Ruble Will Support The RSX

Source: Goodfon

Instrument

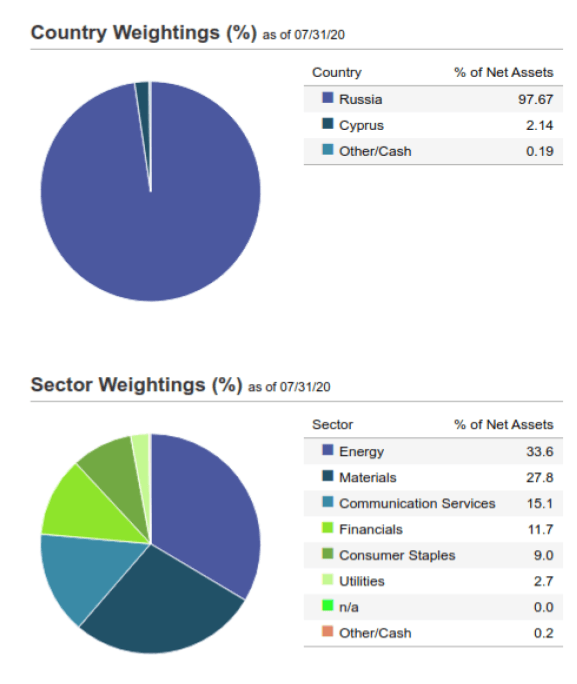

The VanEck Vectors Russia ETF (BATS:RSX) is a fund that offers exposure to equities from Russia, which include publicly-traded companies that are incorporated in Russia or that are incorporated outside of Russia but have at least 50% of their revenues/related assets in Russia.

Source: VanEck

Source: VanEck

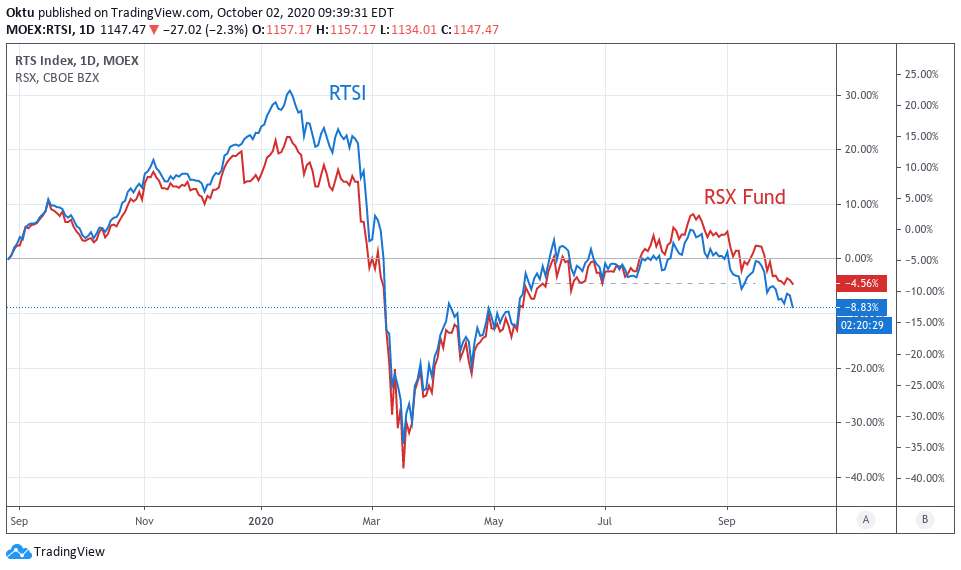

Note: The RTS Index is a free-float capitalization-weighted index of 50 Russian stocks traded on the Moscow Exchange, calculated in US dollars (Wikipedia).

Analysis

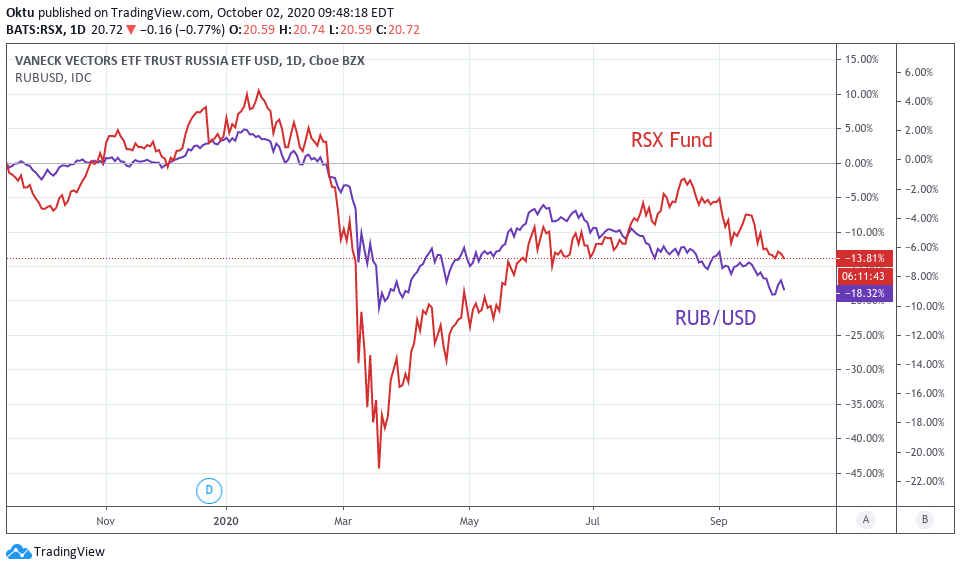

As already mentioned, the RSX is tied to shares of Russian companies that are traded in rubles. Therefore, the value of the Russian currency considerably influences the price of the fund. And in this context, I want to draw attention to some important points.

Since the beginning of June, the ruble has fallen by almost 16% against the dollar. This had a proportional, negative impact on the price of the RSX fund. But it looks like the ruble-weakening phase has come to an end and now we can even expect its strengthening. This will prove to be a supporting factor for the price of the fund.

Let's start with the fact that for the first time in many years, the Russian government has set limits on the size of the net foreign assets of state-owned companies at the level of October 2018. Such an instruction was received, for example, by such major Russian companies as Gazprom (OTCPK:OGZPY), Rosneft (OTCPK:RNFTF) and Alrosa (OTC:ARRLF). Accordingly, this will force Russian state-owned companies to convert surplus foreign assets into rubles. Of course, this will lead to an increase in demand for the ruble in the domestic market.

Further, on October 1, the Central Bank of Russia began selling the currency it received from the sale of Sberbank (OTCPK:SBRCY). Currencies worth 2.9 billion rubles (~$38 mln) will be sold on the market daily. Additionally, the Сentral Bank of Russia continues to sell dollars on the domestic market due to the fact that the price of Brent crude oil is lower than the budgeted level (~$40).

Both factors point to a very important message from the Russian government to the market: there will be no further weakening of the ruble. And this should at least discourage the desire to speculate on the weakening of the Russian currency.

Bottom Line

I recently wrote that several external factors are simultaneously pressing on the Russian market at the moment. At first, it is the factor of Belarus. Secondly, the poisoning of Navalny and the associated possible sanctions on the Nord Stream 2 gas pipeline. And thirdly, the war between Armenia and Azerbaijan, in which Russia is Armenia's ally. In parallel with these events, the ruble was steadily weakening.

Now it looks like the ruble has bottomed out. It is necessary to wait a little for accurate conclusions, but it seems that the factor of Belarus is also beginning to lose relevance. The remaining two factors are still in focus. But at least this is not a situation in which to sell the RSX fund.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.