SPDR Dow Jones ETF: Diversifying Across '2 Stock Markets'

Following the March to August rally and the early signs of a correction in September, many investors must be wondering: which way is the stock market heading? The question is nearly impossible to answer with certainty, since none of us can accurately and reliably predict the future. But even taking a swing at addressing it requires a better definition of "the stock market."

Take the Nasdaq 100 (QQQ) and the Dow Jones Industrial Average (DIA). Historically, their returns have been tightly correlated at a ratio of nearly 0.8 (one means perfect positive correlation, and zero means no correlation). Even their risk-adjusted returns have been nearly identical, with both indices having produced the same multi-decade absolute returns until as recently as December 2019. So, in a way, defining the stock market as either the Dow 30 or the Nasdaq 100 has made little difference - until now.

Credit: Global Financial Data

A look under the hood

Traditionally, The Dow Jones index has been known to be rich in "old economy" stocks: industrials, healthcare, financial services. At the same time, the Nasdaq is often confused with the technology and communication services sectors themselves.

The difference in composition between the two indices became more pronounced with Apple's (AAPL) recent 4-to-1 stock split, which took place on August 31. Before then, nearly 13% of the Dow 30 was allocated to the Cupertino-based company's stock, just about as much as the Nasdaq 100 is today. Now, AAPL accounts for only about 3% of the Dow. Also, only 11% of DIA overlaps with QQQ, on a weight-adjusted basis, according to ETF Research Center (see below).

Source: montage with images from ETFRC.com

With such differences between the indices being recently reinforced by the treatment of Apple, DIA and QQQ seem to reflect two very different realities within the stock market. The former is currently more representative of pro-cyclical companies and their less expensive stocks that have yet to thrive in the new COVID-19 environment. The latter largely represents tech and other growth companies, many of which have benefited from the current economic landscape and whose pricey stocks have already climbed way past their peaks.

Time to shift back to DIA

As we move closer to the end of the third quarter, DIA and QQQ are in very unique positions. While both have lost some market value over the past few trading days, QQQ seems to be in a much more fragile position due to its stretched valuations. DIA, on the other hand, begins to look a lot more like the defensive stock ETF that it has traditionally been over the past several years.

For a number of reasons, I believe that now is an ideal time for most stock investors to consider a rebalance out of QQQ and into DIA. Structurally, DIA has become a better diversification tool than it has been up to this point as a result of the recent change in composition mentioned above. And as far as I can tell, diversification is the best way for investors to produce more "bang for their buck" (i.e. return per unit of risk) with little effort.

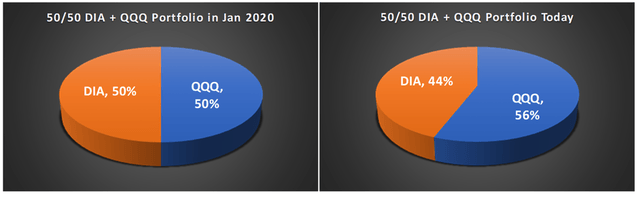

Second, most stock portfolios are likely far from being properly balanced, following such a strong 2020 for tech stocks. For example, a 50/50 investment in DIA and QQQ assembled at the start of the year and not reshuffled since then would now be allocated 56/44 in favor of the tech-rich index. There is no better excuse to lock in some profits and spread out risk better than to rebalance the portfolio back to something closer to 50/50.

Source: D.M. Martins Research, data from Yahoo Finance

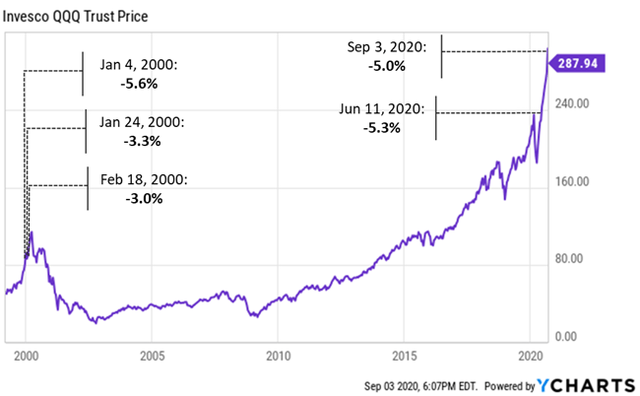

Lastly, I remain concerned that the recent price action in tech stocks may be the first innings of a more pronounced correction in the Nasdaq. Take last Thursday as an example.

The single-day 5% decline off a prior-day peak is a very rare occurrence. In fact, the only other time in history when the Nasdaq corrected by more than 3% off an all-time high was immediately prior to the bursting of the dot-com bubble. This could be a sign of the cracking in the bullish narrative, and that bears who believe the index to be overstretched could take over from here.

Source: chart by YCharts

Final words

I think that long-term growth investors should always be invested in risk assets. But also, knowing what to buy is crucial. Given the recent weakness in QQQ coupled with less exuberant momentum and the low valuations in DIA, I think that a shift back to the latter makes the most sense in the current market environment.

Stocks have been on a choppy ride recently, and the future looks even more uncertain. But all my SRG portfolios have been beating the S&P 500 in 2020 and since inception, while also producing far superior risk-adjusted returns. To find out how I have created a better strategy to growing your money in any economic environment, click here to take advantage of the 14-day free trial today.

Disclosure: I am/we are long AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.