Opportunities In Shadow High-Yielding Muni CEFs

The CEF market tends not to be the most efficient market due to the difficulty in obtaining quality data and the presence of low-information investors. This creates a number of opportunities for discerning investors to enter into attractive strategic positions or to make tactical allocations. In this article, we describe one such opportunity to rotate into funds that we call shadow high-yielders. These funds earn well in excess of their distribution rates but also trade at attractive discount valuations as the market erroneously takes their lower distribution rates as a proxy for low earning levels.

In the article, we highlight the following funds, some of which we also hold in our Income Portfolios.

- Nuveen Quality Municipal Income Fund (NAD)

- Nuveen Municipal Credit Income Fund (NZF)

- BlackRock MuniVest Fund II (MVT)

Shadow High-Yielders

What we call shadow high-yielding CEFs are those whose earnings yields, also called income yields or covered yields, are in excess of their distribution rates. In other words, these funds earn more in income than they pay out in distributions. Why would this happen?

Well, few CEFs pay out exactly what they earn. Most CEFs tend to make stable distributions, making changes only infrequently. In fact, this is one reason why CEFs remain popular income investments, and also why they often cause some anxiety around declaration dates.

Why would shadow high-yielding funds be attractive - intuition suggests that they should, in fact, be unattractive. A fund that can afford larger distributions but scrimps on them is surely less attractive? A closer look at fund dynamics, however, tells us why these funds can be attractive additions to income portfolios.

First, a fund that under-distributes is in a stronger position to raise distributions, and increased distributions are often rewarded with discount tightening, driving stronger price returns.

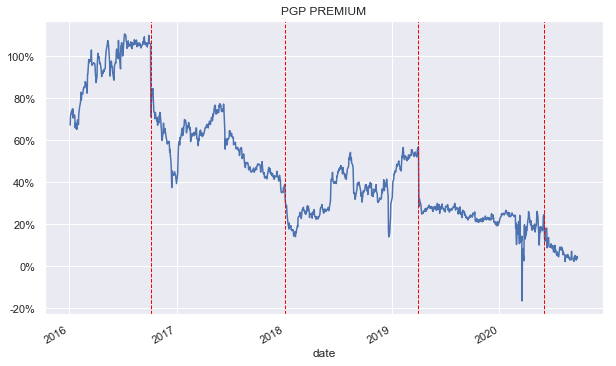

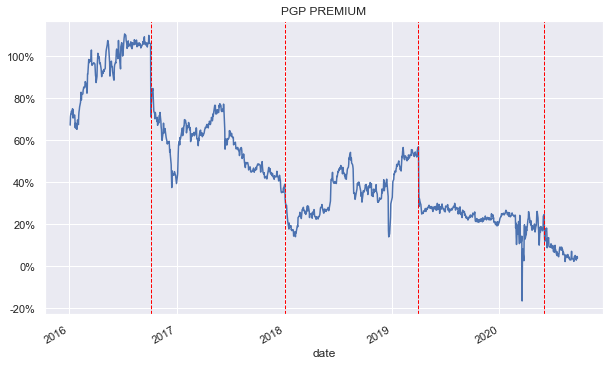

Secondly, CEFs with lower distribution rates tend to trade at wider discounts, all else equal, as the CEF market likes to compress price yields relative to NAV yields. In other words, CEFs with higher distribution rates are often bid up by investors seeking higher distributions, and vice-versa. This is why you often see very high-yielding CEFs also trade at very high premiums and why these funds' premiums often collapse when they cut distributions. The PIMCO Global StocksPLUS & Income Fund (PGP) is a poster child for this kind of historic dynamic. The red lines in the chart indicate when the fund made distribution cuts. These are also the dates when the fund's premium fell sharply as well.

Source: Systematic Income

Wider discounts not only provide an additional margin of safety for the fund's price (funds already trading at wider discounts are at smaller risk of further widening on surprises, all else equal), but they also boost the fund's price yield.

Thirdly, funds that under-distribute are able to use retained earnings to buy additional assets, further boosting earning capacity.

Fourthly, they are also less likely to be forced to use dilutive rights offerings in order to boost NAVs to keep management fees from moving lower with time due to NAV erosion.

To identify the population of shadow high-yielding muni CEFs, we select those funds with a covered yield 0.25% higher than their current yield. The average discount of these funds is 7.8% versus 5.6% for the overall sector, which suggests that the market does put a lower valuation on these funds. In other words, the market does not appear to "look through" to the funds' high covered yield and awards discount valuation based on current yields. This creates an opportunity for discerning investors. In the section below, we take a look at some municipal CEFs that qualify as shadow high-yielders.

Shadow High-Yielding Municipal CEFs

The Nuveen Quality Municipal Income Fund (NAD) has a current yield of 4.74% but covered yield of 5.2%. The fund's discount is 9.4%, or 3% wider of sector average. NAD has a higher-quality portfolio than the sector average and has outperformed the sector over various time horizons in NAV terms.

The Nuveen Municipal Credit Income Fund (NZF) is trading at a 5.15% current yield but 5.7% covered yield, or 1.25% above the sector average. The fund's discount is 9.9% and stands a 14th 5-year discount percentile, well below the sector average. The fund has a somewhat lower-quality portfolio than the sector average but is still around 2/3 investment-grade.

The BlackRock MuniVest Fund II (MVT) is trading at a 4.82% current yield but a 5.42% covered yield, one of the highest in the sector. The fund's discount is 8.2% (2% wider than the sector average), which stands at just the 8th 5-year discount percentile. The fund holds about 80% of its portfolio in investment-grade rated bonds and runs at 37% leverage - both at around the sector average. The fund has outperformed the sector by 0.6% per annum in NAV terms over the last 10 years and marginally over the past year. We continue to hold the fund in our Core Income Portfolio. MVT has a sister fund, the BlackRock MuniVest Fund (MVF), which looks similarly attractive.

Takeaways

The CEF market is not always the most efficient one, which is, in part, what makes it so interesting. The difficulty in obtaining good data and the presence of low-information investors creates some attractive valuation opportunities. One such opportunity is to allocate to funds that we call shadow high-yielders - funds that earn well in excess of their distribution rates but are, in effect, punished by the market, because their low distribution rates are taken as a proxy for their earnings. Their attractive valuation not only further boosts their earnings yields, but also creates an additional margin of safety relative to the sector.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the closed-end fund, open-end fund, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

Disclosure: I am/we are long MVT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.