ProShares VIX Short-Term Futures ETF: Pay Attention To The Signals

Quite a bit has been written about the ProShares VIX Short-Term Futures ETF (NYSEARCA:VIXY), and the coverage is hardly ever bullish. Seeking Alpha contributor QuandaryFX has been one of the most prolific analysts of the fund, having stated that:

VIXY follows an index which drops at a pace of around 50% per year and using it as a hedge is an ineffective long-run strategy. The key reason why these losses are occurring is roll yield.

While the above is true, I believe the ETF can be valuable in at least one other way. Today, I will talk about how VIXY can help a long-only investor in the S&P 500 avoid large losses in the markets, and perhaps even beat the benchmark over time.

Credit: Katie Moum

The logic

Let's set aside the VIXY's value-destructing roll yield feature and focus on what the "underlying asset", the volatility index, usually has to say about the stock market. Generally speaking, volatility rises roughly at the same time that stocks decline. This is true because uncertainty in the market leads to (1) unwillingness to buy assets at rich prices, due to the higher perceived risks, and (2) a wider range of fair value expectations, resulting in more erratic price behavior (i.e. higher volatility).

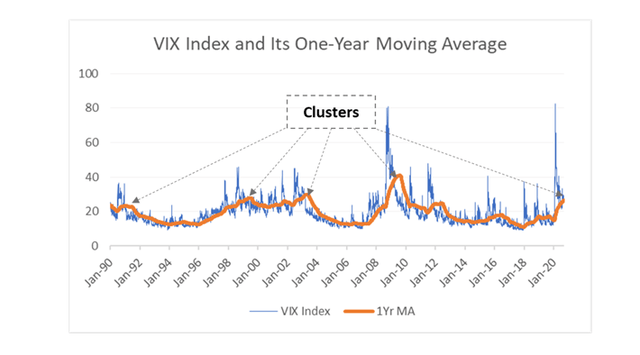

Another interesting feature of volatility is clustering. In other words, as mathematician Benoit Mandelbrot noted, "large changes tend to be followed by large changes, of either sign, and small changes tend to be followed by small changes". Simply put, if the VIX index is high today, it will likely be high tomorrow. Volatility clustering can be roughly seen in the VIX moving average chart below (orange line).

Source: graph by Yahoo Finance

So, if we pull together the ideas above, one reasonable hypothesis might be:

Since volatility clusters, a VIXY that trends higher should indicate an imminent weakening of the stock market because volatility and stock prices tend to be inversely correlated. A VIXY that trends lower, conversely, suggests a recovering stock market. Therefore, sell (or avoid) stocks when VIXY trends higher, and buy (or leverage up) stocks when VIXY trends lower.

Testing the hypothesis

Let's see if the thesis above holds water. I prepared a backtest using the following, simple buy and sell rules for a timed portfolio:

- if VIXY shoots above its trailing 22-trading day average (i.e. prior calendar month), using end-of-day prices, do not hold stocks the next day.

- if VIXY dips below its trailing 22-trading day average, hold 2x leveraged stocks the next day. This can be accomplished, for example, by buying shares of ProShares Ultra S&P 500 (NYSEARCA:SSO).

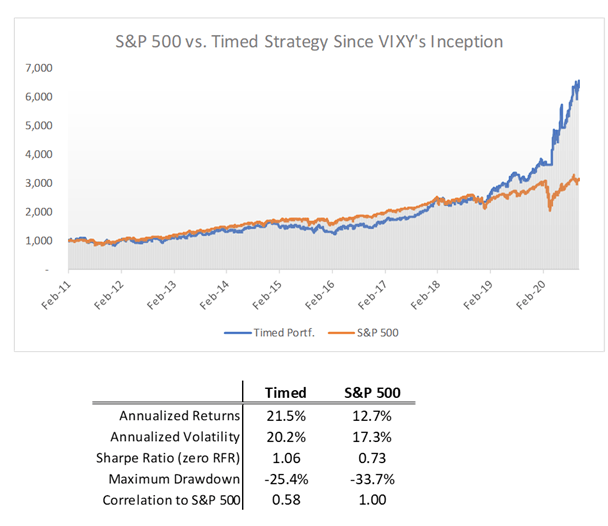

The chart below summarizes the results:

Source: DM Martins Research, data from Yahoo Finance

Notice that not only would the timed portfolio have performed significantly better in absolute terms since the inception of VIXY, it would have done so with (1) little extra day-to-day volatility and (2) less damaging peak to trough declines.

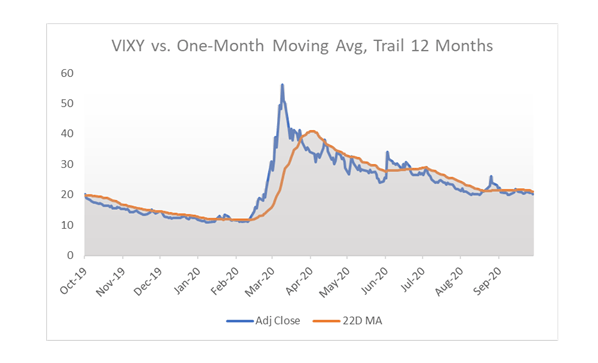

The following graph is also interesting. Using the set of rules proposed above since the start of 2020, the VIXY would have flagged investors to sell out of the S&P 500 on February 21 - only two days after the pre-COVID-19 market peak. It would have then signaled a buy on April 3, about one and a half week after the bottom.

In the previous couple of years, timing rules around the VIXY would have also triggered a sell at very appropriate times. For example, in 2018, VIXY crossed above its moving average on January 24, before the S&P 500 corrected about 10% over the next two weeks. And on October 5 of the same year, the VIXY hopped above its moving average once again, just in time to suggest a sell ahead of the "quasi bear" of 4Q18.

Source: DM Martins Research, data from Yahoo Finance

In conclusion

True, VIXY does not seem to be a good ETF to hedge risk away from a stock portfolio, primarily due to negative roll yield when the VIX curve is in contango (i.e. most of the time). However, VIXY might be a valuable tool for active investors and traders, as it may signal the best times to be more or less exposed to the stock market.

To be fair, trying to time entries and exits during periods of calmness usually leads to lower returns. This is the case because, in a generally upward moving market without substantial pullbacks, being out of stocks for even a few days tends to be a bad idea. The same might be true of sideway-moving markets with too many "head fakes" - think of 2015. However, investors who are concerned about rapidly declining asset prices might want to pay a bit closer attention to VIXY, and sit on the sidelines when the ETF indicates that it is appropriate to do so.

Join the SRG community

"Thinking outside the box" is what I try to do everyday alongside my Storm-Resistant Growth (or SRG) premium community on Seeking Alpha. Since 2017, I have been working diligently to generate market-like returns with lower risk through multi-asset class diversification. To become a member of this community and further explore the investment opportunities, click here to take advantage of the 14-day free trial today.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.