GGN: Income Complement To A Gold Allocation

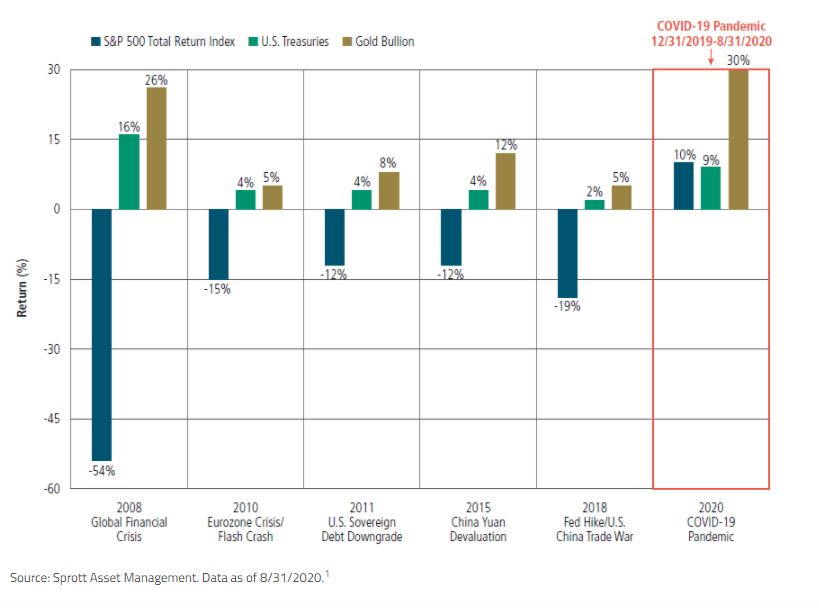

The current environment is creating an historic opportunity for gold. In response to COVID-19, the Federal Reserve has expanded the money supply at an unprecedented rate. Real interest rates are negative and are likely to stay that way for quite a while. Gold is a time-tested way to prepare for an inflationary environment that is likely coming. Moreover, with stock market valuations finally wobbling off all-time highs amidst a backdrop of geopolitical risk, gold is a solid portfolio holding for those looking to prepare for turmoil.

(Source: Sprott)

Gold exposure comes in many forms. In addition to a small amount of physical gold and a basket of gold miners and royalty companies, I am always looking for ways to get gold exposure through funds at a discount.

The case for gold and gold-focused funds is part of a larger commodities supercycle thesis, which also includes energy. In a previous article on the BlackRock Energy & Resources Trust (BGR), I outlined the case for a sharp reversal in energy prices and the use of closed-end funds to benefit from it. The GAMCO Global Gold, Natural Resources & Income Trust (GGN) is one way to combine the gold and energy theses into an income play.

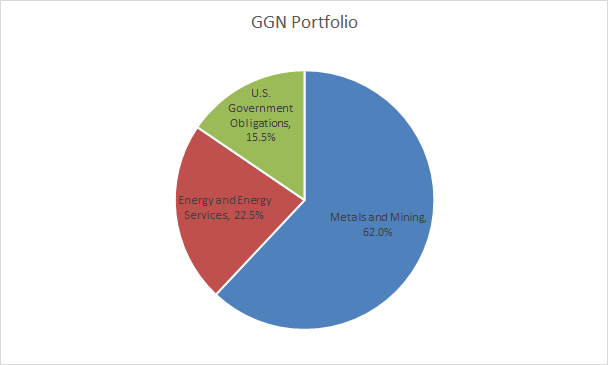

Portfolio

GGN’s portfolio is a relatively unique combination of assets. As of the most recent filings, 62% of the portfolio is in metals and mining companies, 22.5% in energy companies, and 15.5% is in US government securities. Additionally, the fund writes covered calls on many of its positions in order to generate income. Covered calls support GGN’s ability to pay distributions when commodities are out of favor, but at the expense of maximum upside. Additionally, the covered calls strategy allows the fund to benefit from heightened volatility in the gold and energy markets, not just rising prices.

(Source: GGN Semi-annual report)

Performance

GGN’s recent performance has been extremely disappointing. The collapse in energy prices more than outweigh the benefit from the rise in the gold price. However, the market appears to be overreacting - GGN stock price dropped nearly 15% during the first half of the year, when NAV dropped only 0.25%. Meanwhile, the VanEck Vectors Gold Miners ETF (GDX), which has many similar holdings, has surged even more than the increase in the price of gold, as measured by the XAU index (XAUUSD:CUR). Adding insult to injury, GGN’s management fee of 1.0% is exactly twice that of GDX.

Taking a longer view, however, GGN starts to look more favorable. Its 10-year NAV return (-0.83), during one of the worst commodity bear markets on record, is less bad than the NAV return of GDX (-2.81). Additionally, in recent years, the balance between gold and energy has helped investors in the fund sidestep the collapse in energy prices.

Average Annual Returns through June 30, 2020 (%) | |||||

Year to date | 1-Year | 3-Year | 5-Year | 10-Year | |

GGN NAV Return | (0.25)% | 3.70% | 2.25% | 1.45% | (0.83)% |

GGN Stock Return | (14.93) | (12.34) | (2.18) | 0.99 | (2.54) |

GDX | 25.27 | 44.0 | 19.19 | 16.31 | (2.79) |

Energy Select Sector Index | (34.92) | (35.29) | (12.12) | (9.63) | (0.04) |

XAU Index | 21.33 | 54.25 | 17.93 | 16.28 | (2.00) |

(Source: GGN Semi-annual report, GDX website)

There is a notable caveat to this longer-term performance. GGN pays out large dividends (it currently yields 10%). This level of income is unsustainable in a prolonged commodity bear market. As Nick Ackerman pointed out in a previous Seeking Alpha Article, the fund has cut dividends multiple times in its history.

The current combination of gold and energy is not proving effective. However, in the event of another commodity supercycle, this will reverse. It’s possible that GGN’s managers will perform better in a different part of the commodity cycle.

Valuation

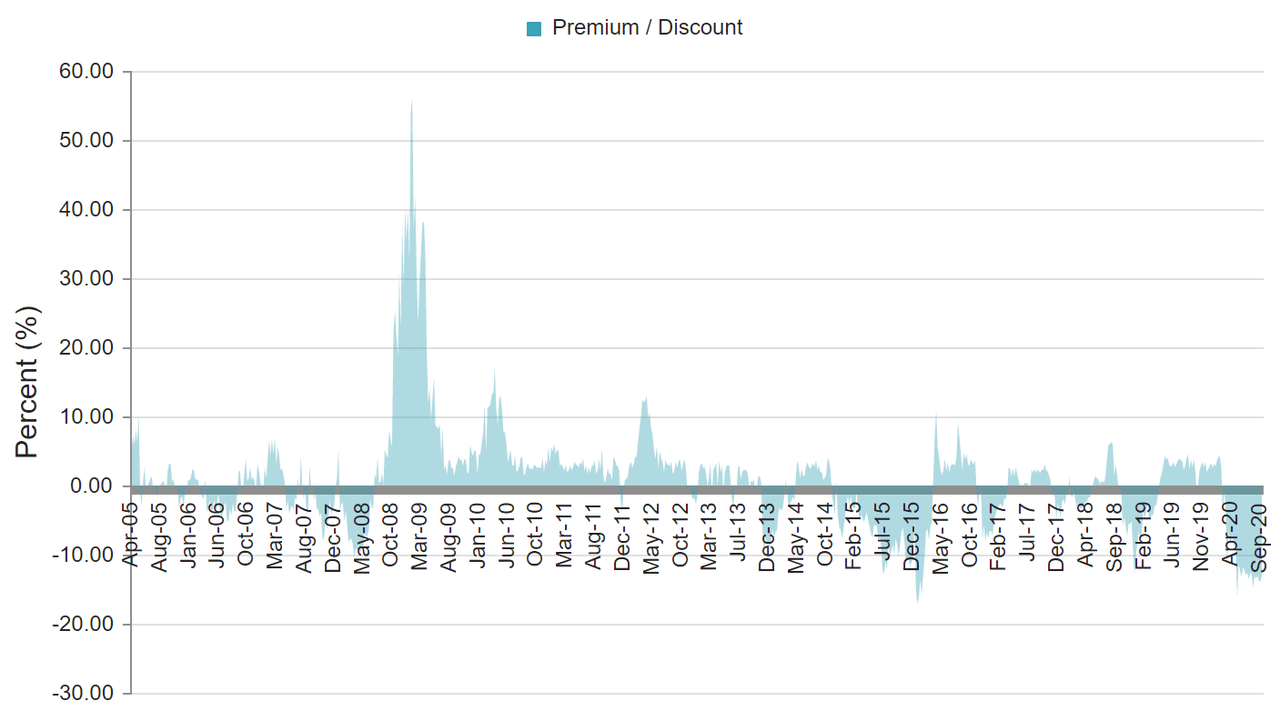

GGN has frequently traded at a premium in the past. In fact, from late 2008 until early 2009, the fund traded at above a 20% premium when gold prices surged, and it maintained a relatively consistent premium until 2013. In the past five years, it has traded at premiums a few times, but overall, it averaged a -2.3% discount. The current discount of -13% is much higher than typical, even though it is now one of the best times to own gold. If there was another gold bull market, GGN would likely surge to a premium again.

(Source: CEFConnect)

Conclusion

In the current market environment, I like commodities, especially gold, and I always like discounted closed-end funds. Yet, I’m hesitant to recommend GGN. It's not the best vehicle for expressing a thesis on gold (or oil). However, there are two situations in which it would make sense to own the fund. First, the potential for the abnormally high discount to close suddenly in a commodity bull market is enticing. Recent market history also shows that a commodity bull market isn’t necessary for GGN to trade closer to NAV. If the fund continues to have a discount in the teens, I’ll build a position and hold it until the discount closes.

Second, GGN is a decent way to get commodities exposure within an income portfolio. Most gold miners have little or no dividend, and physical gold has a negative carry if you want to protect it. In contrast, GGN continues to pay very large distributions, partially supported by a covered call strategy. These distributions interfere with the ability to earn capital gains but make sense if you are trying to live off income from investments. With investments like GGN, you can collect income without worrying that a commodity bull market will leave you completely behind.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.