iShares Emerging Markets Dividend ETF: 7.27% Yield Coupled With Risks

Diversification is at the crux of portfolio management. In order to minimize downside risks, maximize returns, and establish a dividend income stream, investors can look beyond borders and expand their geographical footprint. ETFs can be helpful in this sense, as they simplify the stock-picking process while also provide exposure to a broad range of equities. Moreover, ETFs mitigate single-stock volatility, as the outperformance of some constituents can offset the underperformance of others.

The phenomenally low yield environment makes income starved investors constantly struggle to find meaningful payouts that would be apt for their investing strategies. The remarks Fed Chair Jerome Powell made on inflation point to one evident fact: U.S. interest rates are not about to creep higher, as temporary fluctuations in inflation will be tolerated.

So, today I would like to take a deeper look at a ~7.27% yielding iShares Emerging Markets Dividend ETF (DVYE) managed by BlackRock Fund Advisors, which income-oriented investors might consider for the long term. Certainly, after careful examination of all related risk factors.

The top line Performance

The investment strategy of the fund is to track the Dow Jones Emerging Markets Select Dividend Index. In 2019-2020, DVYE distributed income on a quarterly basis (see page 4 of the schedule). Now, the yield is approaching stupendous 7.27%, which far exceeds the U.S. Treasuries yields.

Regarding volatility, DVYE is not exposed to explosive price gyrations, as its 60-months beta is only 0.85.

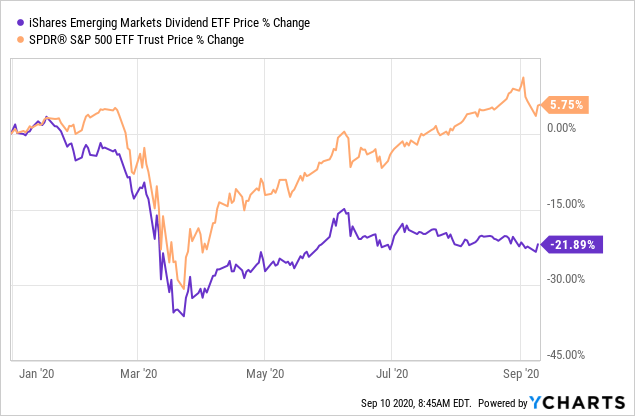

While the U.S. market has risen meteorically this year, DVYE's year-to-date returns are subpar. The U.S. market has shrugged off the economic gloom thanks to unprecedented injections of liquidity by the government and the dovish stance of the Fed while emerging markets were less optimistic about the pace of the recuperation, even despite the accommodating policy of central banks (for example, the Bank of Russia slashed the key rate by 25 bp to 4.25%). However, for a broader context, the International Monetary Fund is expecting the emerging market & developing economies to face only a 1% real GDP contraction, while for the U.S., the Fund forecasted a 5.9% decline.

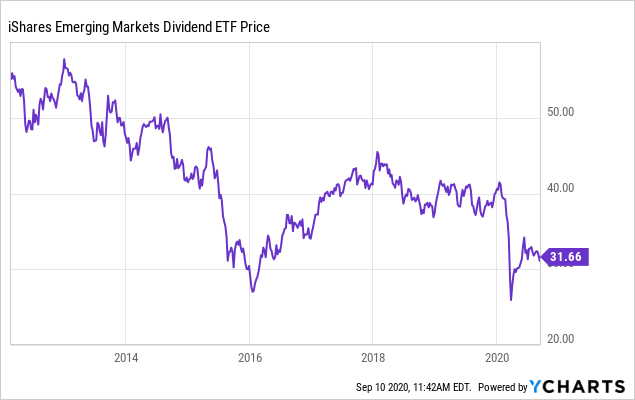

So, DVYE price has not fully recovered from the coronavirus sell-off that hammered stocks across the globe yet. Its 3-year and 5-year price returns are also subpar, (26.67)%, and (1.43)%, respectively. But here comes the magic of dividends. For example, the 5-year total return is much more attractive, 29.85%. Anyway, again, if compared to the S&P 500 total return of 65.14%, this figure is lackluster.

At the moment, DVYE is trading close to an all-time low. As of September 8, its P/E was only 6.34x, while P/B was only 0.9x, which means it is drastically underappreciated if compared, for example, to iShares Core S&P 500 ETF (IVV), which has a portfolio P/E of 22.53x.

Data by YCharts

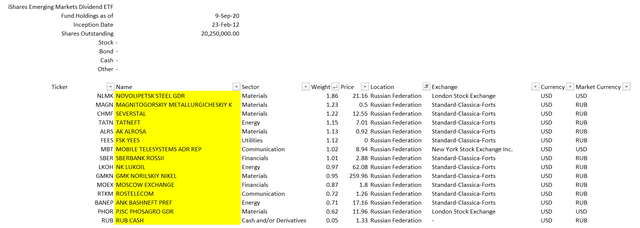

Data by YChartsThe DVYE portfolio is dominated by Financials, which account for 24.39% of the holdings. Real Estate is #2 with a 15.58% contribution, while Energy is the third-largest sector with a 12.46% weight. Speaking about the country mix, the Chinese stocks represent the bulk of the holdings, 21.63%, while Russia and South Africa are in second and third places with 14.65% and 11.76% contribution, respectively.

By the way, the fund holds most Russian blue chips, which are famous for their remarkably generous payouts, like Sberbank (OTCPK:SBRCY) or ALROSA (OTC:ARRLF).

Created by the author using Detailed Holdings and Analytics dataset

What you need to know about the ten largest constituents

Sometimes investors focus solely on the sector and country mix of an ETF, but I would not say this simplistic approach is tenable. To better understand an investment, a meticulous reader should delve much deeper and examine the financial performance of at least the top ten companies in which a fund holds stakes.

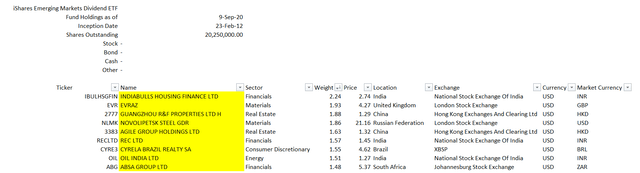

Created by the author using Detailed Holdings and Analytics dataset

Created by the author using Detailed Holdings and Analytics dataset

- Let us begin with Indiabulls Housing Finance Ltd. (OTC:IDKQY), which has a 2.24% weight in DVYE. IBH is a Gurugram-based mortgage lender with a primary listing on the BSE. In Q1 FY20-21, its Yield on Loans was 11.3%; FY20 Return on Equity amounted to 17.6%. The company itself believes that its financial performance is among "the top 5 companies in the sector" (slide 3).

- EVRAZ plc (OTCPK:EVRZF) is an LSE-listed steel industry heavyweight. The company is struggling with a significant revenue shrinkage, as the sapping demand for metals amid the pandemic has taken its toll. But the coronavirus is not the only culprit of its woes. For a broader context, sales have already been in decline since 2018, while cash flow and FCF have also been creeping lower. The silver lining is that analysts are expecting revenues to bottom in 2020 before returning to low-single-digit expansion in 2021. EVRAZ has a burdensome debt (D/E of over 437%), which increases the risk that it will slim down the DPS. However, leverage (Net debt/EBITDA) is on a safe level of only 1.7x (slide 12). What is more, in the 1H20 earnings presentation, it was said that the company "remains committed to stable dividend payments going forward."

- Guangzhou R&F Properties Ltd. (OTCPK:GZUHY) is a Chinese real estate development company with a footprint in Australia, Cambodia, Malaysia, Korea, the UK, and, of course, the PRC. Analysts are expecting its revenues to continue growing in the double-digit range in the medium term.

- Moscow-listed Novolipetsk Steel (OTC:NISQY) has been suffering from a revenue decline since 2018. However, though cash flow also did creep lower, FCFE remained well above the IFRS net income. Besides, I reckon its financial position is robust, as Debt/Equity stands at 64%. In 2019, its Net debt/EBITDA was 0.7x (see page 29). Moreover, since at least 2015, its leverage has never exceeded 1x. An important note worth making here is that NLMK's operations are not limited to Russia. For example, it has a U.S. subsidiary, which operates NLMK Pennsylvania, NLMK Indiana, and Sharon Coating production sites. Assuming a DPS of $2.141, the steel heavyweight is yielding a staggering 10.1%. On a negative side, the company does not have a consistent dividend growth story.

- Agile Group Holdings Ltd. (OTCPK:AGPYF) is a Chinese investment holding company. Its sources of revenue are property development, property management, hotel operation, environmental protection, etc. In the 2010s, it has been exceptionally successful regarding the top-line growth, as its 10-year revenue CAGR stands at 16.2%. Analysts are expecting the expansion trend to continue at least until 2024.

- REC Limited is an NSE-listed Indian public financial institution. Its operations are focused on financing and promoting rural electrification projects across India. Its Yield on Loan Assets touched 10.53% in Q1 FY20, while Return on Net Worth was 20.3% (slide 27).

- Cyrela Brazil Realty S.A. (OTCPK:CYRBY) is a Brazilian homebuilding industry heavyweight. Its 1H20 revenues were down 9%, while LTM ROE touched a four-quarter low of 6.9% (see the presentation).

- Oil India Limited (OTCPK:INOIY) is an NSE-listed Indian Public sector energy company, which operates via Crude Oil, Natural Gas, Liquefied Petroleum Gas, Pipeline Transportation, and Renewal Energy segments. Its sales are heavily dependent on hydrocarbon prices, and, hence, are cyclical. For example, its revenues for the June quarter dipped to Rs. 1,749.71 crore vs. Rs. 3,380.87 crore in 2019 June quarter (page 7).

- Absa Group Ltd. (OTCPK:AGRPY) is a Johannesburg-based financial company. It has multiple revenue sources including insurance, investment banking, personal & business banking, corporate & investment banking, and wealth & investment management. Analysts are skeptical of its expansion in 2020, but they are expecting single-digit growth in 2021-2022.

- Nedbank Group Ltd. (OTCPK:NDBKF) is another South African financial heavyweight. Pundits are anticipating a 13.6% revenue contraction in 2020 and mid-single-digit growth in 2021-2022.

Final thoughts

Multiple risks are associated with investing in emerging markets, from currency headwinds to geopolitics; for example, the Russian ruble has depreciated materially this year, as both the repercussions of the oil price war and the effects of the pandemic whipsawed the national currency.

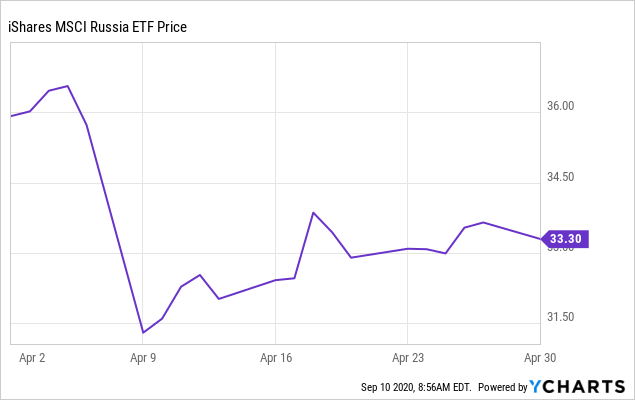

A new round of U.S. sanctions on Russia can also bruise equity valuations. To rewind, in April 2018, when new sanctions were imposed, Russian stocks dipped materially.

Data by YCharts

Data by YChartsBesides, the U.S. President has recently said that he is thinking about "decoupling" the U.S. from China. It is not yet clear what precisely that implies, but the valuations of the Chinese equities will indubitably reflect a higher risk premium.

Thus, the risk premium Mr. Market factors in the EM asset valuations is much higher than in the case of developed countries like the U.S. but meaningfully lower than in the case of the frontier market (like Argentina). Anyway, I reckon DVYE might be worth considering for the long term thanks to generous dividend and ultra-low valuation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.