UGA: Bullish, Demand Exceeds Supply

My judgment is based on looking at publicly available supply and demand reports (EIA).

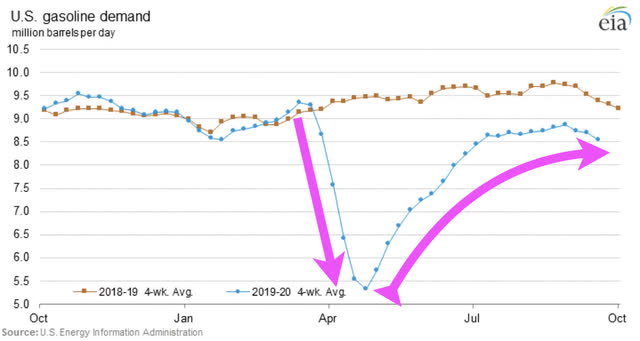

- Those reports indicated that COVID lockdowns crashed demand by ~4 million barrels per day (mb/d). Beginning in mid-April, gasoline demand has recovered to about 1 mb/d below pre-COVID.

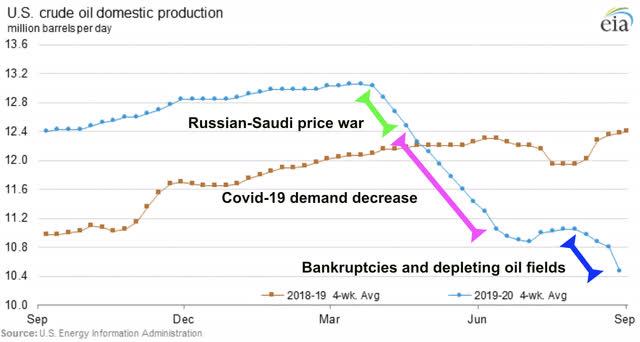

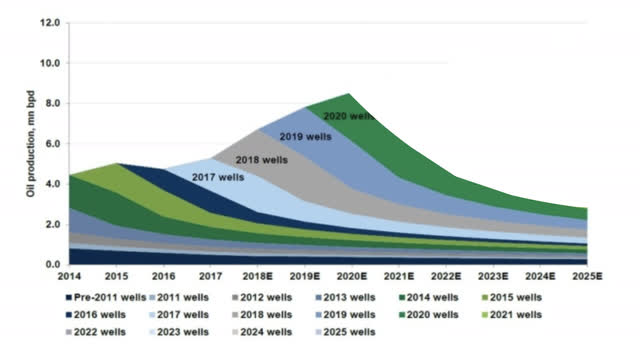

- In response to the Russian-Saudi price war, COVID demand decreases, and financial issues, oil production has decreased by ~2.5 mb/d. With the Rig Count cut by 75% over the past year, to 261, it is unlikely oil supply will ever return to pre-COVID 13 mb/d.

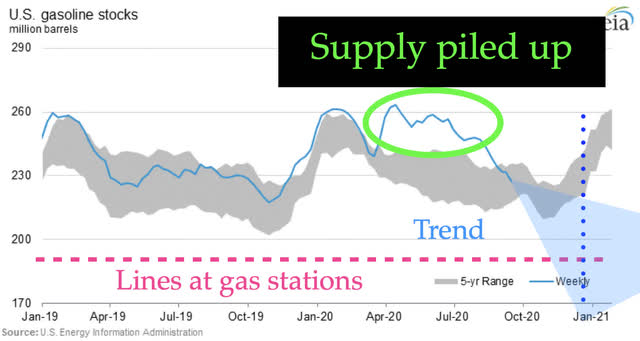

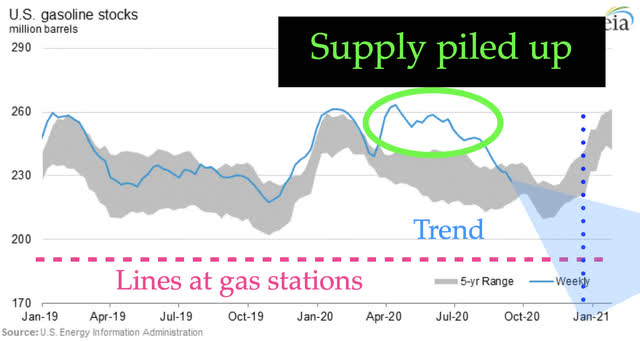

- About 100 million barrels of oil and 20 million barrels (graphic below) of gasoline inventories piled up during the COVID shutdowns. It appears that current demand is being satisfied by burning this inventory. Trends indicate gasoline inventories will drop below the 5-year averages and below the 190 million barrels of inventory where gas shortages occur.

- It seems highly likely that between Dec 2020 and June 2021, gasoline prices must rise high enough to cut demand by 1 mb/d. And, continue to rise to suppress demand as existing fields deplete at 27% per year.

Disclosure: I am/we are long UGA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.