VanEck Vectors Low Carbon Energy ETF: Pricing In A Reallocation Of Capital To Clean Energy

In a letter to CEOs in January, Blackrock (BLK) CEO Larry Fink wrote, "Climate risk is investment risk." He also observed, “In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

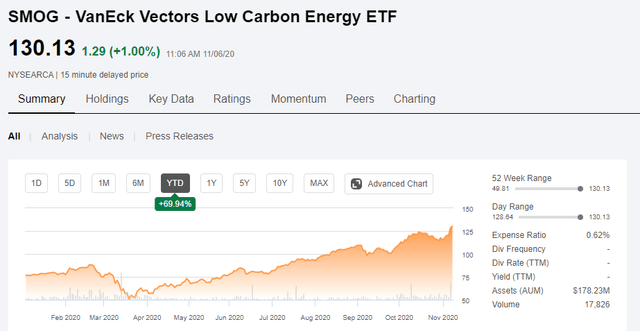

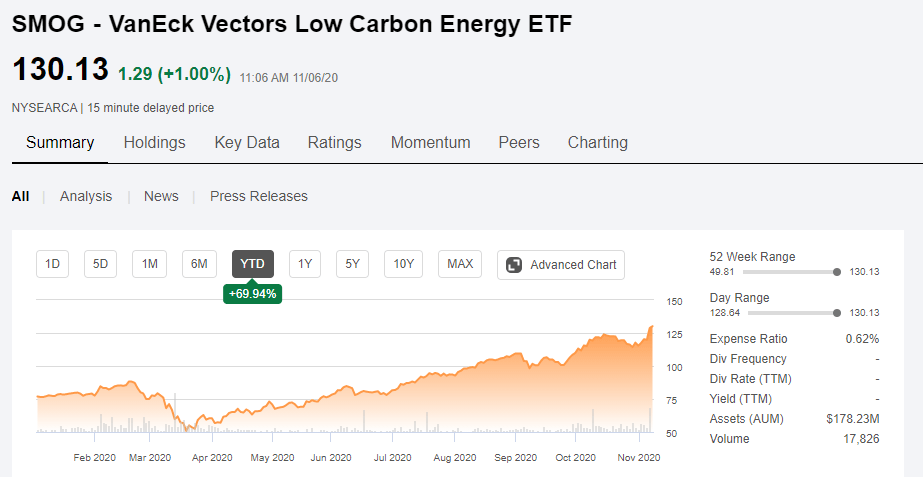

The price movement in the VanEck Vectors Low Carbon Energy ETF (SMOG) reflects some of that reallocation in my view. In the year to date, it has risen nearly 70%.

Fund Summary

The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ardour Global IndexSM (Extra Liquid). The fund normally invests at least 80% of its total assets in stocks of low carbon energy companies. Such companies may include small- and medium-capitalization companies and foreign issuers. Low carbon energy companies refers to companies primarily engaged in alternative energy, including renewable energy, alternative fuels and related enabling technologies (such as advanced batteries). It is non diversified.” - Yahoo Finance

Ardour Global Alternative Energy Extra-Liquid Index (AGIXL)

AGIXL is a product of S-Network Global Indexes, Inc. According to its website,

S-Network is a leader in socially responsible investment, publishing best-practice benchmark indexes in collaboration with Refinitiv. S-Network published the first global alternative energy and water indexes, which today serve as the recognized benchmarks for those sectors worldwide. In addition to publishing socially responsible indexes, S-Network produces proprietary environmental, social and governance ratings on nearly 8,500 public companies worldwide.”

AGIXL is a capitalization-weighted, float-adjusted index of the most prominent alternative energy stocks in the world. To be included in the index, companies must be pure-play and their stocks must pass multiple screens, including those for capitalization, float, exchange listing, share price and turnover.”

Ardour Global Alternative Energy Indexes depend on:

“A clearly defined rules-based methodology, which is overseen by an impartial Index Committee. Little discretion is exercised in compiling the Indexes and a pre-defined screening protocol assures a consistent, transparent and arms-length compilation process.”

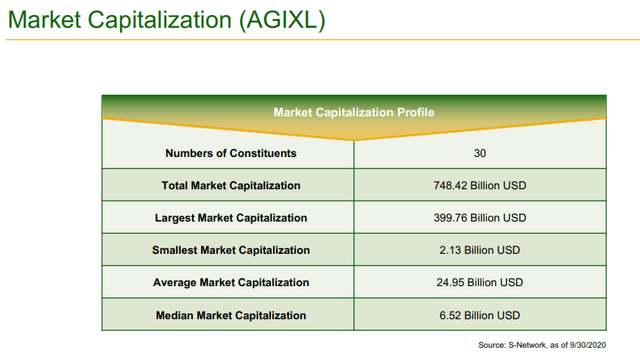

The index has 30 constituents which have capitalizations as listed below:

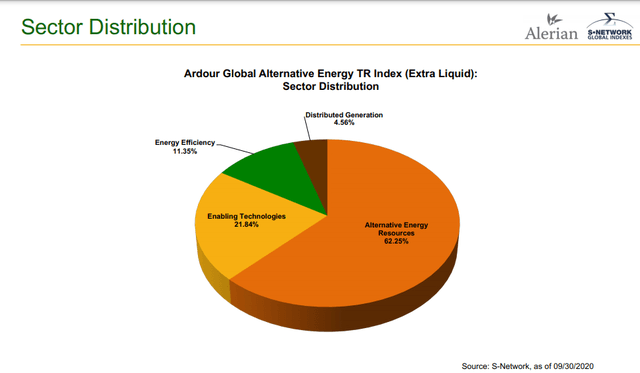

The largest sector is alternative energy resources. The sector distribution is depicted below:

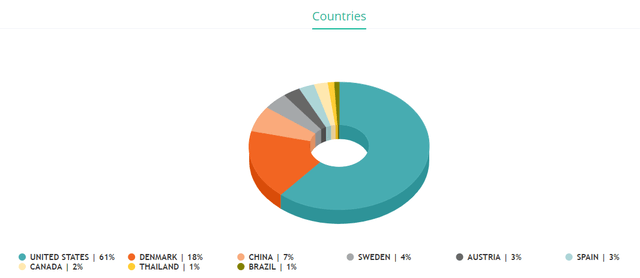

The index is global, though about 61% of the constituents are U.S. based. Below is the geographical distribution:

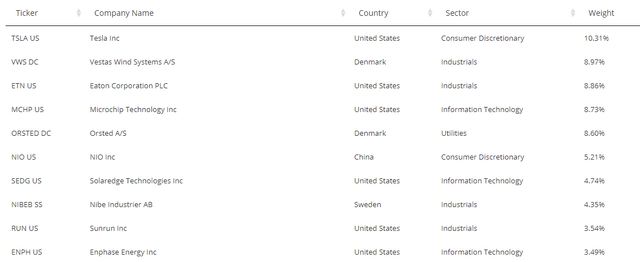

The top 10 components of the index are listed below:

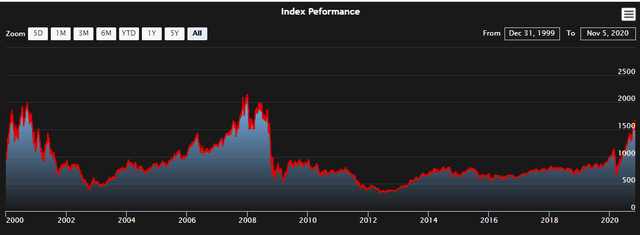

The graph below shows the performance of the index since inception in 1999:

SMOG

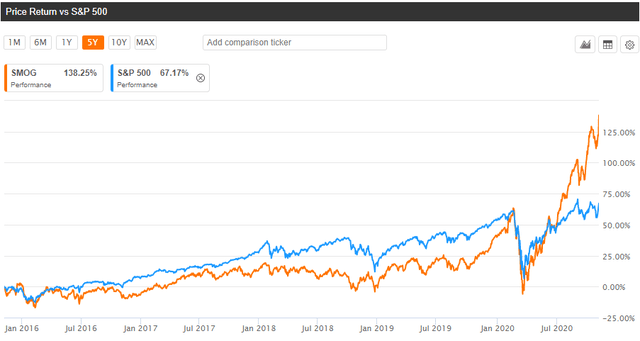

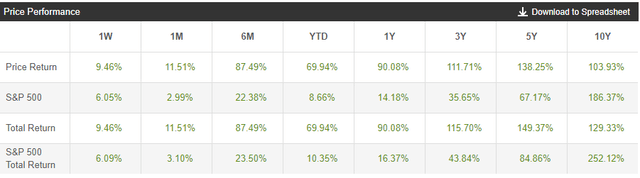

Over the past five years, an investment in SMOG returned 138% as compared to 67% in the S&P 500.

In the year-to-date, SMOG is up 70% vs. 9% for the S&P 500.

SMOG has about $179 million of assets under management and has an expense ratio of 0.62%, which is somewhat high.

The U.S. presidential election may have lent recent support to the names in the fund. If Biden wins, which now seems likely as of this writing, investors or traders may decide to “sell the news” to take recent profits.

Conclusions

For those who agree with Larry Fink’s view about a reallocation of capital due to climate reasons, SMOG appears to be an ideal-type investment. On the downside, the fund already has appreciated significantly this year, and there may be a near-term downturn if Biden is elected. But as a longer-term investment, the fund is invested in a theme that's likely to attract investors for years to come.

To guide investors who are interested in profiting from outstanding opportunities in the energy sector, I provide a service on Seeking Alpha’s Marketplace oriented toward individual investors, Boslego Risk Services. A long/short Model portfolio is continuously updated, along with on-going analysis of the oil market.

I am now accepting new members to Boslego Risk Services and invite you to sign-up. There are monthly and annual pricing options as described here. You may also read reviews posted by members here.

Disclosure: I am/we are long SMOG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.