VanEck Vectors Preferred Securities Ex Financials ETF: A Safe Bet With A Solid Return

"In the short run, the market is a voting machine, but in the long run it is a weighing machine." – Benjamin Graham

The VanEck Vectors Preferred Securities ex Financials ETF (PFXF) is an exchange-traded fund that invests in preferred shares from companies exclusively in the United States. It seeks to invest in companies of all sectors excluding the financial sector. The fund looks to replicate the performance of the Wells Fargo Hybrid and Preferred Securities ex Financials Index, and in this regard, it look to invest at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The Wells Fargo Hybrid and Preferred Securities ex Financials Index is designed to track the performance of convertible or exchangeable and non-convertible preferred securities that are listed on the US national securities exchanges. These securities, however, exclude securities issued by financial services companies and banks. The index is composed of preferred stock and securities that are functionally equivalent to preferred stock, including convertible securities, depository preferred securities and perpetual subordinated debt. Given their risk-return profile, they are below the riskier stock of the company with higher dividends, but above the equivalent bond offering.

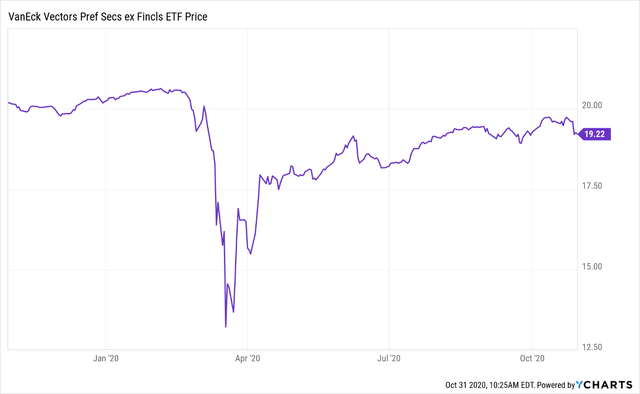

The price of PFXF started to decline in the beginning of March 2020, bottoming out in the middle of the month at below $14, before increasing – much like the overall markets. However, at $19.22 as of Friday, October 30, it has still not recovered to its pre-pandemic level of above $20.

The COVID-19 pandemic caused a collapse in demand for corporate bonds and preferreds as investors fled for the safe havens of cash, gold and more conservative fixed income holdings. This was surprising, especially for the ETF's investment-grade holdings as compared to the general high-yield circulating in the market which are far more riskier, less liquid and are more likely to default when the economic outlook deteriorates.

Given the importance of the corporate preferred share and bond markets as a source of financing for businesses, the unprecedented crisis saw the Federal Reserve step in with an aggressive bond buying program to sure up the fixed income side, which led to an increase in corporate bond prices and to “real” yields on corporate bonds declining into negative territory for the first time in the history of bond markets. This also helped the preferred share sector as it seemingly shored up businesses that may have gone under instead.

The coronavirus pandemic has resulted in the fund underperforming compared to the S&P 500's total return. Not only did the fund exhibit a greater decrease in total return than the S&P 500 when the crisis started in March, but subsequently it has also failed to match the S&P 500 performance during the year, providing a total return of just 0.89% compared to the S&P 500's more impressive total return of 9.40%.

Holdings Breakdown

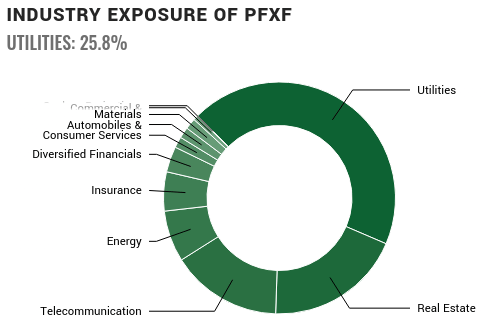

Given the mandate to hold preferred shares, the fund is currently holding 99.8% in preferred shares and 0.2% in cash according to their website. However, analyzing the industry exposure of the fund provides a more in-depth picture. With two thirds of its exposure to the utilities and real estate sector, both of which are renowned for stable business models and reliable and predictable cash flows, the holdings would appear to have some stability during economic downturns. This is especially true with more people working from home, i.e., continuing to pay rent as usual and using household utilities more than usual. This is a boon for the fund as it has helped shield from the worst of the declines in the corporate bond markets.

It has also fared substantially better in comparison to the many traditional preferred ETFs that allocate substantial portions of their roster to preferred securities issued by the financial services and banking sectors, which are seeing net interest margins depressed by the Federal Reserve's assault on interest rates.

This makes the fund especially attractive to investors who want to tap into the income benefits of this asset class while avoiding bank issued preferred securities, being the only fund not tied up in the preferred securities of the banking sector.

The fund's exclusionary strategy has also seen other benefits in particular. For one, excluding financial issuers also increases the proportion of preferred securities paying cumulative distributions and lowers the proportion featuring near-term call dates relative to the broader preferred securities market. This investment strategy is particularly important in today’s environment, where there is the risk of dividend suspensions and higher incentive for issuers of preferred securities to call and then reissue preferred securities with lower rates. Thus, with the fund having a relatively aggressive dividend yield of 5.6%, the strategy just goes to underscore its allure in the current economic climate.

Risks

Even though high-yield preferred shares are subject to greater risk of loss of income and principal than high-rated securities, the crisis caused by the coronavirus pandemic has shown that strong corporate preferreds are not immune from the volatility of investor sentiments. And once the herd starts to stampede, even the fixed income-like security prices of highly rated corporate preferred shares can sink. Had it not been for the unprecedented intervention by the Federal Reserve in the form of its bond buying program, prices may not have hit their floor or recovered as soon as they did.

On the flip side, where the aggressive rate at which the Federal Reserve has cut interest rates has immediately affected the incomes and yields of the financial services and banking sectors, the crisis is far from being done and over with. In the foreseeable future, it remains to be seen whether the rest of the sectors of the economy will long remain insulated from its effects.

Investor Takeaways

The fund's exclusionary strategy has paid off well during the year. It has seen off some major risks to its returns by excluding preferred shares from the financial services and banking sectors while also excluding holdings with near-term call dates. This has allowed the fund to produce price stability and aggressive dividend yields for investors. If you're looking for a way to dip into the market with a higher yield and risk profile in between the cautious bond holdings and risky stock holdings, PFXF fits the bill as a diversified play in the preferred share sector.

*Like this article? Don't forget to click the Follow button above!

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.