DGRO: I Still Favor Dividend Growth Over High Yield

Main Thesis

The purpose of this article is to evaluate the iShares Core Dividend Growth ETF (DGRO) as an investment option. This has been a holding of mine for a while, but its 2020 performance has not been too impressive. With that in mind, I wanted to examine DGRO critically to see if there was merit to keep on adding new cash to it. In my view, I believe there is, as the fund has bested alternative dividend strategies this year, which is an important comparison. Further, DGRO has offered double digit dividend growth year-to-date, which is impressive with the challenging economic environment. Finally, the fund is well diversified, which helps to limit volatility during down markets. The fund certainly owns some of the most beaten down sectors, such as Financials, but this exposure is mitigated somewhat by owning some of the stronger performers, such as Information Technology. This balance helps justify the fund as a core holding, in my opinion.

Background

First, a little background on DGRO. The fund is managed by BlackRock (BLK) and its objective is to "track the investment results of an index composed of U.S. equities with a history of consistently growing dividends." Currently, DGRO is trading at $40.15/share and yields 2.48% annually. DGRO is a fund I have owned for a long time, and I continued to add to my position in 2020. Looking back, this has obviously been a challenging year, and DGRO has unfortunately lagged the broader market since I last covered it in November:

Source: Seeking Alpha

Given DGRO's struggles, I wanted to reassess the fund to see if I should continue to build on my position going in to 2021. After review, I continue to see merit to owning this investment, and I will explain why in detail below.

Dividend Growth Beating High Yield

As I noted above, DGRO has had a neutral year in terms of total return. While the fund has recovered sharply, the losses felt during the Feb-March sell-off have rendered this a lost year in terms of performance (so far). Looking ahead to Q4, it makes intuitive sense that investors may want to evaluate their position in DGRO, and see if there are better options out there.

While this is a valid concern considering DGRO's move in isolation, we should consider its relative performance against alternative strategies. One drawback to the dividend growth strategy is the yield is not "high". The fund focuses on companies that are growing their dividend, but those companies often have strong share price performance as well, keeping the yield at a modest amount. Therefore, many investors may be inclined to check out the high yield dividend ETF space, especially given DGRO's recent performance. I would absolutely recommend looking in to this strategy, not because I want to swap out DGRO, but rather to highlight why DGRO is actually the better investment overall.

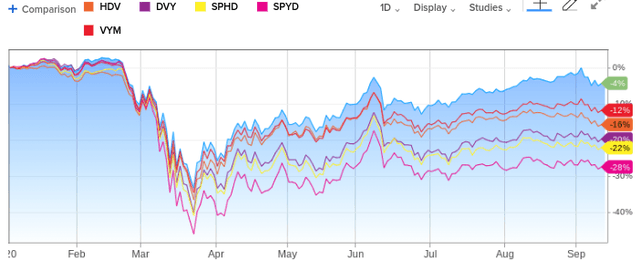

To illustrate what I mean, let us look at the year-to-date performance of DGRO against against some high yield dividend alternatives. While these funds offer higher yields in absolute terms, the benefit of those yields is negated due to lower total returns. For comparison, the graph below shows how DGRO has stacked up against two other funds from iShares, the iShares Select Dividend ETF (DVY) and the iShares Core High Dividend ETF (HDV), as well as other popular high yield dividend ETFs, including the Vanguard High Dividend Yield ETF (VYM), the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), and the Invesco S&P 500 High Dividend Low Volatility Portfolio ETF (SPHD) in 2020:

Source: CNBC

As you can see, DGRO is handily beating high yield dividend ETFs of all stripes. Even once we factor in the higher income stream, the total return divergence is notable. My overall takeaway here is investors need to think in relative terms, when deciding how best to allocate their cash going in to the end of the year. Yes, DGRO's performance has been a bit of a disappointment, but the story for the high yield objective is considerably worse. It shows me that holding DGRO this year has not been the worst mistake I could have made, and I will discuss next why I believe continuing to own it is the right move.

Dividend Growth Continues

My last paragraph illustrated how DGRO would have been the better investment in 2020, when compared against high yield ETFs. While this is an important point, we have to consider this is past performance, so what is actually more important is whether or not this story will be consistent going forward. I believe it will be, for a few key reasons. One in particular has to do with actual dividend growth, which is of course the primary focus of DGRO. While it should be expected that this fund will deliver on this core objective, this has been a year fraught with economic challenges and serious headwinds. Therefore, many large-cap companies were forced to cut, suspend, or even eliminate their dividends as the crisis worsened. With many states still in partial lockdown mode, and global economies also struggling to contain the Covid-19 virus, investors may be surprised to know that DGRO has indeed continued to offer a growing income stream this year.

To illustrate, the chart below shows the distributions DGRO paid out so far in 2020, compared against the same time period last year:

| Jan - June 2019 Distributions | Jan - June 2020 Distributions | YOY Growth |

| $.445/share | $.495/share | 11% |

Source: iShares

Clearly, DGRO has managed solid dividend growth, and that is especially impressive considering the macro-economic climate. It tells me the underlying holdings were well positioned to handle this crisis, and should be in a better financial position coming out of it as well. Simply, any company that was able to maintain operations and still increase its dividend during a global pandemic, is one I feel comfortable owning for the long haul.

Of course, it is not sufficient to consider this metric in isolation, so let us again compare it against the high yield dividend ETFs I highlighted earlier. Not surprisingly, the majority fell short of DGRO, although the spread between the funds was quite wide, as shown below:

| Fund | 2020 Dividend Growth (through August) |

| HDV | 14% |

| DVY | 0% |

| VYM | 8% |

| SPHD | 5% |

| SPYD | (4%) |

Source: Seeking Alpha

My ultimate takeaway here DGRO's dividend growth remains attractive, and it helps make up for the fact that its absolute yield is lower than alternative funds. Sure, a fund like SPYD offers a much higher income stream, but its dividend is declining, not increasing, and its abysmal total return in 2020 makes the high dividend almost irrelevant. If investors are not earning a positive return overall, a high dividend does not do much to soften the blow. DGRO, by contrast, has a lower yield, but stronger than average dividend growth and better total performance. This is a win-win in my book.

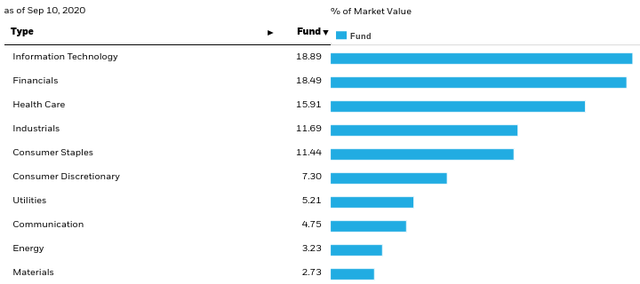

Diversity Is Very Important, Which DGRO Has

I now want to shift to a discussion of the underlying holdings of DGRO, with a specific focus on the sector holdings. What I like about this fund in particular is it is well balanced, and offers reasonable exposure to defensive areas like Health Care and Consumer Staples, which should come in handy if markets falter. Further, over time, the top sector weightings have remained the same, which I prefer because it helps investors know what to expect from the fund for the longer term. What I mean by this is, investors can plan for how the fund may perform in certain economic cycles, as opposed to an ETF that has very high churn or turnover, making it more difficult to forecast performance.

To gain some insight in to DGRO's portfolio, listed below are the sectors within the fund. As I noted, the fund is not overly exposed to any one particular area, and represents most corners of the market, as shown below:

Source: iShares

Source: iShares

I bring this up as a positive attribute because sector performance has been so uneven this year. While investors would have generated alpha by picking the winners, those with the losers would have severely under-performed. While this sounds obvious, my point is it is very difficult to know in advance what sectors will out-perform or not. Therefore, in complicated markets like the one we are in currently, I place a high value on diversification. Rather than trying to bottom feed or go overweight on the market leaders, I prefer to find funds like DGRO that are well balanced, allowing me to take the guesswork out of it. Yes, this would limit returns compared to investors who choose the right sectors, but it also limits my downside potential compared to investors who double down on the losers that then continue to lag.

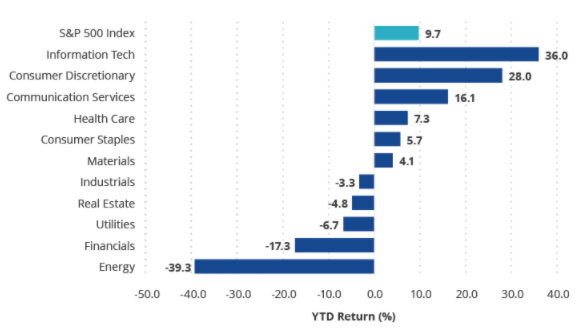

This may sound like an obvious takeaway, but I believe it is especially relevant right now so it makes sense to emphasize it. This is because 2020 performance has been all over the map. While the broader S&P is up around 10%, the gains from each individual sector are very uneven, as shown below:

Source: VanEck

This reality is part of the reason why DGRO has been able to beat the high dividend ETFs, which tend to be more concentrated in sectors like Real Estate and Energy. DGRO certainly has exposure to some of the under-performers, like Financials, but that poor performance is balanced out by the Information Technology exposure, which is far and away the market leader. Similarly, its exposure to areas like Health Care and Consumer Staples have delivered steady, less volatile returns. My conclusion is this is positive for a dividend fund. I don't want wild swings, I want consistent, growing income with diversification to limit the volatility. DGRO has all these characteristics.

A Relative Value Compared To The S&P

My final point on DGRO touches on the fund's valuation. As an equity fund, I want DGRO to offer a reasonable value proposition against other dividend ETF options, but also the broader market. After all, I can find plenty of other income-oriented options, so I want DGRO to offer more than just an income stream. Simply, I want it to offer a reasonable value too. Fortunately, with Tech leading the market to all-time highs, the value proposition for DGRO has markedly improved since last November. In fact, the S&P is more than 50% more expensive than DGRO, in terms of the current P/E ratio, and DGRO offers a higher dividend yield too, as shown below:

| Fund/Index | P/E Ratio | Dividend Yield |

| DGRO | 17.3 | 2.48% |

| S&P 500 | 28.7 | 1.79% |

Source: iShares; Multpl.com

My takeaway is this represents another valid reason for putting new money in DGRO now. With the markets sitting within striking distance of all-time highs, finding true value is extremely difficult. Therefore, relative value is top of mind, and DGRO checks this box as well.

Bottom Line

DGRO is a low cost, diversified dividend ETF that will remain a core holding of mine in 2021. With the major indices giving me some pause, given their stretched valuations, I appreciate DGRO's cheaper price, higher income stream, and dividend growth. As a result, I will add to my DGRO position going forward, and would suggest investors consider the fund at this time.

Disclosure: I am/we are long DGRO, AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.