ProShares UltraPro QQQ: It's Vulnerable

Vulnerability is basically uncertainty, risk, and emotional exposure. - Brene Brown

The ProShares UltraPro QQQ ETF (NASDAQ:TQQQ) has set an ambitious goal - generating a daily return that is three times that of the NASDAQ 100 (NDX), before fees and expenses. It achieves its goals by leveraging its net assets and trading derivative contracts which it keeps rolling over.

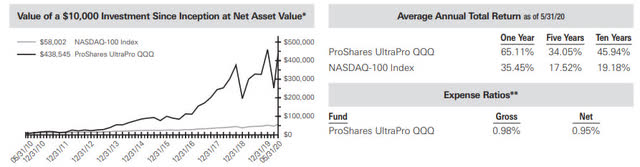

The ETF calculates the daily return by measuring its NAV from one day to the next, and compounds gains for longer-period reporting. For the year ended May 31, 2020, TQQQ reported a total return of 65.11% as compared to NDX's return of 35.45%. For the record, TQQQ has $8.51 billion in assets under management as of October 6, 2020, and its expense ratio is 0.95%.

Image Source: TQQQ's Annual Report

The fund is all about taking calculated risks and managing money smartly. It is a fund for investors, NDX traders, tech stock flippers, and other traders interested in higher-than-usual gains (or losses). Short- and medium-term investors too can consider buying it when they feel that the trend in technology stocks is strong. However, the ETF is definitely not for dividend chasers (TQQQ's current dividend yield is a meager 0.02%).

Here are some more details that can help you judge the fund better:

How TQQQ Gains Leveraged Exposure

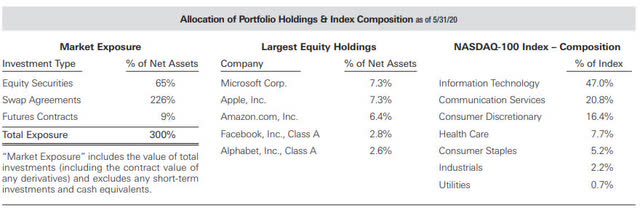

Image Source: TQQQ's Annual Report

To gain leveraged exposure to NDX, TQQQ's managers: (i) enter into total-return swap agreements with reputed global financial institutions and (ii) trade in futures contracts.

In a total-return swap agreement, the protection buyer (asset owner) agrees to pay any increase in the value of the underlying asset and any interest payments received from the asset to the protection seller (in our case, TQQQ). The protection buyer receives interest (LIBOR + spread) and any loss in value of the underlying asset from the protection seller. TQQQ enters into such derivative contracts to increase its returns.

Image Source: Wikipedia

As of May 31, 2020, around 65% of TQQQ's funds were deployed in equities (mostly technology stocks) and 9% in futures contracts. It had leveraged its net assets by 226% after entering into fully collateralized total return swap agreements. If you add everything together, the exposure works out to 300% of the net assets.

Recent Performance

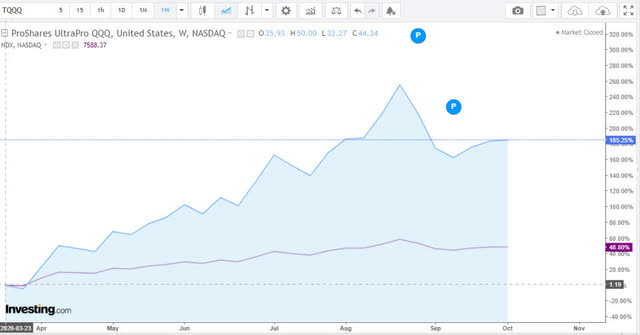

Image Source: Investing.com

TQQQ's price is extremely volatile to changes in its benchmarked NDX. If the NASDAQ gains 1%, TQQQ is likely to gain 3%, and vice versa. Between March 23, 2020, and October 6, 2020, NDX appreciated 48.8% while TQQQ zoomed 185%. That's how violently volatile and risky TQQQ is to NDX.

Investors should take into account that what holds good on the way up also holds good on the way down. In addition, given that volatility is the enemy of leverage, one should take into account the kind of environment we're in so as not to get stuck in the leverage trap that so badly hurts leveraged products in short bursts of time.

How to Trade TQQQ

As TQQQ generates 3 times the gains or losses as compared to the NDX, traders and investors can buy it for spectacular gains when they are sure that the trend for technology stocks is strong.

TQQQ's traders must be razor-sharp in reading charts and judging buy-sell signals. If you are inexperienced in reading charts, stay away from day-trading TQQQ.

Experienced NDX traders who can judge trend and momentum can increase their profit quotient by shifting to TQQQ and its inverse ETF, the ProShares UltraPro Short QQQ (NASDAQ:SQQQ).

Summing Up

TQQQ can be considered by traders and investors. Investors should realize that it's an extremely volatile and vulnerable ETF and any dotcom-like crash can wipe out a heck lot of wealth for long-term holders, while a COVID-19 melt-up can break shorters' hearts. The ETF is likely to witness solid volatility in the run-up to the elections, so investors got to be careful.

*Like this article? Don't forget to hit the Follow button above!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.