VGT. IGV, as primarily a software oriented Tech fund, has none of these hardware/semiconductors company's and holds companies like Zoom Video (ZM), Intuit (INTU), and Autodesk (ADSK) instead, with its top holding Adobe (ADBE) at 8.4% having a ~3x higher weight as compared to the VGT ETF (2.6%).

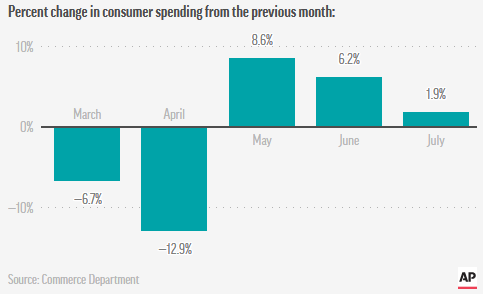

The bottom line: from the top-10 lists, it is clear that an investment in VGT is, for a supposed broad ETF, is an over-weight investment in two stocks: Apple and Microsoft. The other aspect of VGT that strikes me is the abundance of payment processors like Visa (V), Mastercard (MA), and PayPal (PYPL) in the top-10 holdings (an aggregate 9.2% of the ETF). That can be good due to the shift in online shopping, but could go south if the economy continues to sputter due to COVID-19, the high unemployment rate (8.4%), and lower consumer spending - which has started to decelerate:

Source: AP News

Other Important Metrics:

| VGT | QQQ | IGV | |

| Top-10 Holdings % | 61.7% | 56.3% | 56.4% |

| Total Number of Holdings | 328 | 103 | 100 |

| P/E Ratio | 36.4x | 47.0x | 44.6x |

| P/B Ratio | 9.3x | 12.58x | 10.99x |

| Yield | 0.78% | 0.74% | 0.38% |

| Expense Ratio | 0.10% | 0.20% | 0.46% |

Sources: Vanguard, Invesco, iShares

As can be seen in the table above all three ETF hold from ~55-60% of the total portfolio in their top-10 companies, so an investor needs to be comfortable with those top-10 picks. What's interesting to me is that VGT has 328 companies in the portfolio, more than 3x the number of both the QQQ and IGV, yet its expense ratio - at 0.10% - is still considerably lower.

Also, it is clear that VGT is the least expensive of the three funds with P/E an Price-to-Book ratios considerably less than either QQQ or IGV. The yields are roughly equivalent and quite inconsequential when dealing with the current valuations levels of the companies held in these funds.

Performance

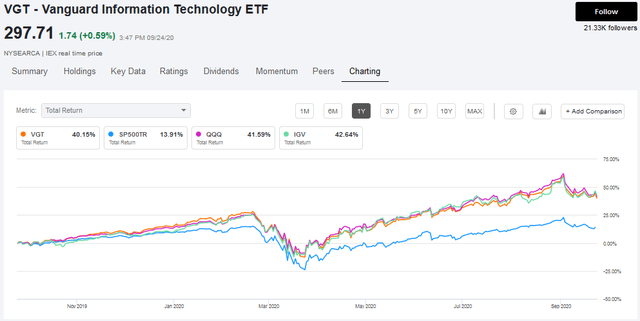

Surprisingly enough, over the past 12-months the performance of these three funds, despite their different portfolio compositions, are remarkably equivalent, with IGV having a slim ~2.5% advantage over VGT:

Source: Seeking Alpha Charting Tool

Source: Seeking Alpha Charting Tool

Going Forward

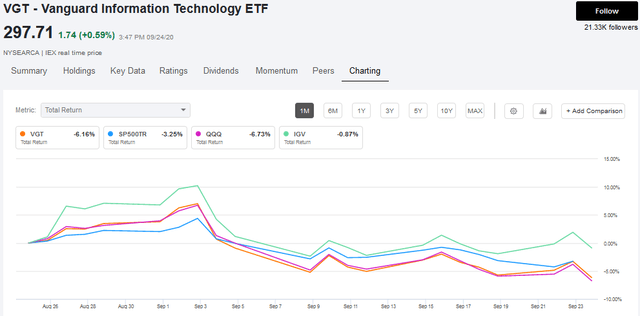

Most investors are aware of the "high-flying" tech sector and the apparent consensus that there needs to be a "correction" to bring them back down to Earth. Indeed, since the beginning of September, we have seen a pullback in the tech sector and it has hit these funds, but the pullback has been fairly mild despite all the headlines:

Source: Seeking Alpha Charting Tool

Source: Seeking Alpha Charting Tool

Surprisingly enough, IGV - the more software oriented and arguably more over-priced fund (in terms of P/E and P/B, see above) as compared to VGT has actually held up ~5% better over the past month.

Where we go from here is anyone's guess. With all the uncertainty - from the upcoming election, the US/China trade war, and COVID-19 to the overall economy and stimulus bills (or lack of them), anyone who tries to predict what the market is going to do and where it will be a year from now, well, they simply don't know, just like no one knew during the March sell-off there would be a massive rotation into the fastest growing and already most highly valued big-tech companies, pushing them to even higher levels.

One thing we do know about the VGT ETF as compared to QQQ and IGV is that from a P/E and P/B consideration, it is less expensive. That said, with an average P/E=36.4x, it is still considerably more expensive than the S&P500 (P/E=27.9x), and more than twice as expensive from a price-to-book perspective (9.3x versus the S&P500's P/B=3.95x).

The Tug-of-War

Yet with the 10-year Treasury yield still in the neighborhood of 0.67%, and given Federal Reserve Chairman Powell's recent statements that the Fed plans to keep interest rates near zero until 2020, investors are still searching for the best way to play this extremely low-rate environment. Bonds obviously don't give decent returns, money market funds and many CDs give a negative real interest rate of return after inflation, while the stocks of traditional income plays like energy and financials are getting hammered.

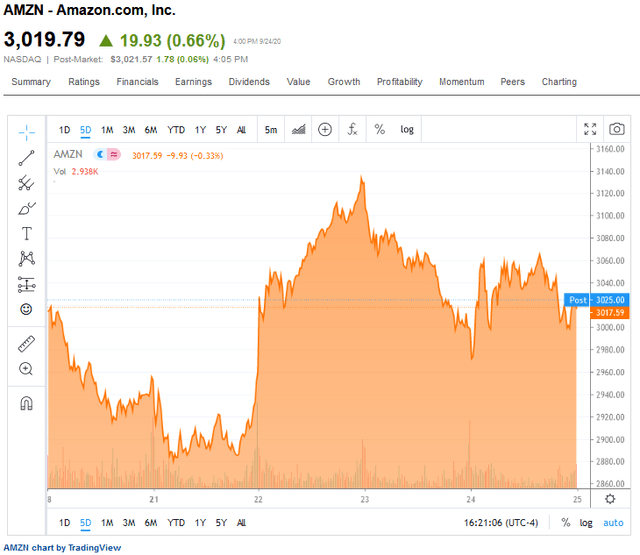

As the tug-of-war continues, the market has been quite volatile from day-to-day, and appears to be trying to figure out if the high-flying growth stocks are worth their valuation given the current environment. Amazon (AMZN) is a case in point - trading in a near $300 point range just over the last few days:

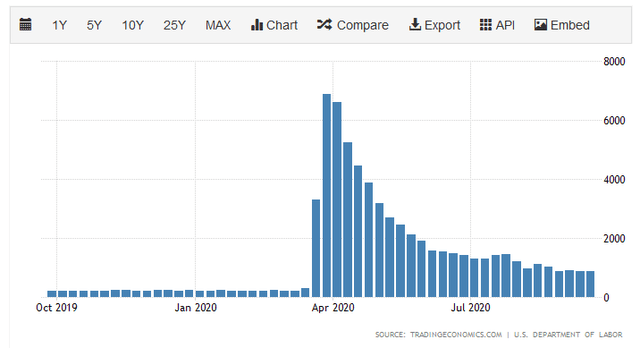

However, big-tech has been able to deliver excellent revenue and earnings growth this year despite the large increase in the unemployed and initial jobless claims, which have remained at elevated levels:

Source: Trading Economics

Source: Trading Economics

Indeed, more Americans applied for state unemployment benefits last week as compared to the week before.

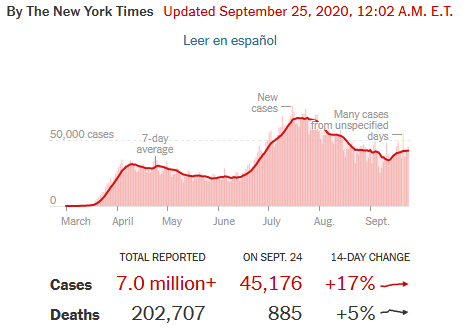

Meantime, the new COVID-19 case count remains stubbornly high at over 45,000/day and apparently the curve is beginning to rise as we head into the seasonal flu and holiday season when many college students will be returning home:

Source: NY Times

Source: NY Times

As a result of the COVID-19 mipact on the economy, more than 26 million Americans are still on some form of unemployment insurance. The bottom line: it may be too early to rotate out of the fast growing big-tech and software stocks. It that is the case, VGT could have further room to the upside, especially if big-tech can demonstrate the same kind of revenue and earnings growth in the upcoming Q3 reports as they did in Q2.

Summary & Conclusion

I can't predict where the market is going to go over the next month, 6-months, or year and I won't even try. What we do know is that from a valuation perspective, the VGT ETF is less expensive than the QQQ and IGV. We also know the expense ratio is lower. One thing is also clear: buying VGT means being comfortable investing ~50% of your money into Apple, Microsoft, and payment processing companies Visa, Mastercard, and PayPal.

My best advice for investors looking to start a position or expand a position in VGT (or QQQ or IGV) is this: average in. Take some time on a weekly or monthly basis and slowly average in, saving up the majority of your allocation for the fund (or funds) so that you can take advantage of any precipice market drop. After all, with the tremendous amount of uncertainty facing the investor these days - the upcoming election, the US/China trade war, COVID-19, the still weak economic backdrop and stimulus bills (or lack of them) - odds appear to be good that investors may have a better buying opportunity before the end of the year.

Disclosure: I am/we are long QQQ IGV AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.