Dynamics Of The Restaurant Industry And Its Effects On PEJ

Invesco Dynamic Leisure and Entertainment ETF (PEJ) is a fund that invests mainly in consumer cyclical and communication companies. A little over twenty-five percent of the ETF is invested directly in the U.S. restaurant industry. I estimate that thirty-one percent of the ETF has U.S. restaurant exposure. It is for this reason that I am dedicating this article to just the U.S. restaurant industry data.

The Dynamics Of The Restaurant Industry

Table 1 - Monthly Restaurant Retail Sales

| 2019 | 2020 | Y-O-Y | |

| Jan | 49,940 | 53,411 | 7.0% |

| Feb | 49,623 | 54,146 | 9.1% |

| March | 57,793 | 41,941 | -27.4% |

| April | 55,206 | 27,761 | -49.7% |

| May | 59,164 | 39,804 | -32.7% |

| June | 58,310 | 48,023 | -17.6% |

| July | 58,679 | 50,847 | -13.3% |

| Aug | 59,318 | 52,163 | -12.1% |

Source: FRED

According to the Federal Reserve Bank Of Saint Louis's economic data, the restaurant industry's August monthly sales were $ 52.2 billion. August sales were down $ 7.2 bn or 12.1% from August 2019. In April, monthly sales were down almost 50%, demonstrating a v-shaped recovery.

The U.S. restaurant industry suffered greatly from the lockdowns, limiting operations to off-premise dining for two months or more. After stay-at-home orders were lifted, restaurants were required to reduce seating capacity by half to allow for social distancing. This rule had investors worried that restaurant sales would decline by 50% too. For sure, some restaurants lost 50% or more of their revenue, but on average, a 50% decline in sales didn't occur.

Factors That Prevented The Decline In Sales

- If it weren't for off-premise dining, restaurant sales in April and May would have been almost zero. After the government partially lifted its coronavirus restrictions, the continuation of off-premise services allowed restaurants to compensate for the loss in on-premise dining capacity.

- There is a common misconception about seating capacity: a restaurant uses a large percentage of its seating capacity and often. On average, I calculated that Cracker Barrel used only 33% of its seating capacity during 2019. So reducing seating capacity in half will not necessarily reduce revenue in half.

- Menu prices have been steadily increasing since the pandemic hit the United States. If there was a way to know the volume of food sold, we could know for sure how much the market recovered.

- I have listened to several earnings calls and heard executives talk about the creative ways their companies added seating capacity. For example, at CBRL, they set up tables outside to be able to serve more people.

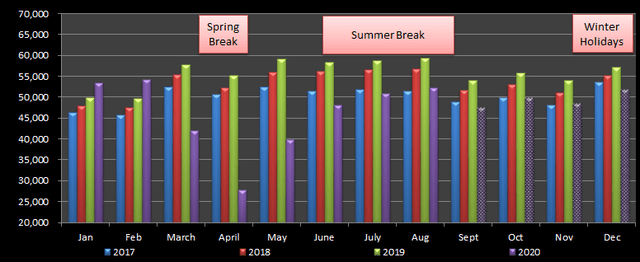

Figure 1 - Restaurant Retail Sales (monthly)

Source: FRED and analyst's estimates (spotted purple columns)

Source: FRED and analyst's estimates (spotted purple columns)

Figure 1 is a chart that I made to highlight seasonality and provide you with my future estimates. At the beginning of the pandemic, the coronavirus disrupted seasonality. Now, I believe that seasonal trends are already becoming more evident and will be even more in the next couple of months.

Table 2 - Estimates Example

| Month | 2019 | 2020 | Delta ($ Bn) |

| July | 58,679 | 50,847 | 7.8 |

| Aug | 59,318 | 52,163 | 7.2 |

| Sept | 53,944 | 47,520 | 6.4 |

My September estimate is based on the belief that the delta will continue to shrink but at a rate determined by seasonality. Cumulative monthly sales during the first eight months of 2020 were down 17.8% compared to the same period in 2019. Total U.S. restaurant sales in 2019 were $ 668.9 billion, and I forecast that it will be $ 565.6 bn this year.

Table 3 - Valuation Multipliers

| P/E TTM | FWD P/E | P/B | |

| Price | $ 32.11 | $ 32.11 | $ 32.11 |

| Ratio | 50.6x | 30.6x | 2.8x |

| Per Share | 0.63 | 1.05 | 11.63 |

Source: Invesco - PEJ Fund Detail

Using the information given by Invesco, I was able to estimate earnings and book value per share. Analysts believe that earnings per share will increase by 65.3% next year. In my opinion, a majority of that increase is a return to profitability.

Conclusion

Without the historical price to earnings ratios, it is hard to use current P/E data to value PEJ. That being said, the restaurant industry is expected to decline by over 11% in the 2H20 (y-o-y) which should decrease PEJ's EPS by at least 3.5%. I feel that PEJ is overvalued based on the high P/E ratio and low growth estimates.

If you like what you read, please "Follow" me via Seeking Alpha. I typically only cover the Brazilian markets, the Robotics Industry, and the Food Industry.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.