The iShares U.S. Medical Devices ETF: Medical Devices Look A Little Risky During A Pandemic

Introduction

The iShares U.S. Medical Devices ETF (NYSEARCA:IHI) is a market-cap-weighted ETF that tracks an index of medical device manufacturers and medical devices in the US. The ETF charges a fee of 0.42% and has a little under $8 billion in assets under management. The fund has about 50 total holdings and is heavily weighted in the top 10.

Source: Unsplash

Portfolio Construction and Holdings

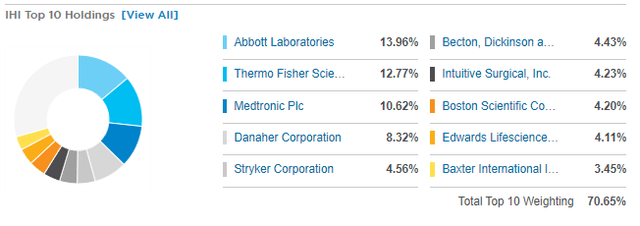

As for individual holdings, the fund holds over 70% of its assets in the top 10 companies. This is definitely very concentrated, even for just a 50 holding fund.

The top holding, Abbott Laboratories (ABT) makes up nearly 14% of the fund overall. Thermo Fisher Scientific (TMO) is nearly 13% of the fund, while Medtronic (MDT) makes up over 10%. Together, these 3 holdings alone make up almost 40% of the fund. The remaining top 7 holdings account for another one-third of the ETF's holdings.

The high concentration means that the top few holdings will likely be where the returns are generated for fund shareholders, and some of the smaller holdings will likely have very little impact. Thus, investors in IHI should be very comfortable holding most, if not all, of the top holdings in this fund.

Source: IHI Fund Home Page

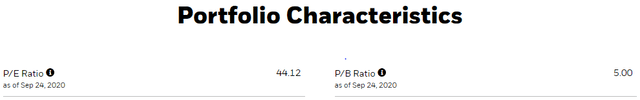

When looking at the ETF from a multiples basis, it certainly isn't cheap at 44 times earnings and 5 times book. In fact, this is quite a bit higher than many technology ETFs out there right now. However, I suspect many of the holdings in IHI will see earnings bounce back after the pandemic, and P/E ratios could be somewhat high due to depressed earnings in a pandemic environment.

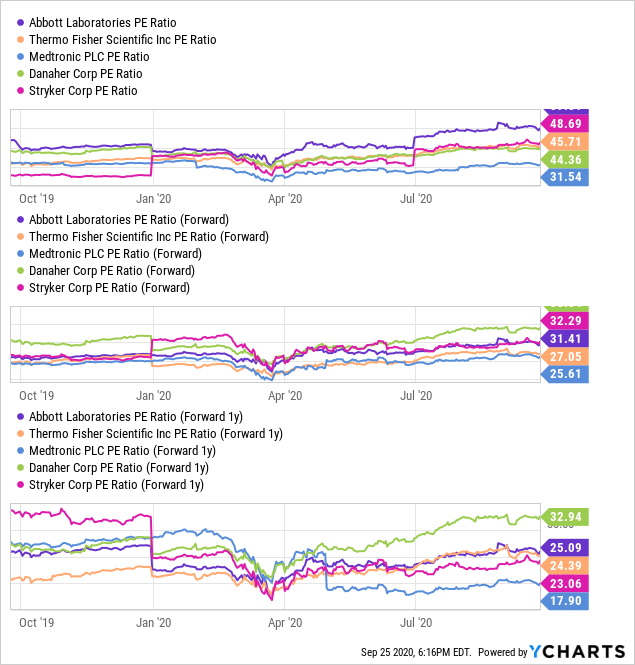

Data by YCharts

Data by YChartsThis argument for current valuations at slightly higher levels is backed up by the valuations on a 1-year forward basis. The P/E ratios of these top 5 companies drop from the high-20s and mid-30s on a current or trailing P/E basis to mostly mid-20s on a 1-year forward P/E basis. Medtronic's 1-year forward P/E is even lower at under 18, suggesting that analysts expect EPS numbers to improve over the next year or so.

Clearly, this brings up the key risk that the pandemic continues into next year, leading some of these companies vulnerable to having EPS estimates cut again. This would likely result in mediocre returns at best and possibly even negative returns for shareholders as these companies see their valuations compress. On the other hand, if the pandemic gets under control and people can return to a more normal state, these companies should be able to recover relatively quickly as medical devices will remain in demand. In fact, pent-up demand may even provide a short-term boost for some of these companies as medical procedures come back online.

Tolerable Performance

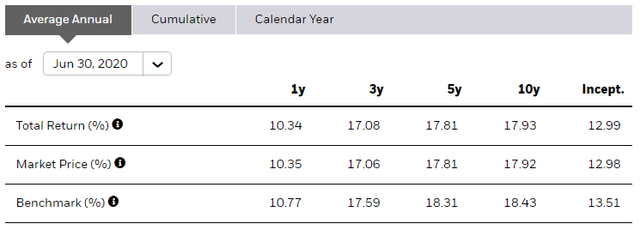

IHI tracks the Dow Jones US Select Medical Equipment Index. IHI has slightly trailed the index on most timeframes, including since inception where the ETF has returned 12.98% annually (using market price) compared to 13.51% for the benchmark.

Source: IHI Fund Home Page

While it has trailed the benchmark by about half a percent per year, the ETF has still provided impressive returns over time. An ETF trailing the index by half a percent is not all that uncommon. I would describe this as acceptable.

Conclusion

IHI is a solid way to get exposure to some medical device companies but is heavily concentrated in the top few holdings. This may mean that investors could be better off selecting the companies they want to hold out of IHI's holdings instead of buying the whole ETF. Furthermore, a key risk to this ETF right now is the COVID-19 pandemic. Some of these medical device companies have seen their product sales slow as medical procedures like surgeries are slowed, delayed, or even outright canceled during the pandemic. The companies IHI holds appear to be relying on next year's forecasted EPS numbers to justify their current valuations, which seem to assume a return to solid growth in EPS. This presents a major risk if the pandemic continues well into the next year, and these companies begin to miss estimated EPS numbers. This makes me neutral on the ETF, and I think playing a wait and see game could serve investors well with this ETF for now.

I'll be writing more articles on great (or sometimes not so great) stocks and ETFs. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. Also, consider checking out the links to my social media pages on my Seeking Alpha profile.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.