VanEck Vectors Video Gaming And eSports ETF: Riding The Evolution Growth With This ETF

If a business does well, the stock eventually follows.

- Warren Buffett

The VanEck Vectors Video Gaming and eSports ETF (ESPO) focuses on tracking a rules-based, modified, capitalization-weighted, float-adjusted index of fewer than 30 companies. All companies are involved in video gaming and eSports (also known as electronic sports) software, hardware, and development, including casinos and online betting. These companies must have at least half of their revenue from those businesses. This ETF is part of VanEck's suite of niche and thematic funds.

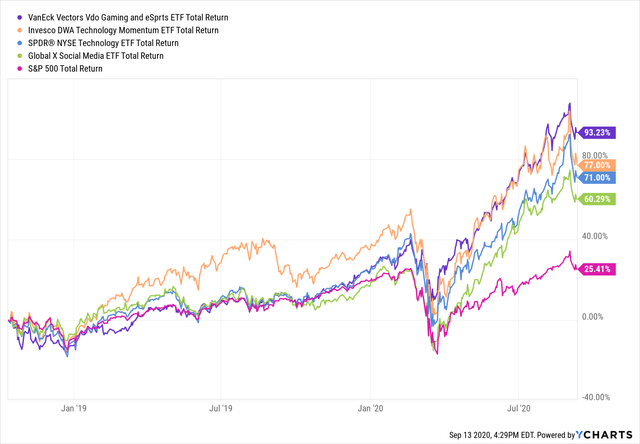

This ETF has increased by 55.28% year to date, as it has benefited mainly by the video games sales surge owing, in part, to the coronavirus pandemic. On a 3x-year basis, it has increased by 93.23%. It is much higher than S&P 500's performance of 25.41% and has beaten many of its peers.

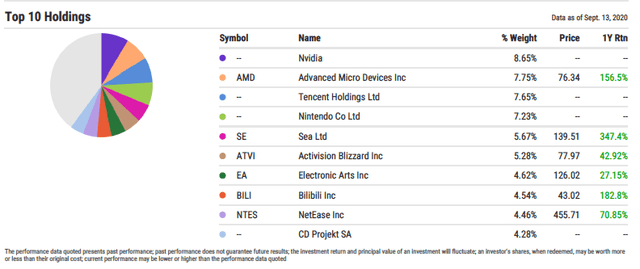

Top 10 holdings account for 60.13% of the portfolio, dominated by Nvidia (NVDA), Advanced Micro Devices (AMD), Tencent (TCEHY), Nintendo (NTDOY), and Sea Limited (SE).

U.S. equities account for 34.29% of the portfolio, followed by Japan (22.79%), China (18.47%), and South Korea (15.05%). Sector-wise, it has a strong focus on Communication Services (83.6%) and Technology (11.7%). ESPO has an evident focus on the video gaming and eSports industries; thus, it's a great addition to an investor's portfolio if the investor wants to bet on it. It charges a management fee of 55 basis points, which is pricey for passive funds but in line with other excellent products.

Strong growth potential in both video game and eSports

Semiconductor manufacturers and video game publishers are driving ESPO's hyper run, but let's not forget about the eSports part of the equation and the enormous potential growth.

VanEck mentioned in a recent note, "News of sold-out stadiums, multi-million dollar franchise fees for professional teams and big-brand sponsorship deals have driven the eSports mania narrative. However, comparing eSports revenues to the broader video game industry can help keep things in perspective. According to Newzoo, out of the $159 billion in revenue that the global video gaming industry is expected to generate in 2020, roughly $1.1 billion will be generated by eSports. In other words, the global video gaming industry should generate around 144 times the revenue of the global eSports industry in 2020."

Over the years, eSports has proven itself to be a growing industry. The coronavirus pandemic has particularly highlighted the increasing synergies between eSports leagues and software publishers. Growth in eSports betting and media revenue are two additional, long-term catalysts for ESPO.

"Publishers own the rights to the games played in the competition, as well as the broadcasting rights, which are sold to media and communication services companies (like Twitch and Facebook)," said VanEck. "According to Goldman Sachs, media rights are expected to grow from representing around 20% of all eSports revenues to 40% by 2022. This means that, after factoring in other revenue sources like sponsorship and game publisher fees, video game publishers are in a position to own the majority of revenues coming from eSports potentially."

eSports makes audiences aware of the increased amount of video game engagement across various streaming services, gaming platforms, and now eSports. It is particularly notable during the pandemic, given how traditional sports have all been canceled. Many athletes, as well as consumers, have transferred over to eSports as a result of it.

It's easy to conflate video game publishers and eSports operators, but the truth is that these segments are intersecting, and it brings enormous opportunities for investors.

"Over the past few years, video game publishers have invested millions of dollars in developing, launching, and running professional eSports leagues," according to VanEck. "Previously, eSports leagues were run by independent third parties separate from the publishers who make the games. We believe this development result is that video game publishers are now primed to gain the most from the eSports phenomenon."

ESPO presents excellent opportunities for ETF investors because the publicly traded pure-play eSports universe is still small, and many of the stocks that have that status don't yet qualify for entry to ETF benchmarks

*Like this article? Don't forget to hit the "Follow" button above!

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.