EOS: A Covered Call Fund That Has Been On Fire

Written by Nick Ackerman, co-produced by Stanford Chemist

The Eaton Vance Enhanced Equity Income Fund II (EOS) has been on fire this year. This is thanks to its heavy weighting in tech. Led by a significant position in Amazon (AMZN). Eaton Vance runs a solid line-up of option-based funds. In this case, EOS is not only set apart by the tilt towards the Russell 1000 Growth benchmark, but it is one of the EV funds that doesn't have a tax-managed focus. This makes the fund a bit more flexible in implementing a strategy. It also means that EOS is set apart by not having large portions of return of capital, like the other EV funds.

The investment policy for EOS is: "investing in a portfolio of primarily large- and midcap securities that the investment adviser believes have above-average growth and financial strength and writes call options on individual securities to generate current earnings from the option premium."

Hence, the fund's focus on tech that has historically had above-average growth. It also differs from the other EV funds in that it writes options on individual securities. This is a large part of why the other funds can generate significant amounts of ROC in that they write options on indexes. The latest volatility is also potentially allowing an investor to jump into this name. The lack of focus on after-tax returns means that this fund could be appropriate for a tax-sheltered account.

EOS is fairly sizeable at around $938 million in total managed assets. The expense ratio is reasonable and around the other funds as well at 1.09%. The fund was last overwritten at 49% of its portfolio.

(Source)

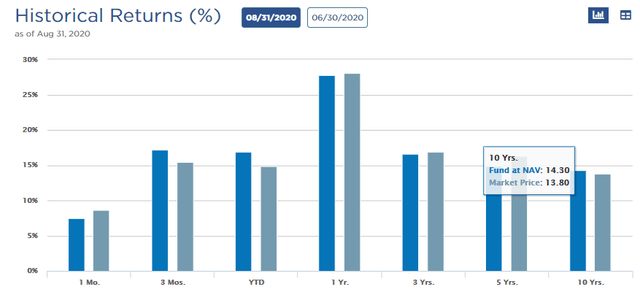

Performance - Providing Healthy Long-term Returns

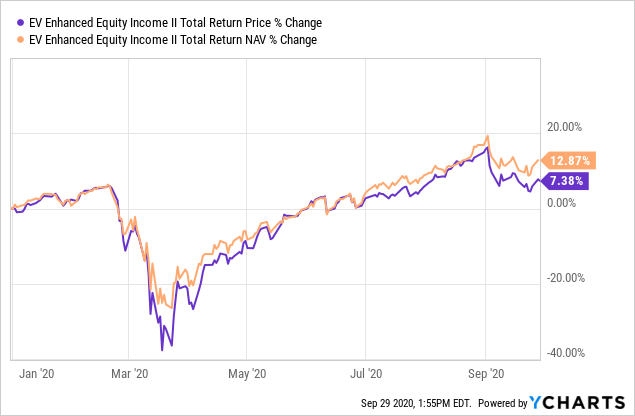

The performance of EOS has done an exceptional job. As mentioned, this was thanks to the heavy weighting in tech. This has put the fund's returns on a YTD basis well above what other covered call writing funds can generate.

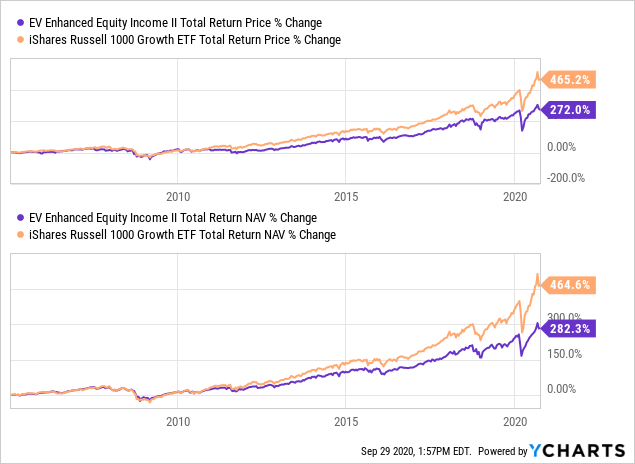

As most should know by now, a covered call fund does mean that we are potentially giving up upside capture due to positions being called away. This does create a bit of a drag in performance, in that against a comparable index they will be lagging.

In this case, the fund benchmarks against the Russell 1000 Growth Index. To compare the numbers, we can use the iShares Russell 1000 Growth ETF (IWF).

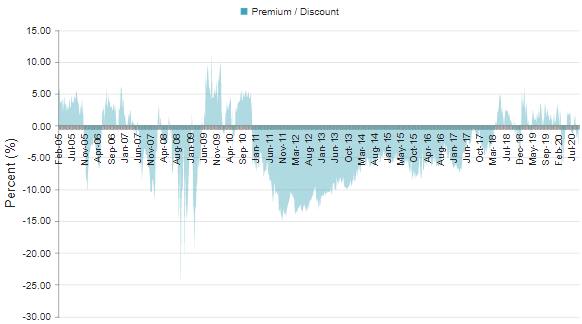

For investors looking for maximum total return, the results are pretty clear. Most CEF investors already know this though. The fact is, the ETF benchmark also can't give investors the potential to buy at a discount most of the time.

This is where the latest volatility comes in, as EOS has now sunk to a bit of a discount at 2.91%. While that isn't completely out of the ordinary, it is better than where the fund has traded over the last 5 years, where it averaged a discount of 1.98%. Those lucky enough, though, would have bought the fund in 2011 through the 2014 period. At that time, it was at some significant discount pricing.

(Source: CEFConnect)

I also don't believe an investor can complain too much if they held this fund over the last 10-year period. They received well over double-digit annualized returns. This was both on an NAV and a price basis. As one might have imagined, the price return has outpaced the NAV, which is why we see the significantly narrowing discount over the last 10 years.

(Source: Fund website)

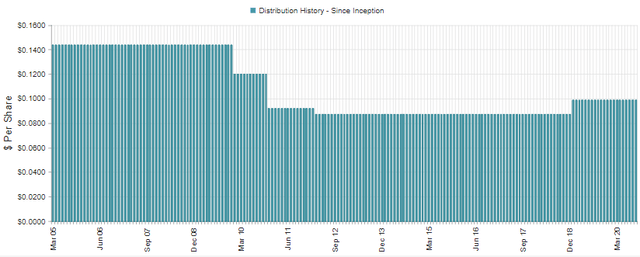

Distributions - Strong Monthly Income Since Inception

Another benefit that one can't get with IWF is a strong monthly distribution. Of course, this does come with a significant reliance on capital gains to help facilitate these high yields. The fund currently pays a monthly distribution yield of 6.47%. This works out to a per share amount of $0.0988. You can compare that with IWF's paltry 12-month trailing yield of 0.73%. It is clear which investment an income investor would be drawn to.

(Source: CEFConnect)

The fund did have several cuts after the GFC of 2008/09, though there are only a few funds that did not. The current NAV distribution is also a reasonable 6.28%, and in current conditions, I would not anticipate the fund having to cut for the foreseeable future.

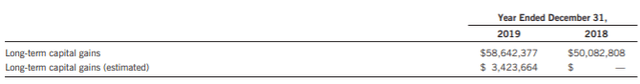

As mentioned above, ROC did not account for any of EOS's distribution for the prior year. Instead, long-term capital gains did for the last two years.

(Source: Annual Report)

The portion that the fund estimated to be long-term capital gains for 2019 did end up including some ordinary income. With that being said, even without a focus on being tax-managed, capital gains distributions receive a lower tax obligation - at least for now.

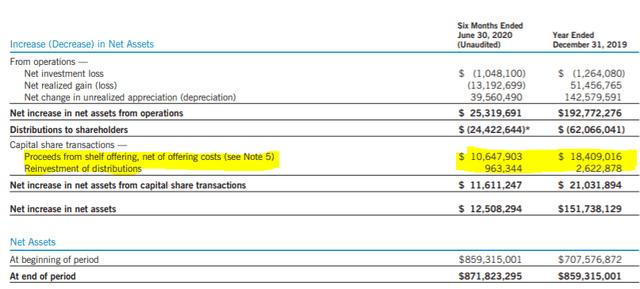

We would generally take a look at the "statement of changes" from the fund's last available report. However, as most funds heavily tilted towards tech positioning, EOS has negative NII. In this case, the loss was $1,048,100 for the six months ended June 30th, 2020.

What is more interesting to note in this section of the fund's report is that it grows some assets through reinvesting distributions and through an at-the-market offering.

(Source: Semi-Annual Report)

Since the fund typically flirts with a premium price, it can retain or grow assets via accretive share creation. The shares get issued at above current NAV, which is potentially beneficial for current shareholders, as the earnings per share can increase on this action alone. The fund is also sitting at over $400 million in total unrealized appreciation that could potentially be tapped for the distribution. Which, to be fair, is changing all the time. Especially as it is tech-heavy, the volatility can make some investors nervous.

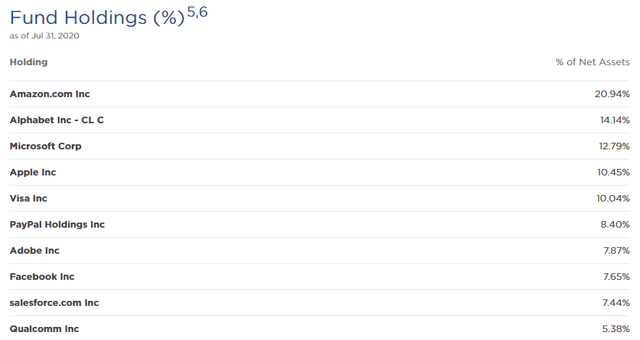

Holdings - Tech and Healthcare Top-Heavy

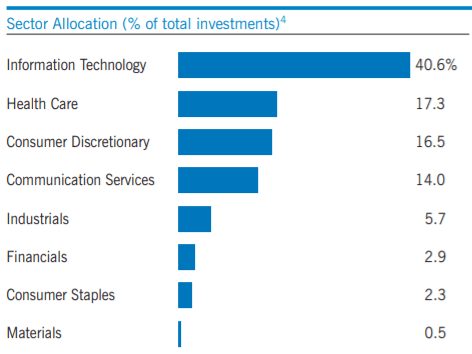

Tech is by far the largest exposure EOS has at 40.6% of its sector allocation. This is followed by the second-largest exposure, which is healthcare at 17.3%. Combine that with the 16.5% in consumer discretionary and 14% in communication services, and it is no wonder this fund has had some solid success on a YTD basis and longer term.

(Source: Semi-Annual Report)

This was as of its latest report ending June 30th, 2020. The fund's portfolio has been between 40% and 58% in the past years. So, it does average flipping half its portfolio annually. For the last 6-month period, this came in at 28% as well. With that in mind, EOS manage a relatively tighter portfolio too. It last reported 59 holdings. In that case, buying and selling about 30 positions would be enough to meet the fund's historical average turnover.

The portfolio's top ten is what really excites me. Yes, they include all the usual giant tech companies; but they also have several of the other bigger names that are incredibly popular, just not included in other CEFs. Though some investors will be concerned with the fund's almost 21% weighting in AMZN.

(Source: Fund website)

If one can get passed the large exposure to AMZN, then I believe names like PayPal Holdings (PYPL), Adobe Inc. (ADBE) and Salesforce.com, Inc. (CRM) are incredibly attractive names that aren't always represented by a lot of CEFs. These are all plays for extended pandemic conditions. That being said, they have all run up quite significantly too. Still, these aren't the same 1999 names that didn't have any revenue at all. These companies do have revenue.

ADBE is also even an old tech name that has survived the 1999 tech crash, 2008 financial crisis and the COVID-19 pandemic of 2020. PYPL is not nearly as old as ADBE, but last reported projected 2020 revenue growth of 20%. Additionally, the company is anticipating EPS growth of 25% for the full year. That is some extremely attractive growth coming from the payment space.

Then there is CRM, a "customer relationship management" platform. This tech helps corporations operate in a pandemic environment. The company last reported revenue growth of 28% year over year. It is anticipating revenue to be up 16% year over year for Q3. Most companies in 1999 were just hoping for any revenue or profit at the end of the day. That is why I believe it is quite different now than it was then. Of course, the growth in stock prices has also "pulled forward" several years of potential growth.

Conclusion

The discount isn't screaming a buy, but is lower than its historical range. That, combined with the tech sector disruption of the last several weeks, makes EOS a prime candidate. Of course, an investor needs to be comfortable with a heavy weighting in tech - the portfolio is at an over 40% tech allocation. AMZN even makes up a large portion of this fund too, at almost 21%. If one combines that with the relatively tight-knit portfolio of around 59 positions, one might not be willing to take those chances. Though there are several positions that I believe present an enticing opportunity in the fund's top ten as well.

EOS' long-term success shows that the top-notch Eaton Vance team has really done an outstanding job with this fund. Though investors that are more familiar with the other Eaton Vance option-based offerings need to realize this fund is quite a bit different. The fact that it isn't tax-managed means that we shouldn't expect to see large portions of ROC in the distribution. Additionally, the focus on the Russell 1000 Growth Index means that it could potentially be in more volatile, growth-oriented names. The monthly distribution from EOS should help ease some investors' minds though, as even during market crashes, we are collecting something!

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long EOS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.